Europe’s biggest producer of advanced chipmaking technology has joined the United States in its escalating standoff with China.

The Netherlands announced Wednesday, via a letter from its trade minister to parliament, that new restrictions on overseas sales of semiconductor technology were needed to protect national security.

While the letter didn’t name ASML Holdings, Europe’s biggest tech firm, the curbs will affect the Dutch company, which is a key supplier to global chipmakers, including those in China.

The announcement marks the first public move by the Dutch government toward adopting rules, advocated by Washington, to restrict China’s chipmaking industry.

Japan has also been involved in three-way discussions with the Netherlands and the United States, a source familiar with the talks told CNN. Reuters reported that Tokyo is expected to issue an update on its policies on chip equipment exports as soon as this week.

China said Thursday it “firmly opposes” the Netherlands’ upcoming curbs, which come just months after the United States restricted sales of some semiconductor machinery to Beijing. For those measures to really bite, Washington needs other important suppliers, located in the Netherlands and Japan, to join.

Chinese foreign ministry spokesperson Mao Ning accused “certain countries” of “coercing and inducing other countries to take export restriction measures against China at the expense of their allies’ interests.”

She didn’t name the United States, but Chinese officials often use the term “certain countries” or “some countries” when making critical comments about Washington.

“We hope the Netherlands won’t follow some countries in abusing export control measures,” Mao said. “China will take all necessary countermeasures to protect our legitimate rights and interests.”

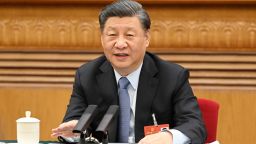

This week, Chinese leader Xi Jinping hit out at the United States with unusually direct comments as he called on China’s private companies to “fight” alongside the Communist Party at a time of mounting challenges. He accused Western countries led by the United States of trying to “contain” and “suppress” China.

Beijing has set a target for China to become a global leader in a wide range of industries, including artificial intelligence, 5G wireless technology and quantum computing.

Intensifying competition

In October, those plans came up against a major obstacle when the Biden administration banned Chinese companies from buying advanced chips and chipmaking equipment without a license. It also restricted the ability of American citizens to provide support for the development or production of chips at certain manufacturing facilities in China.

Chips are vital for everything from smartphones and self-driving cars to advanced computing and weapons manufacturing.

Veldhoven-based ASML is a global leader in the production of lithography machines, which employ light to print patterns on silicon. Customers such as TSMC, Samsung (SSNLF) and China’s SMIC use the Dutch company’s equipment to mass-produce microchips.

“These new export controls focus on advanced chip manufacturing technology, including the most advanced deposition and immersion lithography tools,” ASML said in a statement. “Due to these upcoming regulations, ASML will need to apply for export licenses for shipment of the most advanced immersion … systems.”

It added that it didn’t expect the upcoming measures to have a material effect on its 2023 financial outlook. The company has mainly sold “mature” products to China.

European battleground

The announcement of the Netherlands’ export restrictions, the details of which are expected to be confirmed before the summer, isn’t the first time the US-China tech rivalry spilled over into Europe.

Two European semiconductor deals ran into trouble last year over links with Beijing, in a sign of concern spreading in the West over potential Chinese control of critical infrastructure.

In November, the new owner of Britain’s biggest chipmaker was ordered to unwind its takeover, just days after another chip factory sale was blocked in Germany. Both transactions were hit by national security concerns, and had involved acquisitions by Chinese-owned companies.

In the United Kingdom, Nexperia, a Dutch subsidiary of Shanghai-listed semiconductor maker Wingtech, was told by the government to sell at least 86% of its stake in Newport Wafer Fab, more than a year after taking control of the factory. Staffers have since protested the decision, saying it puts nearly 600 jobs at risk.

In Germany, the economic ministry barred Elmos Semiconductor, an automotive chipmaker, from selling its factory in the city of Dortmund to Silex, a Swedish subsidiary of China’s Sai Microelectronics.

The failed deals illustrate how, at a time of escalating US-China tensions, Europe is also under growing pressure to act, particularly as officials face US calls for key sectors to be kept out of Chinese control.

— CNN’s Laura He and Michelle Toh contributed to this report