US stocks fell sharply in Friday trading as investors continued to worry about even more rate hikes from the Federal Reserve that could land the US economy in a recession.

The Dow (INDU) closed 483 points, or 1.6%, lower in Friday trading, marking its lowest level since November 2020. The S&P 500 (SPX) and the Nasdaq (COMP) Composite were down 1.7% and 1.8%, respectively.

The Dow fell by more than 800 points at one point, falling more than 20% from its record close of 36,799.65 set on January 4, and entering bear territory.

The S&P 500 remains in bear territory.

“We are now in another downswing in the ongoing bear market,” said Brad McMillan, chief investment officer for Commonwealth Financial Network. “This year, there have been four drops and three rallies—and we are down quite a bit. That doesn’t feel good.”

This is a fourth negative day in a row for the major indexes and their fifth decline in the last six weeks.

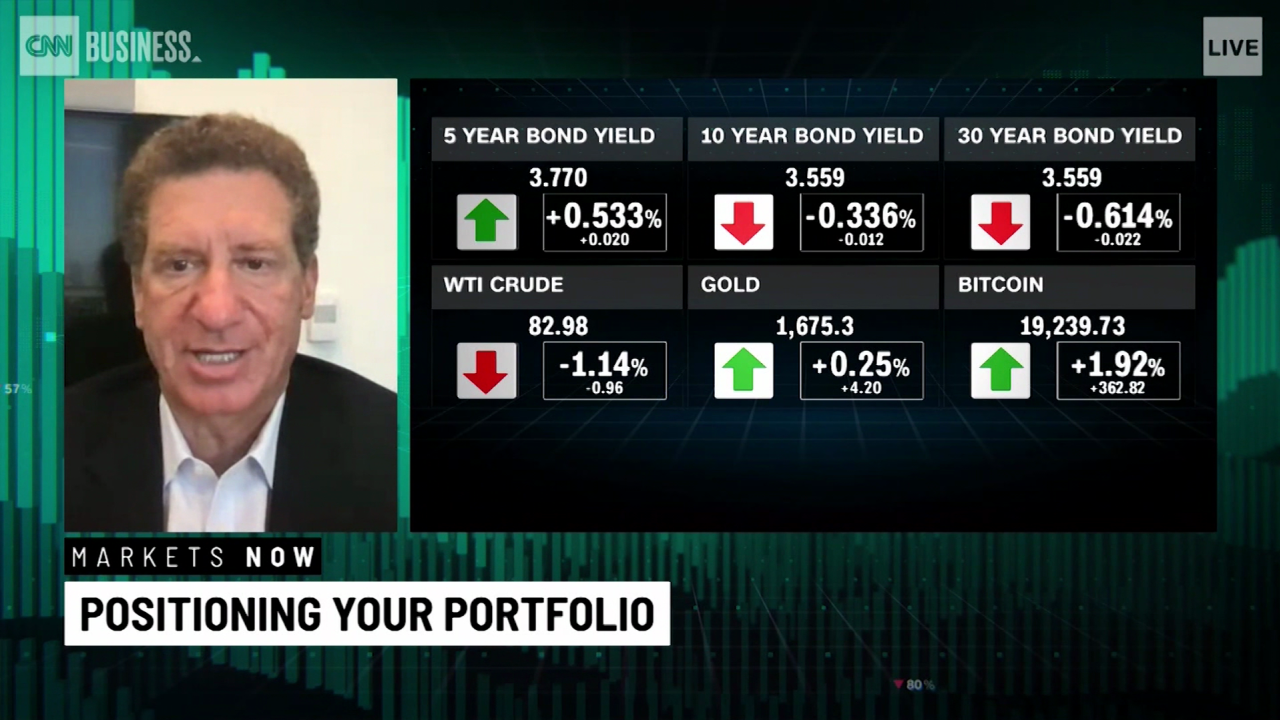

Investors don’t have many places to make money at the moment: In addition to sinking stocks, the bond market is also selling off, sending US Treasury yields soaring to 11-year highs in recent days. The 10-year yield fell back a bit Friday but remains near 3.7%, and the 2-year yield is above 4.1%. That’s a much better return than you can get with stocks these days, so high bond yields are adding pressure on the stock market.

Wall Street also remains concerned that the Fed’s rate-hiking plan could continue to increase borrowing costs, hurting the corporate profits that support their stock prices. And if the Fed is serious about slowing the economy down to gain control of runaway inflation, a recession could cause some real pain for consumers who buy the products that publicly traded companies make.

The market sell-off could continue for some time, as stock valuations are compressed by the Fed’s actions, said Ivan Feinseth, chief market strategist of Tigress Financial Intelligence. Investors “may not see a bottom until there’s confirmation that inflation indicators turned significantly lower, he added.