A version of this story first appeared in CNN Business' Before the Bell newsletter. Not a subscriber? You can sign up right here.

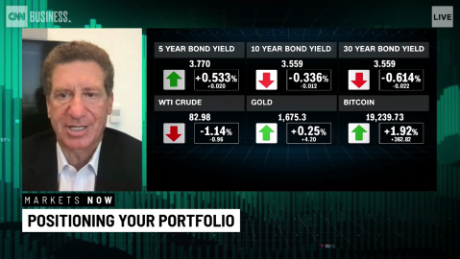

London (CNN Business)Investors trying to decide how to place their bets heading into the last two months of the year face a daunting task.

Between the imminent US election, an alarming rise in Covid-19 cases and a spate of quarterly results due this week from some of the world's top companies, there's no shortage of data to parse.

The election: We're eight days out from Election Day in the United States. Investors have priced in a victory for Joe Biden, with prediction markets putting the odds of a win for the former vice president at 63%.

But some on Wall Street warn that markets aren't perfect crystal balls. "It's not over until it's over," cautioned Nicholas Colas, co-founder of DataTrek Research, in a recent note.

Investors are now counting on a new economic stimulus deal to be pushed through shortly after the election. But that will depend in large part on the outcome. If Trump enters a lame duck period, it could be hard to forge an agreement before a transition of power takes place next year.

Covid-19: Coronavirus cases are surging again in the United States and Europe. While investors continue to set their sights on a vaccine, fresh restrictions on movement and businesses have the potential to halt the nascent economic recovery, muddying the outlook.

The United States hit a record seven-day average of new Covid-19 cases last week, logging more than 83,000 new infections on both Friday and Saturday. Experts will know by early December whether a potential coronavirus vaccine is safe and effective, but there probably won't be widespread availability until later next year, Dr. Anthony Fauci, the top US infectious disease expert, said Sunday.

In Europe, the situation is escalating rapidly. Italy will impose a 6 p.m. curfew on bars and restaurants Monday after cases rose by more than 21,200 on Sunday, a new daily high since the start of the pandemic.

"The second wave of the virus and new restrictive measures risk putting the eurozone recovery into reverse," ING economists told clients Monday.

Tech earnings: Both election jitters and the trajectory of the pandemic could send stocks lower this week. But the biggest US companies ŌĆö including Microsoft (MSFT), Google parent Alphabet (GOOGL), Facebook (FB), Apple (AAPL) and Amazon (AMZN) ŌĆö are also due to report earnings.

If they handily beat Wall Street's expectations, as they have in the past, shares could rocket, supporting the broader market.

Watch this space: The push and pull of these factors has investors bracing for turbulence. The VIX, a measure of the S&P 500's volatility, rose nearly 8% on Monday to its highest level since early September.

Meet the woman who could lead the US Treasury under Biden

Speculation about who might lead the Treasury Department under a Biden administration is already in full swing, my CNN Business colleague Paul R. La Monica reports.

Analysts from Washington to Wall Street say a leading contender would be Lael Brainard, a Federal Reserve governor with years of practical experience for the job.

Brainard, who could replace Steven Mnuchin, would be the first woman to serve in the role. Despite some concerns from market watchers that she might impose tougher regulations on big banks, which could ding stocks, she's not nearly as progressive as Sen. Elizabeth Warren, another rumored contender.

"There could be a tug of war between progressives and more moderate Democrats, but many people would prefer someone with both a deep background in economics and monetary policy," said Quincy Krosby, chief market strategist at Prudential Financial.

Her resume: Brainard's career includes stints at McKinsey and The Brookings Institution. She also served in various economic roles in the Clinton and Obama administrations.

"In terms of sheer experience, Brainard has punched all the tickets," Robert Kuttner, co-founder of The American Prospect, a left-leaning nonprofit publication, said in a report last month. "It would be hard to imagine a more mainstream background."

Kuttner thinks nominating Brainard could appease both Biden's Wall Street allies and progressives, who would likely oppose tapping someone who currently works in finance.

Nothing is set: A spokesperson for the Biden transition team told CNN Business that they are "not making any personnel decisions pre-election." Other names mentioned as potential nominees include former Fed chair Janet Yellen and former Fed governor Sarah Bloom Raskin, as well as Mellody Hobson, co-CEO of money manager Ariel Investments.

Want to make a tech bet? Check the cloud footprint

Many of the world's top tech companies have reaped huge benefits from the shift to remote work this year, driving up demand for their cloud services.

For those that have been slower in prioritizing cloud computing, however, it's been a different story.

See here: SAP (SAP), the most valuable technology firm in Europe, lowered its 2020 revenue outlook on Monday, citing the reintroduction of lockdowns in some regions and softer demand. Shares plunged 18% in early trading.

The company, which makes software for business operations, pledged to accelerate its transition to the cloud. This would allow it to rely less on selling software licenses, a business unit that saw revenue dive last quarter.

But the transition will eat into profits for years. The company has written off its medium-term guidance, rattling investors who aren't sure the new strategy will pay off.

Big picture: SAP competitor Salesforce has seen shares rocket 54% this year thanks to the popularity of its cloud offerings. If SAP can get it right, there's plenty of money to be made. In the meantime, the company's issues are a reminder that tech is not a one-way bet ŌĆö and that these days, cloud footprint matters a lot.

Up next

Hasbro (HAS) reports results before US markets open. New US home sales for September post at 10 a.m. ET.

Coming later: Ant Group is due to price shares ahead of its market debut. It could mark the biggest IPO raise on record.