The secret world of government debt collection

By Blake Ellis and Melanie HickenGovernment agencies across the country are hiring private debt collectors to go after millions of Americans over unpaid taxes, ancient parking tickets and even $1 tolls.

It’s a good deal for cash-strapped states, cities and other local governments. By outsourcing this dirty work and letting private companies charge debtors sky-high fees, government agencies can get these collection services free of charge.

And it's a great deal for debt collectors. In an industry already known for bad behavior, debt collectors that work for government agencies usually don’t have to work within the confines of consumer protection laws – opening the door for higher fees and even more aggressive tactics.

Their government bosses can give them the power to threaten debtors with the suspension of their driver’s license, garnishment of their wages, foreclosure and arrest to get them to pay up.

State lawmakers have even passed laws allowing private collectors to charge debtors steep fees. In Florida, for example, fees can be as high as 40% on top of the total bill, which includes not only what they already owe, but interest and government penalties as well. In Texas, they can reach 30%. And in cases of unpaid toll violations, flat fees can effectively amount to more than 100%. As a result, small unpaid tolls can easily balloon into hundreds of dollars, once government penalties and collection fees are tacked on.

Federal consumer protection rules rarely apply to government debts."

"They keep figuring out ways to stack these fees up,” said Tai Vokins, a Kansas-based attorney and former assistant attorney general. “They’re preying on the absolute poorest people."

And this is all legal.

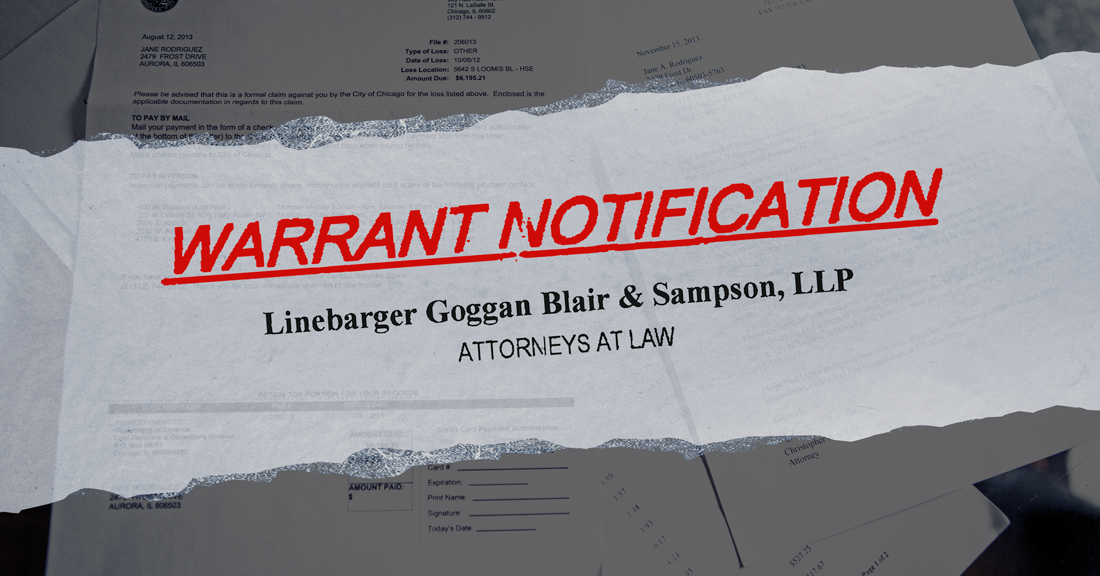

One of the biggest players in this industry is law firm Linebarger Goggan Blair & Sampson. It has worked for small-town school districts, the city of New York and at one point, the largest tax collector in the country: the Internal Revenue Service.

