New York (CNN Business)If you're an investor who knows your market history, you might be tempted to tune out for a bit and start singing Green Day's "Wake Me Up When September Ends." The ninth month is traditionally the worst of the year for stocks.

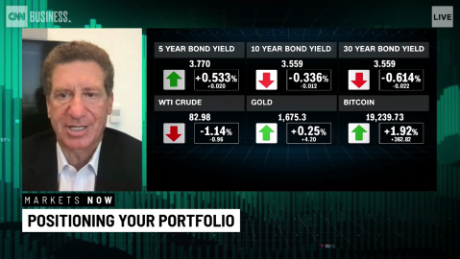

The market was up slightly Wednesday morning, but the S&P 500 has fallen about 0.5%, on average, during the month of September, according to Ryan Detrick, chief market strategist for LPL Financial.

Stocks have tended to go up, on average, during every other month ŌĆö other than a slight dip in February ŌĆö over the past half century.

September 2020 lived up to the month's bad reputation. The S&P 500 fell nearly 4% this month last year. Of course, that turned out to be just a brief blip in the explosive post-Covid lockdown rally.

This September has the potential to be a lousy month, too (just look at the headlines.) And stocks are already at record highs thanks to a seven-month winning streak for the S&P 500

Although corporate profits have surged this year, the S&P 500 is still trading at a price-to-earnings ratio that's well above its five- and 10-year averages, according to John Butters, senior earnings analyst at FactSet.

The Federal Reserve has a policy meeting later this month. Fed chair Jerome Powell reassured investors last week that the central bank won't cut back on ŌĆö or taper ŌĆö its bond purchase program too soon. But investors will be watching every word from Powell for new clues about tapering.

Covid-19 concerns haven't gone away, either.

Although it's true that state and local governments may try to avoid another round of stringent lockdowns, big companies including Google (GOOGL), Apple (AAPL) and Facebook (FB) have all delayed their return to the office plans until 2022.

The start of a new school year also raises enormous risks, especially since kids under age 12 are not yet eligible to receive vaccines.

September is often lousy, but it doesn't have to be

Now that we've got all the bad news out of the way, it's worth reminding investors that buying and selling based on the month on the calendar isn't necessarily a great idea. For one, it's best to stay fully invested to maximize gains instead of trying to time the market.

Sure, your portfolio may get hit along the way, but most investors ŌĆö even the pros ŌĆö find it difficult, if not impossible, to perfectly time market bottoms and tops.

September doesn't have to be a tough month for stocks. Even though share prices pulled back sharply last September, the S&P 500 rallied in September 2017, 2018 and 2019.

According to data from Bespoke Investment Group, there have now been 15 winning streaks of seven or more months for the S&P 500 since 1945. History shows that stocks often build on that momentum. Bespoke pointed out that those winning streaks reached an eighth month 10 times, with a median increase for the S&P 500 of 1.6% in the month following a seventh straight gain.

LPL's Detrick conceded that the September slump could be avoided again this year ŌĆö and that the market rally may continue for awhile longer.

"We remain in the camp that stocks will continue to go higher and investors should use any weakness as an opportunity to add to core equity holdings," he said in a report.

Detrick noted that following the 14 most recent seven-month winning streaks, the S&P 500 has notched further gains over the next six months 13 times, with an average return of 7.8% during that period.