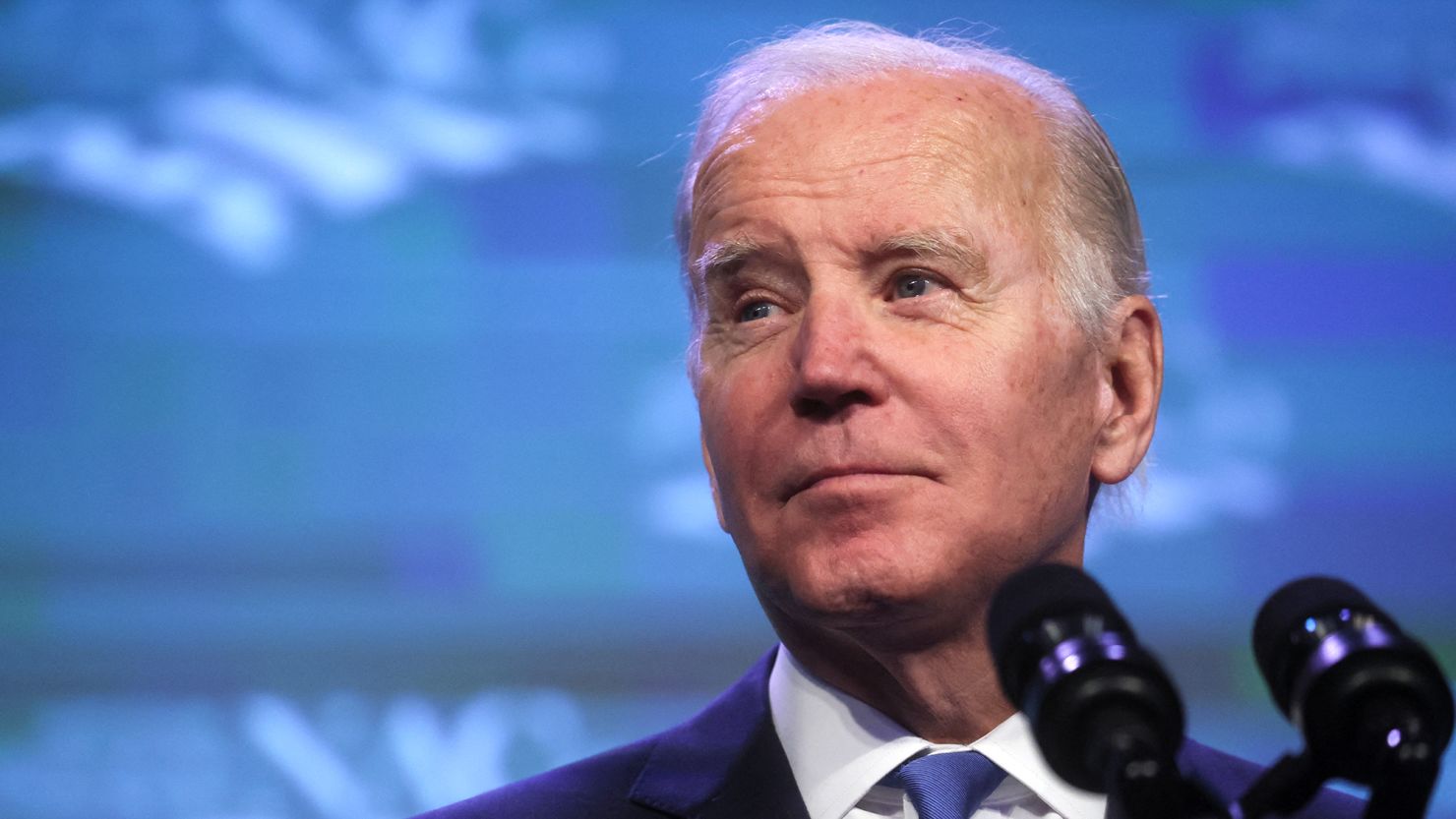

President Joe Biden has made another series of inaccurate claims in an economic speech.

In late January, CNN fact-checked Biden’s false and misleading claims in an economic speech to union workers in Virginia. In a speech this Wednesday to union workers in Maryland, Biden repeated one of those claims and made three other incorrect statements – all of them about statistics.

Trump and the national debt

In the Wednesday speech, Biden criticized the fiscal management of former President Donald Trump. After correctly noting that the federal budget deficit increased every year of Trump’s term, Biden said, “And because of those record deficits, no president added more to the national debt – that’s a 200-year debt – never added more to the national debt than my predecessor.”

Facts First: This claim is false. More debt was added in the eight years under President Barack Obama, with Biden as vice president, than in the four years under Trump. The Trump era set the record for most debt added in a single four-year presidential term, but Biden made it sound here like the Trump era set the record even when you include two-term presidents like Obama. (Biden correctly said in his State of the Union address last week that he was referring to a record for debt added in a four-year period.) Also, while Biden mentioned “record deficits,” plural, under Trump, only one Trump-era deficit, in pandemic-era fiscal 2020, was actually a record; the deficits in fiscal 2017, 2018 and 2019 were all lower than every deficit in Obama’s first term, when the country was emerging from a major recession and Obama approved some policies that increased deficits.

There are various ways to measure the debt. Using the basic headline measure, total public debt, the debt increased about $9.3 trillion over Obama’s eight years, from about $10.6 trillion on the day he was inaugurated in 2009 to about $19.9 trillion on the day Trump took office in 2017. The debt increased by about $7.8 trillion over Trump’s four years, to about $27.8 trillion when Biden replaced him in 2021.

