The Covid era of free money has come to an end.

After dropping interest rates to zero in March 2020 to revive the economy, the Federal Reserve has just shifted gears to go into inflation-fighting mode.

Fed officials said Wednesday they are raising interest rates, beginning their first cycle of rate hikes since the one that began in late 2015.

The fact that the Fed is finally moving away from zero shows confidence in the health of the jobs market. But the speed with which interest rates could go up underscores concerns about the soaring cost of living.

High inflation – consumer prices rose in February at the fastest pace in 40 years – means the Fed will raise interest rates multiple times in the coming months, central bank officials confirmed on Wednesday.

Americans will experience this policy shift through higher borrowing costs: No longer will it be insanely cheap to take out mortgages or car loans. And cash sitting in bank accounts will finally earn something, albeit not much.

“Money will no longer be free,” said Joe Brusuelas, chief economist at RSM US.

When the pandemic erupted, the Fed made it almost free to borrow in a bid to encourage spending by households and businesses. To further boost the Covid-ravaged economy, the US central bank also printed trillions of dollars through a program known as quantitative easing. And when credit markets froze in March 2020, the Fed rolled out emergency credit facilities to avoid a financial meltdown.

The Fed’s rescue worked. There was no Covid financial crisis. Vaccines and massive spending from Congress paved the way for a rapid recovery. But now the Fed must take on another challenge: rising inflation. Here’s how higher rates will impact consumers.

Borrowing costs are going up

Today, unemployment is very low but inflation is very high. The US economy no longer needs all that help from the Fed.

Every time the Fed raises rates, it becomes more expensive to borrow. That means higher interest costs for mortgages, home equity lines of credit, credit cards, student debt and car loans. Business loans will also get pricier, for businesses large and small.

The most tangible way this is playing out is in mortgages, where expectations of rate hikes have already driven up rates.

The rate for a 30-year fixed rate mortgage averaged 3.85% in the week ending March 10. While that’s still cheap historically, it’s up sharply from under 3% in November.

Higher mortgage rates will make it harder to afford home prices that have skyrocketed during Covid. But weaker demand could cool off prices. The median price for an existing home sold in January soared by 15.4% year-over-year to $350,300.

But it’ll still be relatively cheap to borrow

None of this means it will suddenly become expensive to finance purchases.

