New York (CNN Business)There's a good chance you're reading this story in your home office, given that the coronavirus pandemic has upended how (and where) millions of us are now working.

So it should come as no surprise that there may soon be an ETF dedicated to the rapidly growing work-from-home economy.

Fund company Direxion has filed with the Securities and Exchange Commission to launch a fund that would own companies that are likely to benefit from more people working virtually.

The exchange-traded fund would be based on an upcoming new Remote Work index from Solactive that Direxion said will likely include web conferencing leader Zoom Video Communications (ZM), cybersecurity firms Fortinet (FTNT) and Okta (OKTA) and document management software firm Box (BOX).

The proposed ticker symbol for the ETF is "WFH," naturally. If approved, it would trade on the electronic NYSE Arca Exchange.

Thematic ETFs tied to new trends are common in the investing world. There are now numerous ETFs for cannabis stocks, cloud computing companies and blockchain technology, for example.

Solactive told CNN Business that the new index is still in the process of being created. But the company teased what it might look like in a March blog post about a concept for a so-called Flexible Office Index.

If the proposed Work From Home ETF is approved by regulators, it would be Direxion's latest attempt to court longer-term oriented investors.

The firm is mainly known for so-called leveraged and inverse ETFs geared more toward active traders than long-term investors. Leveraged ETFs allow traders to make outsized bets on the daily moves of indexes while inverse ETFs offer people the ability to bet against, or short, the market.

"We've been looking to develop more buy and hold ETFs," said Dave Mazza, managing director and head of product at Direxion, in an interview with CNN Business.

Working from home as a long-term business trend

Many stocks that could wind up in the ETF -- Zoom in particular -- have soared already this year as investors bet that more people will be working from home for the foreseeable future.

The trend towards remote working has been occurring for a while, and Mazza said Direxion had been working on the WFH ETF plan -- as well as ideas for several different thematic strategies -- before the current pandemic.

However, Mazza admitted that the company moved up plans to launch the WFH fund once the Covid-19 outbreak made working from home a reality for many Americans -- something that is unlikely to change any time soon.

Direxion is hoping that the ETF will be approved by the SEC by early summer so that it can begin trading in late June or early July, Mazza said.

A WFH ETF would complement several other new products from Direxion that aim to capitalize on bigger picture investing trends.

Direxion launched new thematic ETFs in February that focused on environmental, social and governance (ESG) investments, high quality stocks and safe haven investments such as Treasury bonds, utilities and gold.

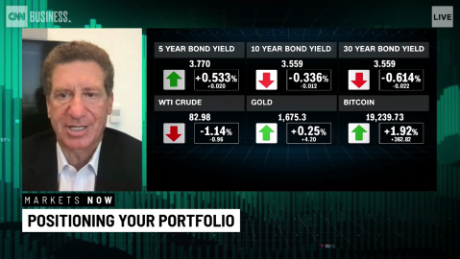

The latter ETF, dubbed the Direxion Flight to Safety Strategy (FLYT) fund, is up more than 3% since its mid-February debut. Two other new Direxion ETFs haven't fared as well.

The Direxion MSCI USA ESG Leaders vs. Laggards (ESNG) fund and Direxion S&P 500 High minus Low Quality (QMJ) funds are both down more than 10% since they launched.

Still, that's better than the broader market. The Dow has plunged more than 20% in the past two months.