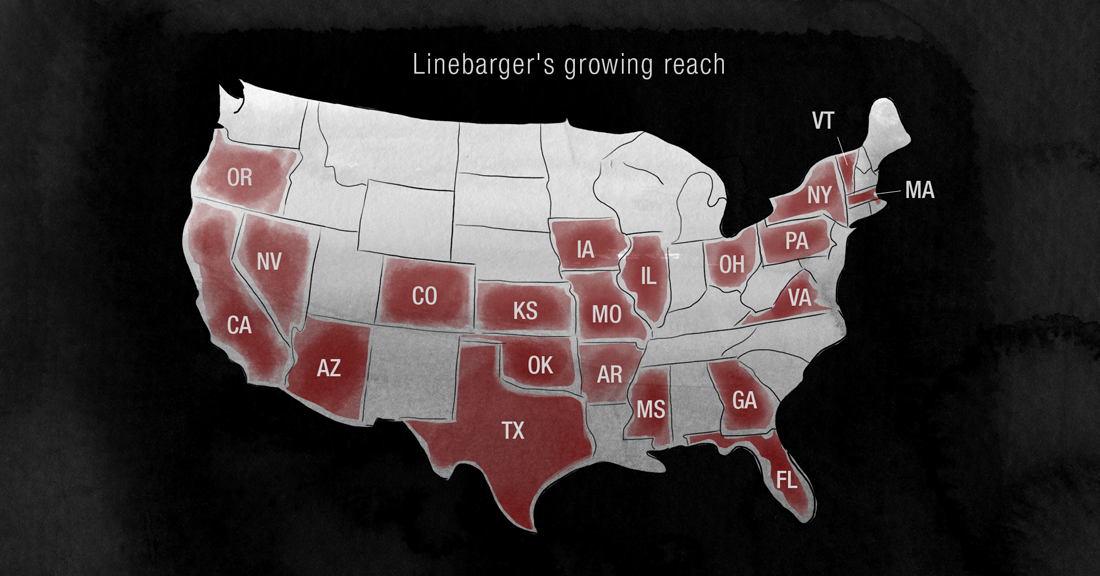

Based in Texas, Linebarger works for 2,300 clients nationwide and collects $1 billion for its clients each year.

The firm, which would only respond to interview questions in written statements, told CNNMoney that government agencies need the money it collects to fund vital services, such as teacher salaries and police budgets.

But the collection system is far from perfect. Government agencies sometimes hire Linebarger to hunt down decades-old debts that people can’t even remember incurring. Some turn over unpaid bills to collections just months after consumers have received them. And others provide the firm with inaccurate information, leading it to pursue the wrong person entirely. These agencies also issue the arrest warrants, foreclosure lawsuits and other harsh threats that Linebarger cites in its letters to debtors.

All of this can lead to some nightmare scenarios.

One Kansas man ended up behind bars three times because he couldn’t afford the growing bill for his unpaid speeding ticket, while another Kansas woman says she had her entire paycheck garnished for back taxes. A Texas woman was threatened with arrest for not mowing the grass on a property she didn’t even own. And an Oklahoma business owner is still bitter about the $112,000 bill he received for taxes he had already paid.

These consumers and many others have gone public with their frustrations. Some have filed complaints with state attorneys general, while others have even sued the firm. Yet, the outsourcing by government agencies continues and Linebarger’s business is thriving.

