Editor’s Note: Mark Wolfe is an energy economist and serves as the executive director of the National Energy Assistance Directors Association (NEADA), representing the state directors of the Low Income Home Energy Assistance Program and the Energy Programs Consortium. He specializes in energy, climate, housing and related consumer finance issues. The opinions expressed in this commentary are his own. View more opinion on CNN.

Rising prices for fossil fuels – oil, natural gas and coal – have led to record profits this year for the companies that produce and sell them. Last week, for example, ExxonMobil reported record profits for a second quarter in a row, and Chevron reported profits that were almost double what they were last year.

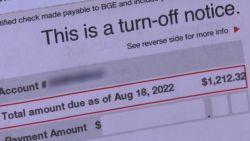

American consumers, meanwhile, have been feeling the pain of high energy prices as their wages have not kept up with inflation. Prices in the US in the past 12 months are up by 18.2% for gasoline, 15.5% for electricity and 33.1% for natural gas. And the impact of these rising prices is being felt particularly by lower-income households and workers.

The message is clear: As energy companies continue to rake in massive profits, energy has become increasingly unaffordable for lower-income Americans. The federal government needs to take action now to help families maintain access to affordable energy throughout the winter.

The US Census Bureau’s recent Household Pulse Survey showed that 47.6% of families earning between $35,000 and $50,000 reduced spending on food or medicine at least once in the last year to pay their home energy bills, up from 39.2% the previous year. As alarming as these numbers are, those who heat their homes with natural gas, electricity or heating oil could see their prices increase by 28%, 10% and 27% respectively under current winter forecasts, according to the Energy Information Administration, and these prices could go even higher if it’s a colder winter than projected.

This is not a complicated problem to solve. Recently, the European Union approved a policy to tax energy company profits that are more than 20% higher than the average yearly profits since 2018. The profits will then go to businesses and households to offset the impact of high energy prices.

The Biden administration and Congress should follow the EU’s lead and pass legislation that would redistribute a portion of energy companies’ profits to families who are struggling to pay their energy bills. Just this week, President Joe Biden indicated his support for a tax on excessive oil and gas company profits as a result of the spike in prices.

Legislation has already been introduced in the US that would tax excess petroleum profits. The funds raised by the tax would be distributed to single filers who make less than $75,000 in annual income and joint filers who make less than $150,000. This bill is a step in right direction, but should also include provisions to tax similar “excess” profits being earned by companies that produce natural gas and coal.

The funds from an excess profits tax could build on the housing efficiency grants and tax credits provided in the recently passed Inflation Reduction Act and help families weatherize their homes to protect them against future price increases by reducing the amount of energy they need to use. They could also provide a cap on the total amount of money a family would spend on home energy bills this winter and protect them from future price increases. This would be similar to Ohio’s Percentage of Income Payment Plan, which limits the amount a low-income family can spend on energy. If they heat their homes with natural gas, their monthly bill and electric bill are each limited to 5% of their gross income. If they heat with electric, their monthly bill is limited to 10% of their gross income.

Get our free weekly newsletter

- Sign up for CNN Opinion’s newsletter.

- Join us on Twitter and Facebook

Energy is becoming increasing unaffordable in the US. By taking these steps, Congress will help mitigate the financial strain on middle and lower-income families and help them afford costs they can’t control due to the continued instability of global energy market conditions.