New York (CNN Business)The Dow tumbled to the lowest level of the year on Wednesday after the Federal Reserve signaled a more aggressive stance than investors had hoped for.

Investors are worried that the Fed adjusted its economic growth forecast lower for 2019 while still signaling that it would continue to raise rates ŌĆö albeit at a slower pace. Most Fed governors said they expect to hike rates only twice next year, after hiking four times this year.

See what's driving markets now

In a press conference Wednesday, Federal Reserve Chairman Jerome Powell said the economy at the end of the year was "more subdued than most expected," and recent "developments signal softening" in the economic outlook. However, he also noted that the "strong economy is benefiting many Americans."

All three major indexes fell after the announcement and the selloff deepened during the press conference. The Dow closed down 352 points, or 1.5%, wiping out an early rally of as much as 382 points. The S&P 500 fell 1.5%, while the Nasdaq lost 2.2%.

"The market talked itself into expecting a more dovish outcome from the Fed than they got," said David Joy, chief market strategist at Ameriprise Financial. "It's a real disappointment of majority of investors who were expecting something different."

It was the S&P 500's worst performance on a Fed decision day since September 2011, according to Bespoke Investment Group.

The turning point for stocks came after Powell said, "a little volatility doesn't leave a mark," hinting that the Fed isn't too worried about the recent market downturn.

Investors also worried about Powell's comments about the Fed's balance sheet. Powell said that in the past the Fed had decided the balance sheet would be on autopilot, using rate policy to react to incoming data. "I don't see us changing that," Powell said.

"The sense the balance sheet is on autopilot is worrying for equity investors," Keith Parker, head of US equity strategy at UBS.

Stocks moved even lower after Powell answered a question from CNN Business' Donna Borak. Asked how the Fed plans to communicate its future rate actions now that it has eight press conferences planned for next year, Powell started to say, "We'll have the ability to move eight times," before correcting himself: "Eight different meetings, not eight times."

It's possible investors thought Powell meant the Fed would hike rates eight times next year, although the Fed had at that point already signaled just two rate increases in 2019. Stocks rallied back just a bit from that point but remained depressed from earlier in the afternoon.

What's worrying investors

The stock market had priced in a steady stream of rate hikes next year. Investors typically like low rates, because higher interest rates pinch corporate profits and raise borrowing costs.

However, a slower pace of rate hikes in 2019 would not necessarily be great news.

The Fed signaled that it would slow its rollout because it expects economic growth to come down to earth a bit. The effect of the late-2017 corporate tax cuts are wearing off, and signs of an economic slowdown are starting to become apparent in the housing market, corporate outlooks and commodities markets.

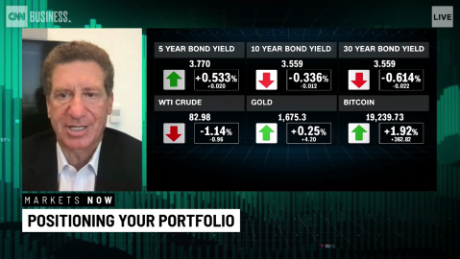

"It does open the door to a slower pace of increases, which translates into a more patient Fed," said Lindsey Piegza, Stifel chief economist, on CNN Business' Markets Now live show with CNN Business editor-at-large Richard Quest Wednesday.

Piegza noted that the housing market has been particularly soft. She called attention to the fact that homebuyers are using more credit than historical norms to purchase their houses. That signals pay increases haven't quite taken hold the way economists hoped they would during the past decade's economic and job boom.

That, combined with other warning signs, calls into question whether the Fed should raise rates as strongly in 2019 as it did in 2018, Piegza said.

Still, Piegza predicts the economy will avoid a recession in 2019. Momentum will slow, however. She thinks the US economy will grow in a range of 1.5% to 1.8% next year, and it will probably enter a recession in 2020.

Next on Markets Now

Lindsey Bell, CFRA Research Investment Strategist, will join Quest to discuss the Fed's meeting and the stock market on "Markets Now" Wednesday.

"Markets Now" will streams live from the New York Stock Exchange again Thursday at 12:45 p.m. ET. Hosted by CNN's business correspondents, the 15-minute program features incisive commentary from experts.

You can watch "Markets Now" at CNN.com/MarketsNow from your desk or on your phone or tablet. If you can't catch the show live, check out highlights online and through the Markets Now newsletter, delivered to your inbox every afternoon.