New York (CNN Business)The Federal Reserve's unrivaled influence on the world's economy is due in no small part to the belief that it simply doesn't care about politics.

The American central bank has proven that it's not scared to tap the brakes on the economy to prevent runaway inflation ŌĆö even if an election is lurking around the corner. That track record creates stability in global markets and gives confidence to investors.

Now President Donald Trump is putting that carefully-crafted perception of Fed independence at risk. Trump has repeatedly attacked the Fed and has said he even considered firing its chairman, who he selected.

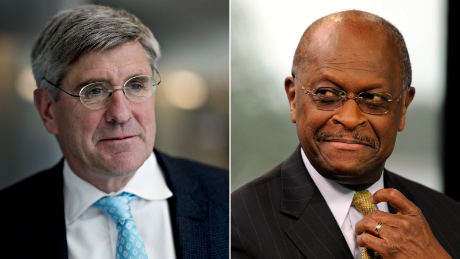

More recently, he announced two controversial potential nominees to 14-year terms on the Fed's board of governors: former Trump campaign adviser Stephen Moore and former Republican presidential candidate Herman Cain. They would serve 14-year terms on the Fed's board of governors.

Trump's moves are seen by many in business as an effort to politicize an institution that, to succeed, must be viewed as and remain apolitical. And that has consequences, potentially serious ones.

"The Fed is not a place to put your cronies," former Federal Reserve governor Sarah Bloom Raskin told CNN Business.

Raskin, who was appointed by President Barack Obama and served on the Fed board from 2010 to 2014, said Trump's attacks on the central bank and the selections of Moore and Cain "run the risk of politicizing the Fed."

"When you undermine the credibility of the Fed, you reduce the effectiveness of an important way to bring about economic prosperity," she said.

'More suited to be talk show hosts'

Trump complained about the Fed again on Friday and urged it to slash interest rates to speed economic growth.

"I think they really slowed us down," Trump told reporters.

David Kotok, co-founder and chairman of Cumberland Advisors, fears that the Fed's reputation on the world stage is being badly damaged.

"He is politicizing the Fed. He's doing it in a divisive and destructive way," Kotok said. "I am very worried about Trump's rhetoric and Fed-bashing."

The White House declined to comment.

Trump, Kotok noted, is not the first president to criticize the Fed. President George H.W. Bush, for instance, lectured the Fed about rate hikes.

Early in his administration, Trump selected traditional individuals to join the Fed, much to the relief of Wall Street. Trump elevated the well-respected Jerome Powell from governor to chairman. He appointed Pimco economist Richard Clarida as vice chair and named Randal Quarles vice chair of supervision. And Trump nominated Kansas banking commissioner Michelle Bowman as governor.

But Trump's most recent Fed picks have veered straight into the political arena ŌĆö just as his attacks on central bank policy have escalated.

"He goes from appointing boring, competent people to people who are more suited to be talk show hosts than central bankers," said David Wessel, director of the Hutchins Center on Fiscal & Monetary Policy at the Brookings Institution. "They say things that don't make any sense."

Remember the 9-9-9 plan?

Days after his name was floated, Moore, a former CNN analyst and Trump campaign adviser, called for the central bank to immediately slash interest rates. Former Fed officials warned that the move would be radical and counterproductive.

"Editorializing for a rate cut as a presumptive nominee is unthinkable behavior," said Kotok.

And Cain, the former CEO of Godfather's Pizza, believes the United States should return to the gold standard. As a 2012 presidential candidate, Cain puzzled many with his 9-9-9 plan, which called for 9% income tax, 9% business tax and 9% retail sales tax.

"He has bizarre economic views. The whole nine-nine-nine thing didn't add up to anything," said Wessel, who is a contributing correspondent to The Wall Street Journal.

Cain does have business experience and even did a stint at the Fed. He previously served as chairman of the Kansas City Federal Reserve Bank.

"Cain passes my test," Kotok said.

But even some Republicans expressed skepticism about the wisdom of adding Cain to the Fed.

"If Herman Cain were on the Fed, you'd know the interest rate would soon be 9-9-9," Utah Senator Mitt Romney told Politico on Thursday. Romney added that he doubts Cain will ultimately be nominated.

Neither Moore nor Cain responded to requests for comment.

Dissenting voices

Both Moore and Cain have altered their former views on Fed policy to more closely align with Trump's, according to Barclays chief US economist Michael Gapen.

"These 'easy money' policies stand in contrast to the 'hard money' views both had expressed in recent years," Gapen wrote in a report titled, "The beginning of the politicization of the Fed."

Of course, Moore and Cain would be just two voices on a committee of 19. Their voices would presumably get shouted down by the more mainstream picks.

That means even if Moore and Cain make it to the Fed, they may not be able to affect the central bank's actions.

However, Raskin, the former Fed governor, warned it's rare to have multiple dissenting votes. Such disagreement can confuse investors by weakening the central bank's message.

Bond market revolt would hit economy

Trump's attacks on the Fed could represent a political tactic by the White House. If the economy stumbles heading into the 2020 election or if markets tank, Trump can simply pin the blame on an institution that won't fight back: The Federal Reserve.

"The underlying economy is not as strong as people may think," said Raskin. "If he is insightful enough to look beyond markets, then I think he could very well see that he needs a fall guy. And that could very well be the Fed."

But that could backfire economically.

If investors fear the Fed doesn't have the "spine" to fight inflation by raising rates, long-term rates will rise higher than they would otherwise be, Wessel said.

That would lift borrowing costs on everything from mortgages to auto loans ŌĆö and slow the economy and stock market down.

"There is a price to pay for undermining the credibility of the Federal Reserve," Wessel said.

Trump's attacks on the Fed might be a smart short-term political strategy. But in the long run, they could end up hurting Trump where it hurts the most: the economy.