To undercut its fast-growing rivals, Subway is making a big change to its meats.

The chain’s roughly 20,000 US locations will freshly slice their deli meat beginning Wednesday, marking Subway’s biggest change since two years ago, when it began refreshing its menu offerings, ingredients and restaurant appearances to boost once-sagging sales and make itself an attractive acquisition target.

Subway has struggled in recent years as competition in the industry has ramped up, and the staid brand has fallen out of favor with customers. As part of its turnaround effort, the company added customization to its menu – a feature many rivals have popularized – which helped lift sales nearly 8% at American stores last year. Subway doubled down on pushing orders to its app, which helped digital sales. Fresh-sliced meat is another step in that direction, although the payoff remains to be seen.

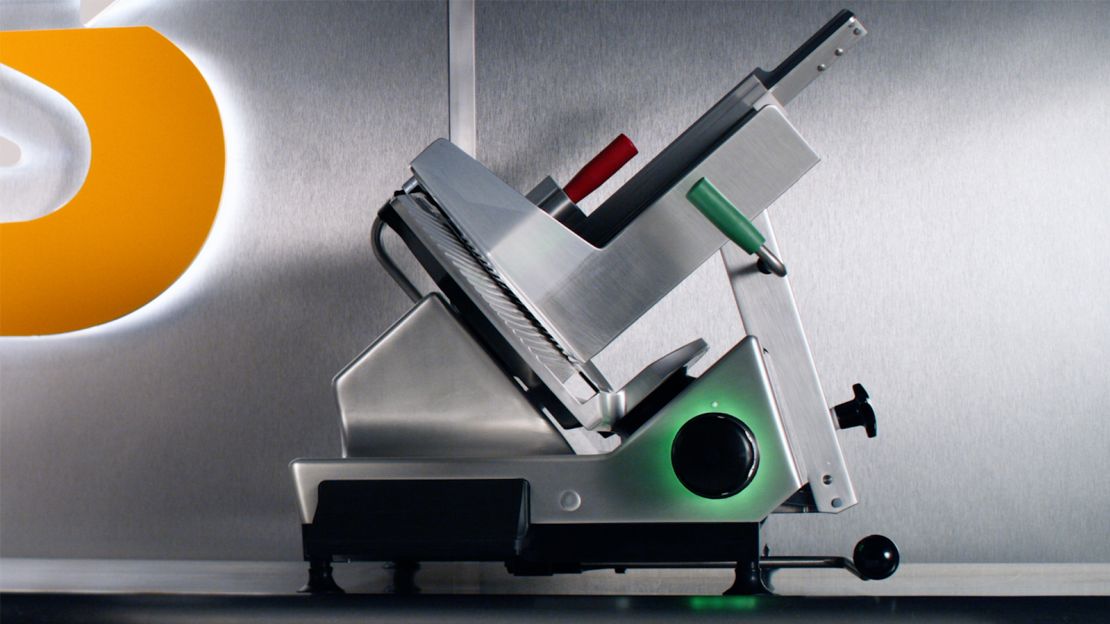

Around 80% of stores will display the $6,000 slicers prominently (space permitting) near the deli counter with most of the meat sliced several times a day, including turkey, pepperoni, roast beef, ham and salami. That’s a major shift from Subway’s previous method of slicing meat at its factories and delivering it to stores.

In addition to boosting freshness, slicing cold cuts at its stores brings the chain in-line with methods at its smaller competitors like Jimmy John’s, Jersey Mike’s Subs and Firehouse Subs, all of which have been growing their store counts in recent years. That’s in sharp contrast to Subway, which has closed roughly 7,000 locations since 2016.

Subway locations currently fresh slice vegetables and freshly bakes bread and cookies daily. Adding freshly sliced meat “felt like the natural step that we needed to get back to and address,” Trevor Haynes, president for Subway’s North America operations, told CNN.

Cheese, steak and rotisserie chicken will still be delivered pre-sliced.

To promote the changes, Subways is rolling out four new sandwiches that highlight the new slicer, including turkey, garlic roast beef, ham and “The Beast,” which features pepperoni, salami, turkey, ham and roast beef on Italian bread.

A year ago, Subway unveiled its most extensive makeover in the company’s nearly 60-year history. The makeover placed less of an emphasis on customization in favor of a “Subway Series” sandwich menu, which now accounts for 20% of sales. Digital growth is also a bright spot for the company, with sales made through its app or third-party services doubling compared to 2021.

Average yearly sales at Subway US restaurants, however, are much lower compared to its sandwich business rivals. Data from QSR Magazine reveals that its three rivals pull in about $1 million per unit, with an average Subway location raking in less than $500,000.

Still, privately held Subway said it had a record-setting year in 2022 with sales at its North America stores that have been open at least a year rising 7.8% last year compared to 2021. Sales also exceeded projections by more than $700 million, but the company didn’t reveal specific numbers.

Subway is also up for sale, with Haynes saying that it’s “on track” for an imminent announcement, likely in mid-July.