New York (CNN Business)Samsung sent a clear message to the world this week with the debut of several bold new products: Innovation isn't dead.

As smartphone sales stall due largely to slower upgrade cycles, manufacturers must try even harder to inspire consumers to trade in existing devices for newer models.

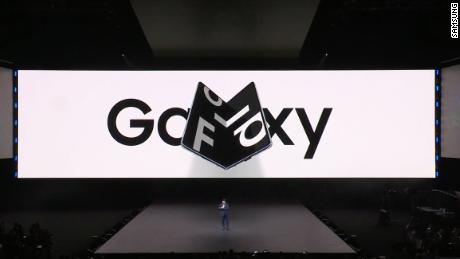

Samsung (SSNLF) spent the better part of its "Unpacked" press event on Wednesday showing off shiny gadgets, including the Galaxy Fold smartphone that morphs into a tablet, in an attempt to convince consumers the future is bright for both smartphone innovation and the company itself.

"Samsung has made Apple look bad," Canalys analyst Ben Stratton told CNN Business. "Galaxy Fold is a great marketing tool. It paints Samsung as cutting-edge and innovative, and as a consequence, makes its rivals look slow."

At $1,980, the Galaxy Fold will likely be a niche product that won't give Samsung a major sales bump out of the gate. But analysts say it's a reminder that Apple hasn't brought the "wow" factor in quite awhile.

"Just as with the very popular Motorola RAZR devices back in the feature phone era, we see foldable screens as a compelling form factor," Goldman analyst Rod Hall said in a note on Thursday. "We see this as challenging for Apple, who could find themselves with no access to the critical flexible OLED technology for which we believe Samsung has at least a two year lead over other display competitors."

In addition to the Fold, Samsung introduced the Galaxy S10 5G тАФ the first mainstream 5G phone тАФ and updated versions of its best selling Galaxy S smartphone, some of which tout an ultrasonic fingerprint scanner embedded in the screen, and a unique display that can charge other smartphones.

Apple might not have a foldable iPhone up its sleeves (though it does have a patent for one) and its rumored 5G iPhone is reportedly delayed until 2020, so it'll need to show consumers and investors new iPhones are still worth buying. Apple's biggest smartphone innovations in recent years have arguably been more around price than product. The screens have gotten bigger, in part because of pressure from Samsung's popular large devices, and Apple's added some bells and whistles such as facial recognition, augmented reality and animated emoji. But beyond dropping the home button in 2017, the look and feel of the product itself hasn't changed much.

In the first quarter of 2018, Apple reported a 15% drop in iPhone revenue during its holiday season. At the time, CEO Tim Cook cited reasons such as foreign exchange rates, a popular battery replacement program and the decrease in carrier smartphone subsidies for a decline in iPhone sales.

"[Innovation this year] does not have to be a folding display, and could be related to camera, audio or battery instead," Stanton said. "But it has a phenomenal team of well resourced engineers, and there will be no excuses if this year's iPhone is iterative."

With its core iPhone business in decline, Apple is increasingly investing in more services, such as offering more original TV programming and reportedly launching a subscription news service.

"Apple needs to grow a large installed base of iPhone users to sell services to, but it cannot do this without being much more flexible about iPhone discounting," Stanton said. "Apple is approaching an inflection point."

There's no denying Samsung drummed up excitement around the future of smartphones for the first time in awhile. Now it's in Apple's court.

"Apple has a penchant for standing on the shoulders of the giants that came before them when announcing a feature -- such as phablets and 4G LTE," said Ramon Llamas, research director of market research firm IDC. "It will get there eventually, but on its own terms."

Correction: An earlier version of this article incorrectly attributed Ben Stanton's quote about the need for Apple to be flexible about iPhone pricing.