New York (CNN Business)Is the market's love affair with Big Tech finally coming to an end? That might be a stretch. But there's a growing chorus on Wall Street for investors to look beyond the FANG momentum plays and more toward value stocks.

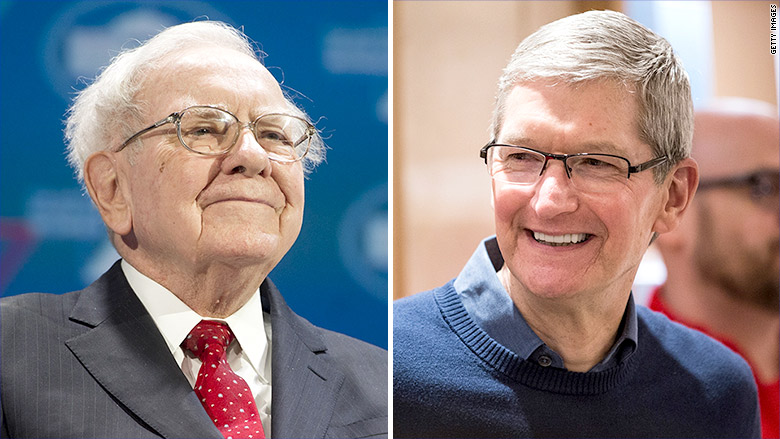

In other words, investors are pulling a Warren Buffett.

Companies in sectors like banking, energy and health care have started to mount a comeback after lagging growth stocks for the past half-decade. Those sectors typically don't trade at prices as high as Facebook (FB), Amazon (AMZN), Netflix (NFLX), Alphabet (GOOGL)and other large tech firms.

The S&P 500 Value Index (IVE) is up about 40% in the last five years while the S&P 500 Growth Index (IVW) has soared more than 80% during the same time frame. But value stocks have narrowed the gap considerably as of late. The value index is up nearly 18.5% this year ŌĆö not far behind the gain of 20% for the growth index.

Materials, industrials, energy and tech firms will probably show the strongest earnings growth in 2020, predicts John Augustine, chief investment officer for Huntington Private Bank ŌĆö especially if the US and China reach a trade deal and the Federal Reserve continues to cut interest rates to keep the economy growing.

Slower global growth could make value more attractive

With the exception of tech, Augustine cites three other sectors that tend to trade at more reasonable prices than growth stocks. But even within tech, Augustine points out that much of the earnings growth for next year may come from semiconductor stocks, which are typically a lot cheaper than cloud software, social networking and e-commerce companies.

"If these earnings projections hold up, we could see more investors start to shift from growth to value," Augustine told CNN Business. "These are all cyclical companies and could have a strong 2020."

But there's more to value than cyclical companies. Many investors also flock to slower-growth but dependable companies that pay big dividend yields. That trend should continue now that interest rates are expected to fall further in the United States, and yields for Japanese debt and many government bonds in Europe have fallen into negative territory.

So Dow components like Coca-Cola (KO) and Verizon (VZ) and other high-yielding stocks will become increasingly attractive.

"Given that companies in defensive sectors like utilities, consumer goods, telecommunications and real estate generally sport higher dividend yields than their cyclical counterparts, falling interest rates have also helped drive defensive stock leadership," said Alec Young, managing director of global markets research for FTSE Russell, in a recent report.

Growth ŌĆö but at the right price

Still, some fund managers warn investors to not bail on momentum tech darlings just yet.

Brian Macauley, a portfolio manager with Broad Run Investment Management, which subadvises the Hennessy Focus Fund, told CNN Business he'd be wary of many big banks and materials companies due to concerns about slowing global growth. Just because a stock looks like a bargain does not mean that it can't fall further.

"Some stocks are cheap for the right reasons," Macauley said.

That's why he prefers to buy stocks that he thinks offer growth at a reasonable price ŌĆö companies that may not have bargain basement valuations but can justify their price because of solid prospects. He likes Priceline owner Booking Holdings (BKNG), used car dealer CarMax (KMX) and Keurig Dr Pepper (KDP) for example.

He's not completely shunning traditional value stocks either. Macauley also owns specialty finance firms such as debt recovery firm Encore Capital Group (ECPG), real estate giant Brookfield Asset Management (BAM) and brokerage giant Charles Schwab (SCHW).

Damon Ficklin, a portfolio manager with Polen Capital, said he's also prioritizing growth over value. But it's nice to have a mix of both, which is why some of his top tech holdings are companies that trade at lower valuations and also pay dividends, such as Microsoft (MSFT) and Oracle (ORCL).

Ficklin also said he likes Visa (V) and MasterCard (MA) ŌĆö two companies that are technically financial stocks but have benefited from the explosive growth in digital payments.

The key, Ficklin told CNN Business, is to find market leaders that can weather any economic, political or other macro storms. It almost doesn't matter if they are value stocks or growth stocks. You just want dependability.

"Take away cyclical factors and quality growth should shine through." he said. "We want to own businesses for at least five years. We expect to own companies through a recession or other tough market environments."

Even Buffett seems to appreciate that. While his Berkshire Hathaway (BRKB) conglomerate has lagged the market this year, Buffett has been taking steps to embrace more reasonably valued tech stocks in recent years.