New York, New Jersey and Connecticut aren’t backing off from a legal fight with the Treasury Department and the Internal Revenue Service.

The three blue states filed a lawsuit in federal court in New York challenging the constitutionality of the Trump administration’s decision to block a workaround that would have helped high-tax areas to bypass a $10,000 limit on federal deductions for state and local taxes.

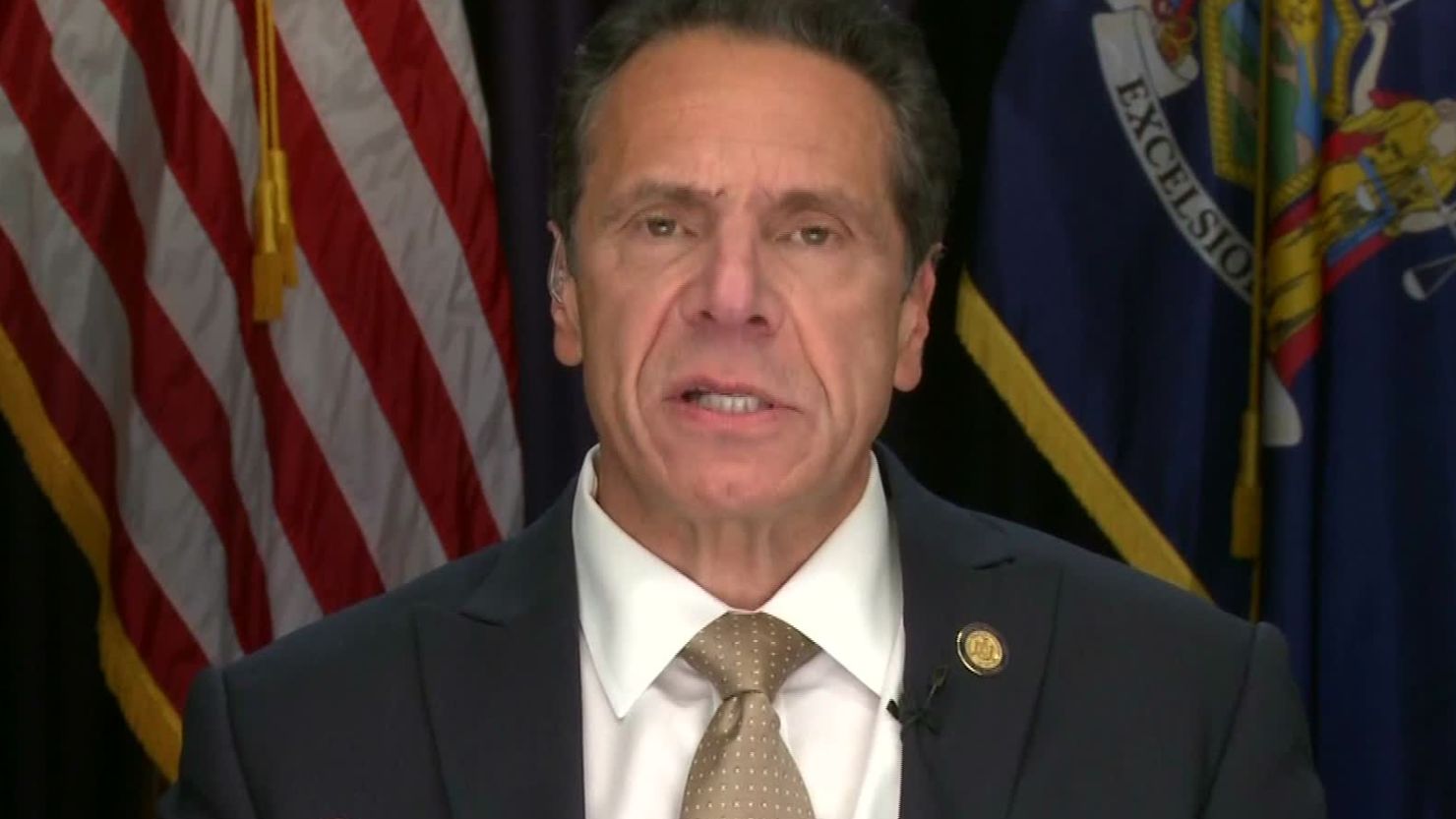

“The final IRS rule flies in the face of a century of federal tax law that says state choices to provide tax incentives for charitable donations do not affect the federal deductibility of those gifts,” according to a joint statement released by New York Gov. Andrew Cuomo’s office.

In June, the Treasury Department finalized regulations that would bar individuals in high-tax states from creating charitable funds in exchange for state tax credits – a maneuver developed as a workaround for changes to the treatment of state and local taxes under the 2017 tax reform.

The Republican-backed law capped the amount of state and local tax – or SALT – payments that individuals could deduct from their federal taxes at $10,000. As a result, states like New York, New Jersey and Connecticut tried to find ways to minimize the economic pain felt by residents from the cap.

“The regulation is based on a longstanding principle of tax law: When a taxpayer receives a valuable benefit in return for a donation to charity, the taxpayer can deduct only the net value of the donation as a charitable contribution,” the Treasury Department said in a statement.

Democratic lawmakers have repeatedly issued dire warnings about the limit, saying the measure primarily hurts Democratic-leaning states that tend to have taxpayers with higher incomes and higher home prices.

The controversial limit was a key revenue raiser in the $1.5 trillion tax code overhaul, which slashed tax rates for corporations and individuals.

This is not the first time these three states, along with Maryland, have challenged the deduction cap. In their latest lawsuit, the states argue that the rules violate the Administrative Procedure Act because they are inconsistent with federal tax law regulations about deducting charitable contributions.

“This is entirely unacceptable and as I’ve said before, the IRS should not be used as a political weapon,” Cuomo said in the joint statement. “The IRS regulations lack any basis in the law, upend decades of precedent without authorization from Congress, and target programs established by New York and other states to incentivize charitable contributions.”