Christmas is just 10 days away, and investors hoping for a Santa Claus rally have found little holiday cheer on Wall Street this month – especially Thursday.

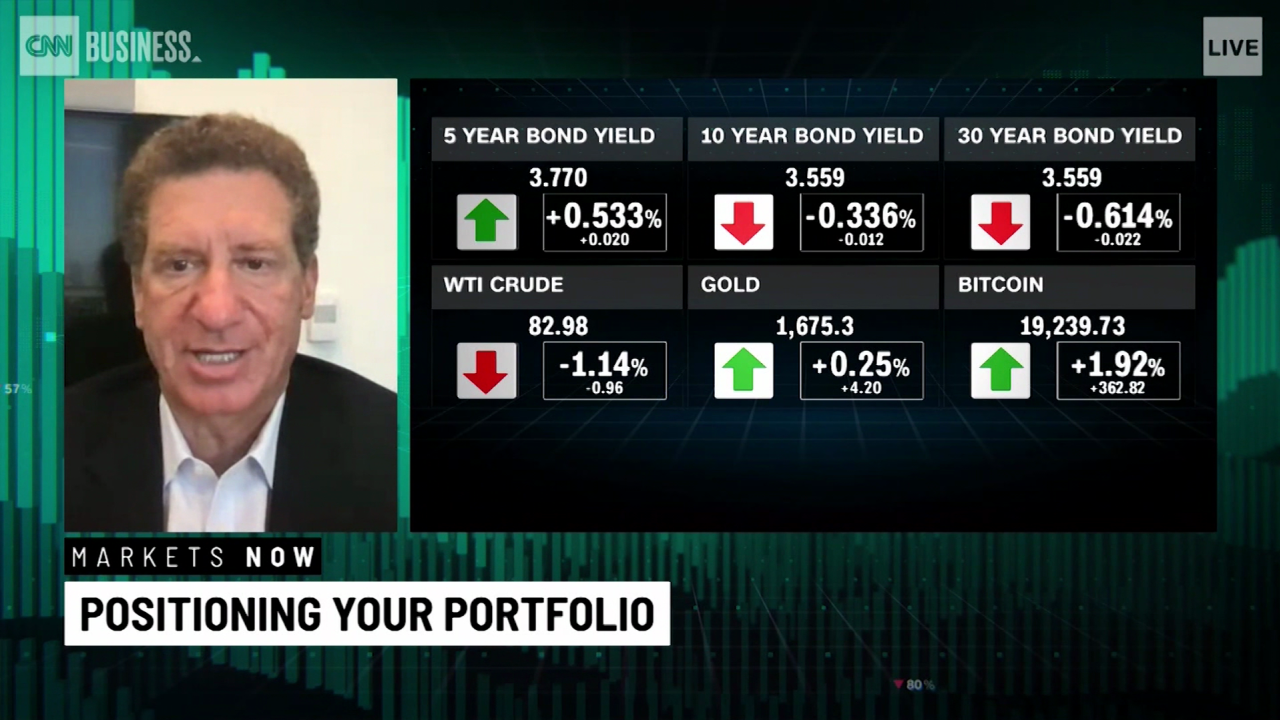

The Dow plummeted nearly 765 points, or 2.3%, Thursday, and it is down 4% in December following solid gains the previous two months. Verizon (VZ) was the only one of the 30 Dow stocks in positive territory.

The S&P 500 fell 2.5% and the Nasdaq was 3.2% lower Thursday. The S&P 500 is now off 4.5% for the month while the Nasdaq has sunk nearly 6%.

Stocks were sliding Thursday as investors continued to fret about the latest economic forecasts from the Federal Reserve. The Fed raised rates by “just” half a point Wednesday, as expected. The Bank of England and the European Central Bank followed suit Thursday morning with half-point hikes of their own.

But the Fed also indicated it anticipates the US economy will barely grow in 2023. The Fed’s new forecasts also call for a bigger jump in the unemployment rate, a larger rise in consumer prices and higher interest rates than it expected in September.

It didn’t help that the Commerce Department reported a much bigger drop in retail sales for November than expected, on Thursday. All of this has led some to worry about the dreaded stagflation scenario of stagnant growth and persistent inflation. Stocks could be in for a rough stretch as a result.

“This is not a buy-the-dip day. 2022 has not been a buy-the-dip year. if you have done so, you have lost money,” said Judith Lu, CEO of Blue Zone Wealth Advisors. “Inflation is way too high and the Fed has this monstrous job trying to get a handle on it.”

Lu said she thinks stocks are overvalued right now, given that analysts are only expecting earnings to grow about 5% in 2023. Those projections are probably “wishful thinking” and “too ambitious,” she added.

Of course, the slowdown fears may not become reality. The economy could avoid dipping into a recession and inflation pressures may wind up cooling faster than expected. But at the very least, market volatility may be back for the foreseeable future.

Investors are worried that the Fed (and perhaps other global central banks) will also continue to act, even though there is already evidence that consumers are starting to feel a one-two punch from higher prices and higher interest rates. For its part, the labor market remains on solid footing: Weekly jobless claims just hit their lowest level since September.

Jefferies economists Aneta Markowska and Thomas Simons paraphrased T.S. Eliot in a report about the retail sales figures Thursday, saying “the holiday shopping season started not with a bang, but with a whimper.”

“This year’s Black Friday sales clearly did not live up to expectations,” they added.

It also doesn’t help that Powell has made the mistake before of acting too hawkish before the holidays, a time when market moves are often magnified due to lower trading volume at the end of the year.

“Let’s not forget that Jay Powell wrecked a Santa Claus Rally in 2018 when he got very hawkish and talked rates up and then the market basically went into a bear market until Christmas Eve,” said Nancy Tengler, CEO of Laffer Tengler Investments, in a report. “So I think you want to remain vigilant and focused on the long term.”

Some experts are hopeful that jitters about the economy will soon ease. After all, a recession wouldn’t be a major surprise at this point. Companies, consumers and investors have been bracing for one for months.

“The market has been very much anticipating a recession all year,” said Eric Marshall, a portfolio manager with Hodges Capital. “This could be a shallower recession.”

Marshall said investors should be looking at beaten-up stocks in the technology, health care and consumer sectors. They may be the first to rebound.