New York (CNN Business)The stock market has soared since mid-March. It's almost as if investors have forgotten that Covid-19 will continue to cripple the global economy and corporate earnings for the foreseeable future.

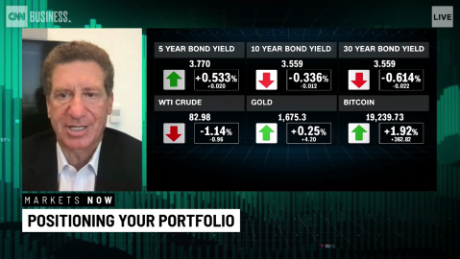

But it's a different story in the bond market. Long-term Treasury yields remain well below 1%, a sign that fixed income investors are painfully aware that much of the world is now probably in recession.

Is there a disconnect here? Perhaps.

One major reason stocks have surged is that investors are hoping a successful Covid-19 vaccine will be developed. Biotechs Novavax (NVAX) and Moderna (MRNA) are among the many companies working on a treatment.

Still, even if a viable coronavirus vaccine is rushed into mass production, it will still take some time before many consumers and businesses may be willing to go back to life pre-Covid-19.

That's why analysts expect profits to plunge for the rest of 2020 and economists are forecasting a steep Great Depression-like drop in the nation's gross domestic product for the second quarter.

But hope springs eternal for stock market investors -- in large part because the tech companies that dominate the S&P 500 are still thriving. Facebook (FB) is at an all-time high while Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google owner Alphabet (GOOGL) aren't far from records either.

"The stock market is not representative of the broader economy. A small percentage of companies in the S&P 500 are making up a big part of the growth and they are still doing fine even in this godawful situation," said Stephen Dover, head of equities for Franklin Templeton Investments.

Bond market expects lower rates for longer

Dover adds that bonds are pricing in the potential "Japanification of the economy" -- meaning that bond yields could remain low for an extremely long time because the Federal Reserve will probably keep interest rates near zero for the foreseeable future to support the economy.

So when you view the economy and markets through that lens, the recent action on Wall Street may not seem as strange as it might first appear.

"The stock market is anticipating the comeback will be sharp and quick. They are not viewing this as a fundamental problem with the economy. It was an exogenous shock," said George Calhoun, professor of quantitative finance at Stevens Institute of Technology.

Calhoun added that this is not your average recession. It was not caused by any financial excesses like the tech bubble in 2000 or subprime mortgage meltdown in 2008. This, he said, is more like the equivalent of an asteroid slamming into the Earth.

And because the Fed and other global central banks -- as well as President Trump and Congress -- have quickly reacted by pumping trillions of stimulus dollars into the economy, the bond market reaction makes sense too.

Bond investors are pricing in an infinite amount of quantitative easing from the Fed, Calhoun said, so bond yields will (and should) remain this low even if the stock market keeps rallying.

In other words, the Fed's actions are working as planned.

The bond purchases, including the unprecedented move by the central bank to purchase junk bond ETFs, is helping to keep rates low in order to encourage investors to buy stocks.

"It's hard to take too many signals from the bond markets because the Fed is buying so many bonds in order for their policies to work," said Gibson Smith, founder and chief investment officer at Smith Capital Investors.

"The Fed is encouraging investors to own riskier assets and it is working right now," Smith added.

Smith conceded that there are potential moral hazards from these unconventional policies. But he thinks that Fed Jerome Powell is doing a masterful job so far to manage the crisis.