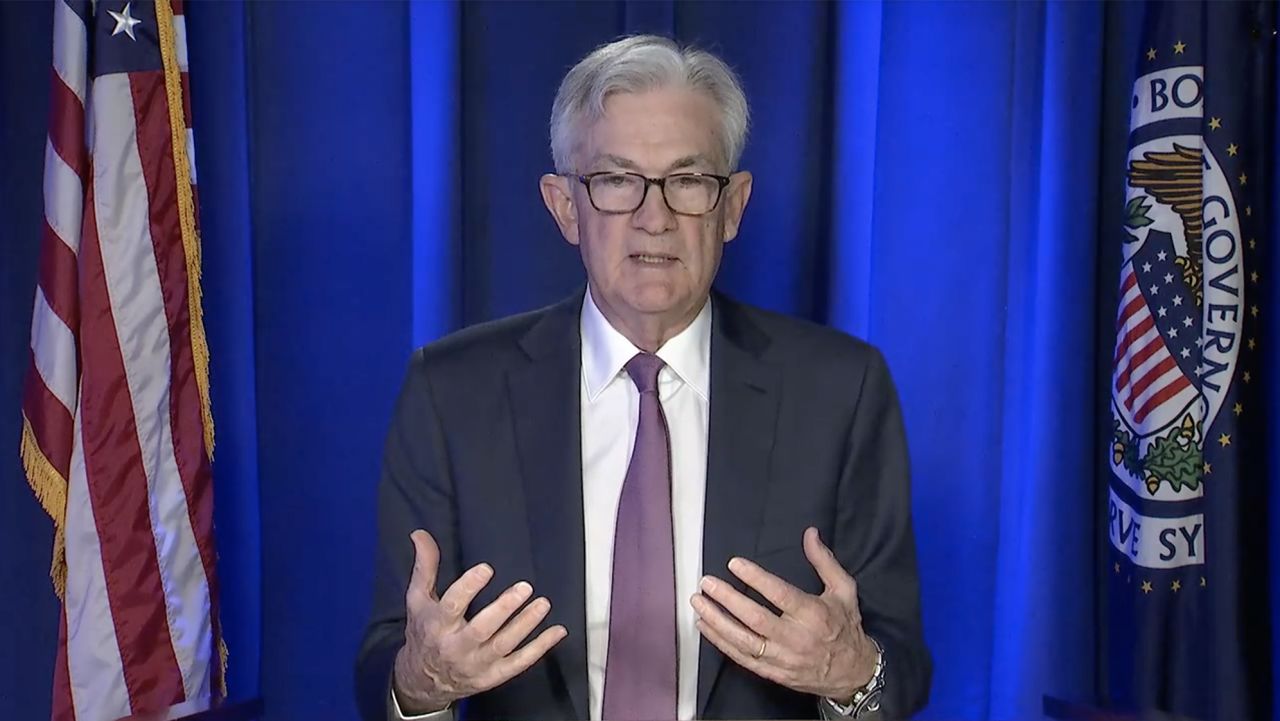

Federal Reserve Chairman Jerome Powell said the central bank will likely raise interest rates six more times this year, for a median federal funds rate of 1.9% by the end of the year.

While that’s up from 0.125% today, it’s still low historically.

For context, the Fed raised rates to as high as 2.37% during the peak of the last rate hiking cycle in late 2018. Before the Great Recession of 2007-2009, Fed rates got as high as 5.25%.

And in the 1980s, the Paul Volcker-led Fed jacked interest rates up to unprecedented levels to fight runaway inflation. By the peak in July 1981, the effective fed funds rate topped 22%. (Borrowing costs now won’t be anywhere near those levels and there is little expectation that they will go up that sharply.)

Still, the impact to borrowing costs in coming months will depend chiefly on the speed of the Fed’s rate hikes. There remains much debate about that, although Chairman Jerome Powell said in January he believes there is “quite a bit of room” to raise rates without threatening the jobs market.

Good news for savers

Rock-bottom rates have penalized savers.

Money stashed in savings, certificates of deposit (CD) and money market accounts has earned almost nothing during Covid (and for much of the past 14 years, for that matter). Measured against inflation, savers have lost money.

The good news, however, is that these interest rates will rise as the Fed gets away from zero. Savers will start to earn interest again.

But this takes time to play out. In many cases, especially with traditional accounts at big banks, the impact won’t happen be felt overnight.

And even after several rate hikes, savings rates will still be very low – below inflation and expected returns in the stock market.

Markets will have to adjust

Free money from the Fed has been amazing for the stock market.

Zero percent interest rates depress government bond rates, essentially forcing investors to bet on risky assets like stocks. (Wall Street even has an expression for this: TINA, which stands for “there is no alternative.”)

Higher rates could be a challenge for the stock market, too, which has become accustomed to – if not addicted to – easy money. Markets have already experienced significant volatility amid concerns about the Fed’s plan to fight inflation. Last week, the Nasdaq tumbled into a bear market, signaling a 20% decline from previous highs.

But much will depend on how fast the Fed does raise interest rates – and how the underlying economy and corporate profits perform after they do.

At a minimum, rate hikes mean the stock market will face more competition going forward from boring government bonds.

Cooler inflation?

The goal of the Fed’s interest rate hikes is to get inflation under control, while keeping the jobs market recovery intact.

Consumer prices spiked by 7.9% in February from the year before, the fastest pace since January 1982. Inflation is nowhere near the Fed’s goal of 2% and has gotten worse in recent months.

Economists warn inflation could get even worse in March because commodity prices have spiked since Russia’s invasion of Ukraine. Everything from food and energy to metals have become more expensive, although oil prices have pulled back from their recent highs.

And in recent days, China has suffered its worst Covid-19 outbreak in two years, prompting authorities to lock down key parts of the country. The lockdowns will add further pressure to scrambled supply chains at the heart of inflation.

The high cost of living is causing financial headaches for millions of Americans and contributing significantly to the decade low in consumer sentiment, not to mention President Joe Biden’s low approval ratings.

Yet it will take time for the Fed’s interest rate hikes to start chipping away at inflation. And even then, inflation will still be subject to developments in the war in Ukraine, the supply chain mess and, of course, Covid.