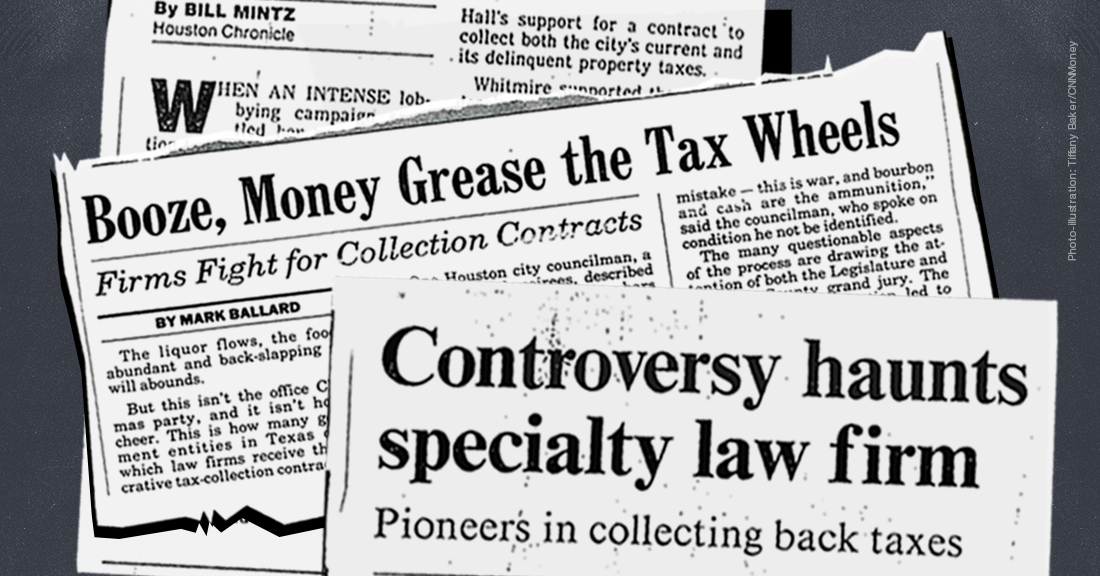

Despite decades of scandals over the way the firm gets business -- and even jail time for one of its top executives -- Linebarger still lands lucrative government contracts.

Many attribute this success to the millions of dollars the firm has spent wooing politicians, from local mayors to powerful players like former Texas Governor Rick Perry. Its political pull has even helped it get certain state and federal laws changed in its favor – including Texas legislation that allows it to charge debtors such high fees.

For one out-of-town driver who mistakenly failed to pay $7.50 in tolls on a Texas highway, these fees became a $157.50 bill in a matter of months. The toll road was due the original toll amount, plus $66 in administrative fees. Linebarger added $84 for itself.

The Harris County Toll Road Authority told CNNMoney that it uses the funds collected by Linebarger to help keep Houston’s toll roads drivable and safe. More than a dozen of Linebarger’s other current and former government clients were also contacted for this report, but the toll authority was the only one to provide comment.

Linebarger maintains that its fees are reasonable and depend on the kind of debt and how hard it is to collect.

By collecting these fees, Linebarger says it doesn’t have to charge the majority of the state and local governments that hire it, thereby keeping taxpayers from subsidizing its collection costs.

This is different from a consumer creditor like a bank, which typically has to pay for its collection costs out of the money recovered from debtors.

In a months-long investigation into the government debt collection industry and Linebarger, CNNMoney analyzed hundreds of consumer complaints obtained from six state attorneys general and the Federal Trade Commission, among other organizations. We interviewed more than 60 consumers, former Linebarger employees, attorneys and other experts. We also reviewed more than 100 lawsuits against the firm -- alleging everything from unfair fees to harassment.

CNNMoney found that with the power of government agencies behind them, debt collectors like Linebarger are able to play by their own rules, in essence acting above the law.

Thanks to legal exemptions, government collectors usually don’t have to follow the main federal law that regulates the debt collection industry. State consumer protection laws often don’t apply either. And when debtors have challenged Linebarger's government collections work in court based on other laws, the firm has gone so far as to argue it has immunity because it is an extension of the government.

Because the law so often lands on Linebarger’s side, consumers often end up in a black hole with little recourse.

They keep figuring out ways to stack these fees up. They're preying on the absolute poorest people."

— Tai Vokins

Former Kansas assistant attorney general

"I had no defense whatsoever," said Houston Army veteran Harry Memnon, who says his unpaid $1.25 toll charges became a nearly $300 bill.

Protections go ‘out the window’

While Linebarger isn’t the only government debt collector out there, it is one of the largest. And as it continues to grow -- with clients in 21 states -- so does the controversy surrounding its methods.

