The Fed wants “below-trend growth”

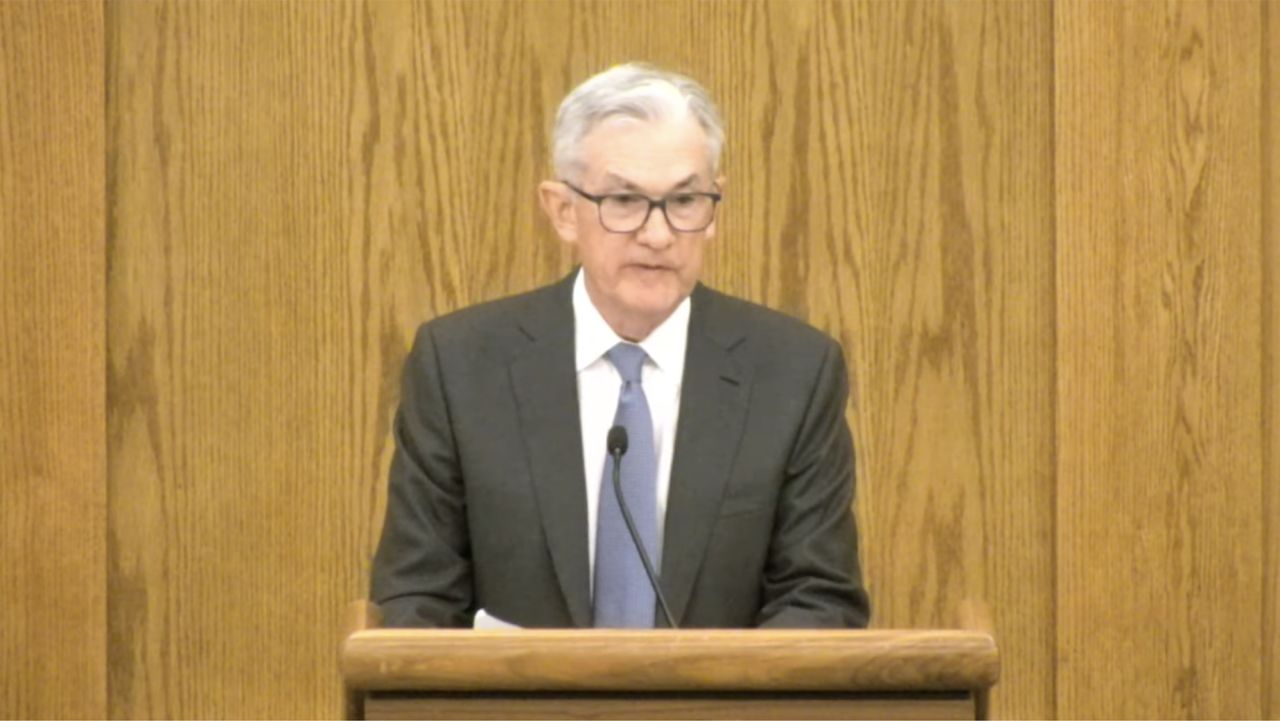

Federal Reserve Chair Jerome Powell said Friday there is still a risk that inflation won’t come down to the Fed’s 2% target as the central bank faces the proverbial last mile in its battle with higher prices.

“Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy,” Powell said.

Generally, if demand is red hot, employers will want to hire to meet that demand. But many firms continue to have difficulty hiring, according to business surveys from groups such as the National Federation of Independent Business. In theory, that could prompt wage increases in order to secure talent — and those higher costs could then be passed on to consumers.

While some Fed officials back a more aggressive stance on fighting inflation, others think there will eventually be enough restraint on the economy and that more hikes could cause unnecessary economic damage. The lagged effects of rate hikes on the broader economy are a key uncertainty for officials, since it’s not clear when exactly those effects will fully take hold. Research suggests it takes at least a year.

Acknowledging progress on inflation

Powell pointed to the steady progress on inflation in the past year: The Fed’s preferred inflation gauge — the Personal Consumption Expenditures price index — rose 3% in June from a year earlier, down from the 3.8% rise in May. The Commerce Department officially releases July PCE figures next week, though Powell already previewed that report in his speech. He said the Fed’s favorite inflation measure rose 3.3% in the 12 months ended in July.

The Consumer Price Index, another closely watched inflation measure, rose 3.2% in July, a faster pace than the 3% in June, though underlying price pressures continued to decelerate that month.

In his speech Friday, Powell stood firmly by the Fed’s current 2% inflation target, which was formalized in 2012 — at least for now. The Fed is set to review its policy framework around 2025, which could be an opportunity to establish a new inflation target.

An economy more resistant to monetary policy?

Powell also weighed in on an ongoing debate among economists about whether the “neutral rate of interest,” also known as r*, is higher since the economy is still on strong footing despite the Fed’s aggressive pace of rate hikes.

In theory, the neutral rate is when real interest rates neither restrict nor stimulate growth. The Fed chair said higher interest rates are likely pulling on the economy’s reins, implying that r* might not be structurally higher, though he said it’s an unobservable concept.

“We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint,” Powell said.

Either way, while the Fed chief hinted that more rate hikes might be coming down the pike, there’s no guarantee either way.