Neither the stock market nor President Donald Trump are pleased with the Federal Reserve right now.

The fear among both camps is that the Fed is ending the era of easy money too quickly. Rising rates sent stocks spiraling lower this week, prompting Trump to say the Fed has “gone crazy” and is “out of control.” Stocks bounced back on Friday, but still suffered their worst week since March.

All along there was a risk that Washington’s debt-fueled tax cuts and spending splurge would backfire by overheating the economy. That kind of help is typically reserved for times of war or recession, not prosperity.

“We’re in the boom. And all the earmarks of a bust are developing,” said Mark Zandi, chief economist of Moody’s Analytics.

Trump has cast blame for the market turmoil on the US central bank. “The Fed is going loco and there’s no reason for them to do it,” Trump told Fox News.

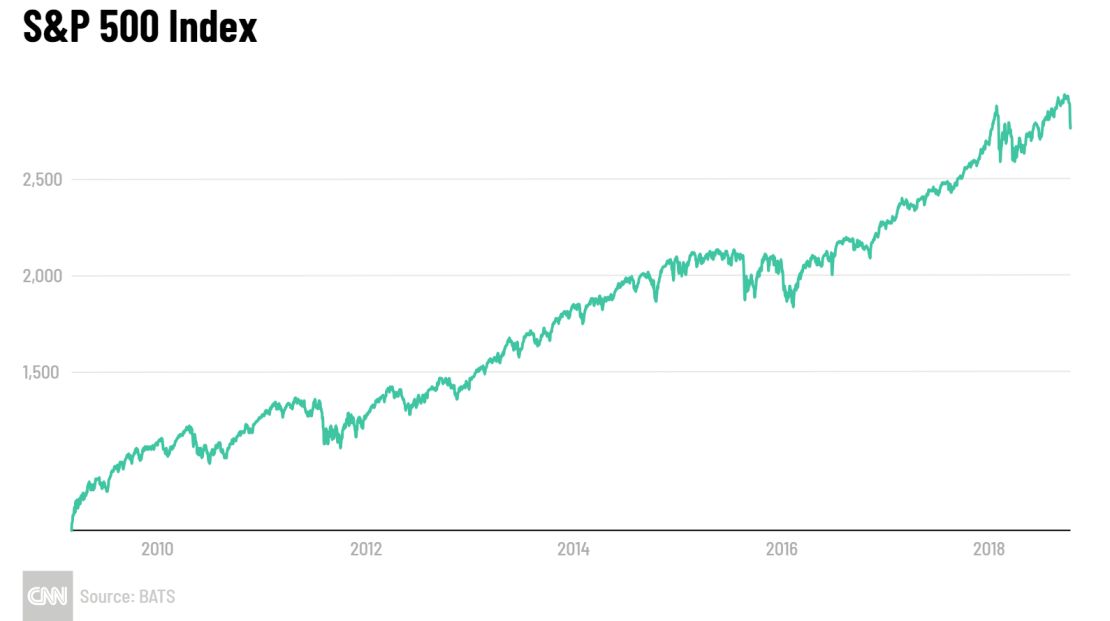

The stock market skyrocketed after Congress enacted massive corporate tax cuts late last year. The tax cuts immediately juiced corporate earnings, the main driver of stock prices. Even better for Wall Street, companies used their tax savings to buy back record amounts of their own stock.

Little attention was paid to another likely outcome: higher interest rates and a more aggressive Federal Reserve.

One way to think of it is that Trump’s tax cuts were equivalent to pouring gasoline on the economy. Now, he’s blasting the firefighters at the Federal Reserve who are attempting to prevent runaway inflation by raising interest rates.

“The economy is red-hot and threatens to fry. The Fed is desperately trying to cool things off before it goes up in flames,” said Zandi.

Kristina Hooper, global market strategist at Invesco, said the Federal Reserve has taken a thoughtful and prudent approach to the accelerating economy.

“Everyone knows the Fed isn’t acting crazy. There is no going loco for the Fed,” said Hooper.

The Fed’s rate hikes are also designed to give it room to provide support for the economy whenever the next downturn arrives. That’s especially crucial because Washington’s soaring deficit could make it harder to borrow to fight a recession.

“The Fed doesn’t have the luxury of moving much slower. It needs dry powder for the next crisis,” said Hooper.

Economics 101

Treasury yields spiked in recent weeks, reflecting a range of factors: faster economic growth, Fed rate hikes and the federal government’s surging budget deficit from the tax cuts.

“If anyone picked up an economic textbook, they would have known this was coming. It’s pretty obvious,” said Zandi.

The higher rate environment is a sudden shift for an economy and stock market that grew accustomed to unbelievably low rates over the past decade. Easy money meant ultra-cheap borrowing costs for households and businesses. Extremely low bond returns also forced investors to gamble on stocks.

“Interest rates are the most important ingredient in economic activity. And for almost 10 years, money has been free,” said Wasif Latif, head of global multi assets at USAA.

That trend is now reversing. Mortgage rates have climbed above 5% to the highest level since February 2011.

Tariffs are inflationary

The picture has been further clouded by Trump’s trade crackdown. Tariffs have begun to lift raw materials prices. A growing number of major US companies have complained about the trouble caused by Trump’s tariffs on China – and retaliatory tariffsby Beijing.

In other words, the trade war threatens to exacerbate the inflationary pressures the Fed is already grappling with.

“Many of Trump’s economic prescriptions invite inflation – so obviously the Fed has to take away the monetary punch bowl,” Greg Valliere, chief global strategist at Horizon Investments, wrote to clients on Thursday.

Yet the tit-for-tat tariffs could also slow growth, forcing the Fed to shift course. The IMF downgraded its 2019 growth forecast forboth the United States and China.

Is a recession coming soon?

The good news is that while inflation has come back to life, it’s not yet at the point that would cause the Fed to slam the brakes on the economy.

Investors cheered a new report released on Thursday showing that consumer prices increased by a cooler-than-expected 2.3% in September. That’s hardly runaway inflation territory. And wage growth actually decelerated a bit in September.

“The risk of late-cycle fiscal stimulus leading to rampant inflation, and causing the Fed to rapidly raise rates, is not playing out just yet,” said Jeff Mills, co-chief investment strategist at PNC Financial Services.

The Trump administration has responded to the market turmoil by emphasizing the strength of the economy but downplaying the risk of a boom-bust situation.

“We are in an economic boom most folks thought was impossible,” Larry Kudlow, Trump’s top economic adviser, told CNBC on Thursday. “I don’t see an end do it…I don’t think this is anything resembling a sugar high.”

But is the stock market signaling an end to the recovery from the Great Recession?

Zandi doesn’t think so. He pointed to continued aid the economy is receiving from tax cuts and government spending.

“Gasoline is still being poured on the economy,” Zandi said. “The real day of reckoning will come early next decade, around 2020.”