Linebarger says that consumers should typically receive at least one notice (and sometimes multiple notices) from the government before a debt ends up in collections.

Yet many people say the government never notified them, and Linebarger’s threatening letters and phone calls were the first they had heard of their debt. Angry, frustrated and suspicious consumers have posted complaints on sites like Ripoff Report, Yelp and the Better Business Bureau.

Some were so confused that they became convinced Linebarger’s collection claim was a scam and refused to pay. Others say that no matter how much proof they had provided that a debt wasn't theirs, Linebarger kept calling and sending them threatening letters.

And for those who just couldn’t afford to pay what they initially owed, the firm’s fees left them trapped in debt and fearful that they may lose their driver’s license, their home or end up in jail. After a class-action lawsuit challenged the fees Linebarger charged under a contract with the city of New Orleans, the Louisiana Supreme Court even ruled that the firm’s 30% fees were unconstitutional.

Yet Linebarger still has the Better Business Bureau’s A-plus rating, which the organization stands by. The BBB says Linebarger, which is a paying member, does a good job responding to complaints -- a requirement for the firm to stay in good standing. It also noted Linebarger’s complaint volume was in line with the size of the firm and that it had waived fees in a few cases where consumers hadn’t been notified of the original debt.

Linebarger says it tries to negotiate payment plans or reduce the debt whenever possible.

But Oklahoma tax attorney Paul Tom, who has represented dozens of people battling the firm, said while he has sometimes been able to negotiate the taxes owed, Linebarger’s fees are always set in stone.

Consumers tell a similar story.

Memnon, who is a high school ROTC instructor, was so worried about having his driver’s license suspended that he used a credit card to pay Linebarger’s $287 bill -- which he says the firm told him all stemmed from $1.25 in toll charges.

The Harris County Toll Road Authority said it doesn't send out bills until three toll violations have been incurred, and that it notifies people of their outstanding charges before handing over the debt to Linebarger. The agency wouldn't comment on Harry's specific situation though.

Linebarger declined to comment on any individual grievances. But it did say that it does everything it can to reduce errors and that the cost of collection -- even for a small amount like a toll -- can be significant. It also said that in general, toll violators are given multiple opportunities to pay before the debt escalates.

"While we understand that this is frustrating to some debtors, they can avoid all fees by doing what the vast majority of Americans do – pay their tolls when they’re due instead of allowing them to go delinquent," said Linebarger partner and chief marketing officer Michael Vallandingham.

Debtors can avoid all fees by doing what the vast majority of Americans do -- pay their tolls when they're due."

— Michael Vallandingham

Linebarger partner and chief marketing officer

But Memnon says he wasn’t notified of the 2009 toll charges or given a chance to pay until he received a $102 bill from Linebarger in July of 2012, which demanded he pay or attend a hearing. Confused, he immediately called the firm. After being told the violation was incurred by a rental car driver, he asked for proof the debt was his. When he didn’t hear back and another call to the firm went unanswered, he became convinced it was a scam and didn’t attend the hearing.

Then a new bill arrived in September, and the amount owed had nearly tripled, growing from $102 to a $287 bill, thanks to new collection fees and fines due to the missed hearing.

At this point, he had already fought the firm for months over the phone, so he gave up and paid.

Grieving mother Laverne Dobbinson received a particularly horrifying letter from Linebarger in 2012 -- billing her recently deceased son for $710 in damage to the New York City police car that killed him.

Courtesy Linebarger Goggan Blair & Sampson Linebarger partner Michael Vallandingham

"I could hardly breathe -- I couldn't believe they were sending me a letter [like this]," said Dobbinson. "My whole family was outraged."

The City of New York did not comment, though at the time of the incident the city acknowledged the letter was sent in error.

Even when the mistake is clearly on the part of one of Linebarger's clients, those who end up in Linebarger's crosshairs feel like they have little recourse.

