A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here. You can listen to an audio version of the newsletter by clicking the same link.

As the Federal Reserve continues its inflation-fighting tightrope act, market moves suggest that investors may be feeling more at ease with the central bank’s actions. That’s not necessarily a good thing.

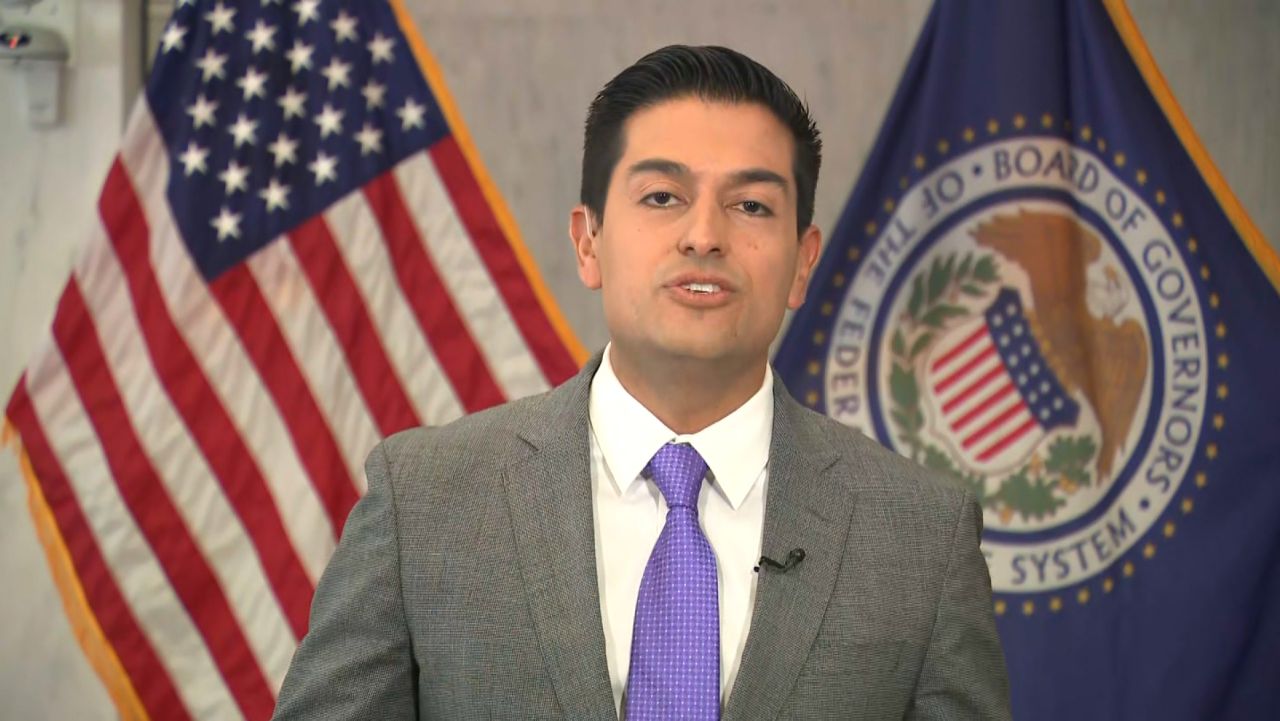

What’s happening: The Fed is widely expected to reduce the pace at which it is hiking rates to a quarter of a percentage point in its upcoming meeting in February, following a similar deceleration in December when it hiked by half a point instead of three-quarters.

The Fed has eased last year’s historically high interest rate increases and recent data suggests that the chances of a “soft landing” for the US economy have improved. Price increases are also moderating: December brought the sixth consecutive monthly fall in consumer price index (CPI) inflation to 6.5%.

This all means that investors are beginning to worry less about the Fed. To put it simply: Wall Street has bigger fish to fry.

In the past few weeks, market reactions to speeches by Federal Reserve governors and new inflation data have gotten smaller while reactions to fourth-quarter corporate earnings announcements have gotten larger, according to Savita Subramanian, a quantitative strategist at Bank of America, in a recent analysis.

That’s a change from 2022 when the Fed and the market tended to move in unison.

