Sales of previously owned homes in the United States fell in March as home prices climbed and mortgage rates held steady that month, reflecting the persistent pain of America’s affordability woes and undermining the crucial spring homebuying season.

Existing home sales, which make up the majority of the housing market, fell 4.3% in March to a seasonally adjusted annual rate of 4.19 million, the sharpest drop in more than a year, the National Association of Realtors reported Thursday. Sales fell across the country except in the Northeast region, which saw an increase for the first time since November 2023.

Meanwhile, the median price of an existing home was $393,500 last month, an increase of 4.8% from a year earlier. That was the highest March price on record. Rising home prices coupled with mortgage rates stuck at elevated levels means Americans are still dealing with a tough housing market.

Home sales are up from the decades-lows seen last fall and were off to a robust start this year, but now that momentum seems to have come undone. Sales might not rise meaningfully higher as the Federal Reserve signals that it won’t cut interest rates anytime soon.

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” NAR chief economist Lawrence Yun said in a release. “There are nearly six million more jobs now compared to pre-Covid highs, which suggests more aspiring homebuyers exist in the market.”

A difficult road ahead for the market?

Mortgage rates play a key role in determining housing affordability. That could be a frustrating sticking point.

Last year, home sales were in the doldrums at their lowest level in nearly three decades as mortgage rates shot up, reaching a two-decade high of 7.79% in October.

Then mortgage rates began to decline on hopes that the Fed would cut interest rates aggressively in 2024, but those expectations have been thrown out the window. Disappointing inflation reports and signs that the economy remains strong are keeping the Fed in wait-and-see mode, pushing back the timing of the first rate cut. Mortgage rates have held steady in recent weeks but are poised to rise because they track bond yields, which are climbing on persistently high inflation readings.

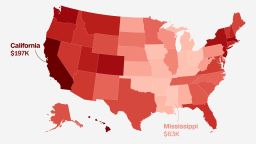

Home prices nationwide, which also play a role in affordability, haven’t retreated in any meaningful way.

One bright spot in NAR’s latest report on existing home sales: There was an increase in first-time homebuyers trickling into the market. They represented 32% of all transactions in March, up from 26% in February and 28% higher than a year ago, while the share of buyers who were investors declined in March.

“Good to see that number go up above 30%” Yun said. That may be “because people heard about the lawsuit settlement where the buyers possibly need to come up with extra funds to pay up some professional representation, but they want to do it before the new rules takes place sometime in July,” Yun added.

A historic NAR settlement, which was announced in March and is expected to change how homebuyers and sellers pay their real estate agents, hasn’t been approved by the courts yet. But it is already sending shockwaves through the real estate industry, with some buyers saying they plan to begin searching for a home before the new rules take effect.