Washington, DC (CNN)Rivian's stock price soared Thursday, a day after its Wall Street debut, valuing the company at more than $100 billion. It also had the biggest American initial public offering since Facebook.

Rivian, which plans to deliver about a thousand consumer vehicles by the end of 2021, is worth more than every automaker but Tesla, Toyota and Volkswagen. (Rivian's market cap is roughly similar to that of Daimler, the owner of Mercedez-Benz.) America's two largest automakers by volume, Ford and General Motors, will likely sell more vehicles in a day than Rivian will in the entire year.

Rivian's lofty valuation highlights how interest in electric vehicle-focused companies has exploded since the start of the pandemic. Governments have set aggressive targets for shifting to electric vehicles. Companies like Uber, Lyft, and Amazon, a big backer of Rivian, have talked of adopting electric vehicles. Tesla's stock made a historic run in 2020 and the company is now valued at more than $1 trillion.

That's a far cry from when Tesla, the original electric car disruptor of the auto industry, went through its own IPO in 2010, at a valuation of about $1.6 billion. It had sold fewer than 1,000 Roadsters, its sportscar, and was planning the Model S sedan, for which it had received about 2,000 reservations. There were no assurances that the Model S would be a commercial success, Tesla said at the time. Tesla raised $226 million in its IPO, whereas Rivian raised an estimated $11.9 billion.

Tesla's S-1, the IPO paperwork that companies file with the U.S. Securities and Exchange Commission, didn't even mention the word "trillion." The word "billion" appears only twice.

Compare that with Rivian, which claims in its S-1 that the market it can serve in the next three years is worth $1 trillion, and its long-term market is worth $9 trillion. Tesla had about 500 employees at the time of its IPO. Rivian had more than 9,100 employees as of October 31.

Technology developments since Tesla's IPO have also helped boost Rivian's prospects. Tesla said of the Model S ahead of its IPO, that some of the sedans would have as little as 160 miles of range on a single charge. Batteries have improved since, and new Teslas today come with a minimum of 267 miles of range. Rivian's consumer vehicles will both have more than 300 miles of range.

Rivian has said it has pre-orders for more than 55,000 of its consumer vehicles. It's also been helped by Amazon's order of 100,000 electric delivery vehicles for its growing logistics business. Even so, Rivian will need to prove itself, including that it can mass produce vehicles economically.

"I hope they're able to achieve high production & breakeven cash flow," Tesla CEO Elon Musk tweeted Thursday. "That is the true test."

Rivian has said it plans to deliver approximately 10 electric vehicles to Amazon this year. Amazon can walk away from the deal at anytime, if it wants.

Rivian will face competition from Tesla as well as incumbent automakers like VW, Ford and GM, which are investing more in electric vehicles. Chinese companies like BYD Auto and Nio have also emerged.

For now, the markets are optimistic of Rivian's chances, and its talk of a sustainable future.

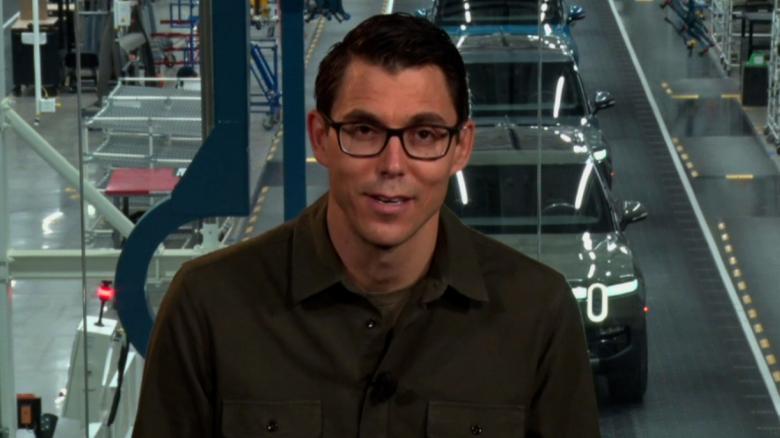

"We still have a lot to do, and always should, but this is a critical step forward," Rivian CEO RJ Scaringe said in an email to potential customers Wednesday. "Our goal is to protect our natural world for all the generations that follow us -- our kids' kids' kids."

CNN's Chris Isidore contributed to this report.