Investors have a serious fear of uncertainty, but they’re sleeping well ahead of next week’s Fed policy decision — they’re about 98% sure that the central bank will announce a quarter-point hike, according to the CME FedWatch tool.

Not so fast: There are still plenty of reasons for the Fed to remain hawkish. Labor markets remain strong, with the unemployment rate dropping to a post-pandemic low of 3.5%, and wage growth also remains high. Policymakers also seem to expect that the robust labor market will persist for some time.

Even as inflation slows, a look under the hood of the latest report suggests that price increases may be higher and more persistent than the market hopes. Services inflation continues to run hot. Shelter inflation, a measure of housing costs and the CPI’s largest component, just marked its strongest annualized rate (7.5%) since the 1980s.

Investors are misreading the outlook for inflation, just as they did in July 2022, argues Gargi Chaudhuri, head of iShares Investment Strategy for the Americas at Blackrock. “We’ve seen this movie before,” she wrote in a recent note.

Fed funds futures now imply that the central bank will end its tightening streak by June and predict that it will ease interest rates by half a percentage point by the end of the year. But that outcome is at odds with the Fed’s own verbal guidance and with its summary of economic projections.

“We do not expect the Fed to ease this year, even as growth slows, making it likely that we will see a recession in the U.S. in the second half of 2023,” said Chaudhuri.

This could mean that the upcoming Fed meeting will generate a lot of market disappointment, said Christian Scherrmann, an economist at DWS Group.

The Fed flagged investors’ persistent belief in a pivot away from elevated rates as something that could hurt efforts to restore price stability. Officials have also pointed to the growing gap between its projections and market pricing as a problem.

What it means: “The Fed foresees a soft landing, with an increasing risk of a mild recession, enabling it to keep rates higher for longer,” said Scherrmann. “On the other side, markets are pricing in a more severe economic downturn, forcing the Fed to bring down rates quickly.”

There appear to be two conflicting views on the table for how the economy will evolve; next week’s Fed meeting may help bring them together or tear them further apart.

Bed Bath & Beyond can no longer pay its debts

Bed Bath & Beyond coupons never expire, but you still better use them quickly. That’s because the end could be near for the long-struggling retailer, report my colleagues Paul R. La Monica and Nathaniel Meyersohn.

Bed Bath & Beyond warned in a regulatory filing Thursday that it received a notice of default from its lender, JPMorgan Chase. Shares of the company plunged more than 20% on the news, to about $2.56 a share.

The company said in its SEC filing Thursday that “at this time, the Company does not have sufficient resources to repay the amounts under the Credit Facilities and this will lead the Company to consider all strategic alternatives, including restructuring its debt under the U.S. Bankruptcy Code.”

Bed Bath & Beyond defaulted “on or around” January 13, according to the Securities & Exchange Commission filing. As a result, creditors are demanding immediate payment and Bed Bath & Beyond could be forced to file for Chapter 11 bankruptcy reorganization due to its financial woes.

Google’s long period of online dominance could end

This week, the US Justice Department accused Google of running an illegal monopoly in its online advertising business and called for parts of it to be broken up, reports my colleague Brian Fung.

Google said the Justice Department is “doubling down on a flawed argument” and that the latest suit “attempts to pick winners and losers in the highly competitive advertising technology sector.”

If successful, however, the blockbuster case could upend a business model that’s made Google the most powerful advertising company on the internet. It would be the most consequential antitrust victory against a tech giant since the US government took on Microsoft more than 20 years ago.

But even though the lawsuit drives at the heart of Google’s revenue machine, it could take years to play out. In the meantime, two other thorny issues are poised to determine Google’s future on a potentially shorter timeframe: The rise of generative artificial intelligence and what appears to be an accelerating decline in Google’s online ad marketshare.

Just days before the DOJ suit, Google announced plans to cut 12,000 employees amid a dramatic slowdown in its revenue growth, and as it works to refocus its efforts partly around AI.

As Brian writes: “For the better part of 15 years, Google has seemed like an unstoppable force, powered by the strength of its online search engine and digital advertising business. But both now look increasingly vulnerable.”

Nothing lasts forever.