Last year brought skyrocketing unemployment and a global pandemic that battered the economy, but people were still buying homes. Existing home sales in 2020 rose to the highest level in 14 years as prices climbed to a record high.

Home prices rose 9% in 2020 from the year before, with the annual median price of an existing home climbing to $296,500 according to a report from the National Association of Realtors. That is the highest price on record.

More from Success

Shrinking inventory, especially among lower priced homes, was one of the biggest drivers of those rising prices. The year ended with the lowest number of homes ever available.

Lawrence Yun, NAR’s chief economist, predicts the strong activity in the housing market to continue into this year.

“Although mortgage rates are projected to increase, they will continue to hover near record lows at around 3%,” Yun said. “Expect economic conditions to improve with additional stimulus forthcoming and vaccine distribution already underway.”

But Yun cautions that the current market is not what he would describe as a “healthy market,” in which home prices rise in line with income growth and buyers have enough time to make informed decisions about a major purchase.

“In that sense, it is unhealthy,” Yun said. “Buyers are making hurried decisions.”

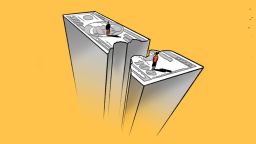

Home prices are also rising much faster than incomes, increasing the wealth divide in housing. Homeowners saw an average of roughly $24,600 in home equity gain this year, said Yun. Meanwhile, first-time buyers and those at the lower end of the market are findingit harder to come up with down payments or to make competitive offers.

“Homeowners are smiling because they are seeing price increases,” said Yun. “They can trade up to their next home purchase. But the frustration is coming from first-time buyers.”

That’s because there are fewer homes to buy than ever before and more competition for the homes that are for sale.

Inventory is at an all-time low, according to NAR, with 23% fewer homes for sale in December than a year ago. And the number of available homes to buy is down in all price categories except those $750,000 and above.

“More acute affordability challenges will emerge if inventory stays this tight and home-price growth continues to accelerate,” said Joel Kan, the Mortgage Bankers Association’s associate vice president of economic and industry forecasting. “This, in turn, would be especially challenging for first-time homebuyers, who make up a third of all home sales.”

The strong existing home sales pace seen in the latter part of the year continued into December with sales of existing homes – which include single-family homes, townhomes, condominiums and co-ops – up 22% from a year before to a seasonally adjusted annual rate of 6.76 million.

Homes at the upper end of the market continued to sell at a faster pace than those at the lower end of the market. While sales of homes priced at $100,000 and under dropped by 15% in December from the year before, sales were up 76% for homes sold between $750,000 and $1 million. For homes $1 million and above, the number of sales essentially doubled.

That drop at the lower end is due to persistent low inventory, said Yun.

“If we had more inventory on the lower price points, we would have even greater home sales than is being reported.”