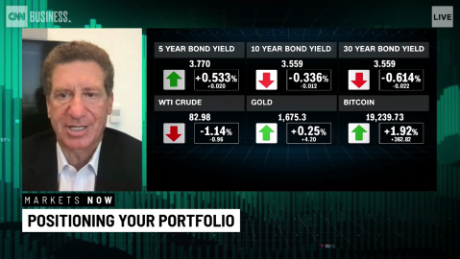

New York (CNN Business)The bipartisan infrastructure plan and President Joe Biden's $3.5 trillion proposal to widen the social safety net won't cause runaway inflation if passed by Congress, according to a new report by Moody's Analytics.

"Worries that the plan will ignite undesirably high inflation and an overheating economy are overdone," Mark Zandi, the chief economist at Moody's Analytics, wrote in the report released Wednesday.

The analysis, first reported by Axios, pushes back on one of the main attack lines against Biden's ambitious agenda at a time when Americans are getting hit by prices rising at the fastest pace since 2008.

"This concern cannot be dismissed, but it is likely misplaced," Zandi wrote.

Rather than inflame inflation, the analysts point out that new spending on items such as rental housing for low-income Americans, reducing prescription drug costs and making childcare more affordable is aimed at cooling prices off and easing shortages.

"Much of the additional fiscal support being considered is designed to lift the economy's long-term growth potential and ease inflation pressures," Zandi wrote.

Indeed, economists, including Zandi, have told CNN Business that Biden's Build Back Better Agenda is unlikely to cause inflationary problems because it is largely focused on adding much-needed supply, not boosting demand.

Crucially, Moody's Analytics notes that the Biden plan does not call for enormous deficit spending that could boost inflation.

"The legislation is more-or-less paid for on a dynamic basis through higher taxes on multinational corporations and the well-to-do and a range of other pay-fors," Zandi wrote.

Moody's Analytics said the proposals, if passed by Congress, will "strengthen long-term economic growth," with most of the benefits going to lower and middle-income Americans.

Zandi, like the White House and top Federal Reserve officials, has argued that inflation is largely going to cool off as the economy reopens. Yet some leaders on Wall Street, including BlackRock (BLK) CEO Larry Fink and JPMorgan Chase (JPM) boss Jamie Dimon, have warned recently that inflation may not be temporary.