It’s also important to note that it is an oversimplification to blame presidents alone for debt incurred during their tenures.

A significant amount of spending under any president is the result of decisions made by their predecessors – such as the creation of Social Security, Medicare and Medicaid decades ago – and by circumstances out of a president’s control, such as an inherited recession for Obama and the global Covid-19 pandemic for Trump.

And while some debt can fairly be attributed to a single party – Trump’s 2017 tax cuts, unanimously opposed by congressional Democrats, were a significant contributor – other debt is bipartisan. Notably, the debt spiked in 2020 after Trump approved trillions in emergency pandemic relief spending that Congress had passed with overwhelming Democratic and Republican support.

Biden was right when he said that the deficit increased every year under Trump. But the deficits in fiscal 2017, 2018 and 2019 under Trump were all below $1 trillion – lower than the deficits in fiscal 2009, 2010, 2011 and 2012 under the Obama-Biden administration. The deficit then roughly tripled, to a record level of about $3.1 trillion, in pandemic-era fiscal 2020.

Biden and the national debt

In another part of the speech, Biden said, “We cut the debt by $1.7 billion the last two years.” The White House made a correction to the official transcript to make it “$1.7 trillion” instead of “$1.7 billion.”

Facts First: This claim is inaccurate even if you ignore Biden’s billion-versus-trillion mixup. The national debt has continued to increase under Biden. It is the deficit that has declined by about $1.7 trillion – and experts say it is misleading for Biden to take credit for that reduction.

The debt has increased about $3.7 trillion during Biden’s time as president, rising to about $31.5 trillion. As Biden also did in speeches during the 2022 midterms, his claim in this speech conflated the debt (the accumulation of federal borrowing plus interest owed) with the deficit (the one-year difference between spending and revenues).

The deficit did fall by roughly $1.7 trillion between fiscal 2020 and fiscal 2022, from about $3.1 trillion to about $1.4 trillion. But as CNN has repeatedly noted, it is highly questionable how much credit Biden deserves for the decline – which overwhelmingly occurred because the emergency pandemic spending from the end of the Trump era expired as planned. In fact, independent analysts say Biden’s own new laws and executive actions have significantly added to current and projected future deficits, not reduced those deficits. You can read more here and here.

Medicare and the Inflation Reduction Act

Biden made a confusing remark about prescription drug costs and the Inflation Reduction Act he signed into law last year.

He said the law “saves seniors a lot of money” on prescription drugs, then added that, by bringing down the cost of these drugs, the law “will cut the federal deficit, saving taxpayers hundreds of billions of dollars over time.”

Both of these assertions are fair. But then Biden added that if Republicans repealed this law, they would be getting rid of “$159,000 a year in savings on lower drug costs.”

Here’s a fuller quote: “Now, our Republican friends want to repeal the Inflation Reduction Act. They’d get rid of the savings on prescription drugs that we buy, like Medicare – I mean, we buy from – through – through Medicare. And it would eliminate, today, right now, $159,000 a year in savings on lowered drug costs. Now, that just means your tax dollars are going to save – be saved $159,000 to do what we’re doing right now.”

Facts First: The Inflation Reduction Act does not provide “$159,000 a year in savings on lowered drug costs.” A White House official made clear to CNN on Thursday that Biden was attempting to say that government savings of $159 billion over 10 years would be lost with a Republican repeal of two key Inflation Reduction Act provisions on prescription drugs.

Viewed one way, Biden’s “$159,000 a year” figure significantly understated the total savings from these two provisions. (One allows Medicare to negotiate the price of certain prescription drugs. The other requires pharmaceutical companies to pay rebates to Medicare for price increases over the rate of inflation.) But his use of such a modest number may have led some listeners to believe that he was talking about giant savings to particular seniors or families rather than modest savings to the government. And his figure was incorrect regardless of how it was perceived.

The White House corrected this section of the official transcript of the speech after CNN inquired about the “$159,000” figure.

Billionaires and taxes

Biden reprised an inaccurate figure he used in the Virginia speech in late January. He said of billionaires in the United States: “You know what their average tax they pay is? About 3%.”

Facts First: Once more, Biden’s “3%” claim is incorrect. For the third time in less than a month, Biden inaccurately described a 2021 finding from economists in his administration that the wealthiest 400 billionaire families paid an average of 8.2% of their income in federal individual income taxes between 2010 and 2018; after CNN inquired about Biden’s “3%” claim in the late-January speech, the White House published a corrected transcript of that speech to make it “8%” instead. Also, it’s important to note that even the 8% number is contested, since it is an alternative calculation that includes unrealized capital gains that are not treated as taxable income under federal law.

“Biden’s numbers are way too low,” Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute think tank, told CNN in late January – though Gleckman also said we don’t know precisely what tax rates billionaires do pay. Gleckman wrote in an email: “In 2019, Berkeley economists Emmanuel Saez and Gabe Zucman estimated the top 400 households paid an average effective tax rate of about 23 percent in 2018. They got a lot of attention at the time because that rate was lower than the average rate of 24 percent for the bottom half of the income distribution. But it still was way more than 2 or 3, or even 8 percent.”

Biden has cited the 8% statistic in various other speeches, but unlike the administration economists who came up with it, he tends not to explain that it doesn’t describe tax rates in a conventional way. And regardless, he said “3%” in this speech and the Virginia speech – and “2%” in another January speech.