If these were consumer debts, like an old credit card bill, consumers would have a number of state and federal laws protecting them, and they could turn to an attorneys general office or the Consumer Financial Protection Bureau for help. CFPB officials declined to comment on whether they have oversight of government debt collectors but encouraged consumers to share their story or submit a complaint to the agency.

The main federal law regulating debt collectors is the Fair Debt Collection Practices Act. It prohibits collectors from charging any fee that wasn’t already agreed to in a contract or permitted by state law. Collectors also aren’t allowed to make false threats of arrest -- since consumer debts rarely land debtors behind bars -- and they are required to provide proof that a debt was incurred if the debtor requests it.

Federal consumer protection rules rarely apply to the government debts Linebarger collects, however, because they usually aren't considered "consumer debts." Speeding tickets and property taxes, for example, aren't considered a service or product that has been purchased, like an unpaid water bill.

So while shocking to some, Linebarger's high fees are completely legal. And the threats it makes are okay too, since the firm's government client can pursue an arrest warrant, foreclosure or other penalty to back it up.

"All of these [consumer] protections seem to go out the window," said Alex Kornya, assistant litigation director at Iowa Legal Aid.

Linebarger says that as a law firm, it is held to a higher standard than typical collectors. "Our law licenses, and thus our jobs, are always on the line," said Vallandingham.

Yet in lawsuits, Linebarger's attorneys have argued that consumer laws don’t apply or that it has "immunity" to certain laws, claiming it operates as an agent of its government clients

Air Force Major Jose Iraheta has been battling Linebarger in court for more than seven years because the firm hit Iraheta with a foreclosure lawsuit while he was serving in the Middle East. While active duty military are able to delay paying property taxes without penalty until they return to Texas, Linebarger sued him over a $10,500 bill for unpaid property taxes.

All of these consumer protections seem to go out the window."

— Alex Kornya

Iowa legal aid attorney

Photo: Jeremy Freeman Air Force Major Jose Iraheta sued Linebarger after it tried to collect on property taxes while he was serving in the Middle East.

Linebarger dropped its lawsuit after he countersued, claiming the firm had broken state and federal laws. His case is ongoing. Linebarger would not comment on the suit.

"How can I defend other people’s rights halfway around the world when I can't defend my rights at home?” he said. “Linebarger holds itself to be above the law."

FBI probes and jail time

Despite decades of scandals and bad press surrounding the firm and its partners, Linebarger continues to wield widespread political influence and rake in new million-dollar contracts.

The scandals date back to its early days, when firm partners became infamous for using political connections to win contracts and change laws. Past controversies ranged from allegations of illegal loans to public officials to inappropriately influencing lawmakers, including a controversial Mexican getaway with a Texas Speaker of the House that reportedly involved a topless dancer.

Some critics thought the firm could even face extinction in 2002 after a major partner, Juan Pena, was indicted on charges that he bribed two city councilmen with more than $10,000. (See timeline)

Pena eventually pleaded guilty to bribery charges, lost his law license and was sentenced to 30 months behind bars. He did not respond to requests for comment.

Yet the scandals have continued. Take Chicago, for example, where Linebarger's contract was terminated in 2008 because the firm had paid for the trip of a top city official. The bad blood didn’t last long though, with the city hiring it again in the same year.

"The incident ... was embarrassing to say the least, but we worked very hard to earn another chance to represent the City," said Vallandingham.

Meanwhile in Memphis, attorneys in a class-action lawsuit challenging the firm’s fees questioned Linebarger’s payment of millions of dollars to a local attorney who helped it win the city contract to collect taxes. After the lawsuit was filed, Memphis ended its relationship with the firm.

And in Texas, a partner was indicted in 2012 for covering up donations to a local elected official and his case remains ongoing. More recently, two Linebarger consultants have been at the center of alleged bribery schemes -- one of which is heading to trial and another that is still under investigation.

Linebarger says the firm itself has never been charged with committing a crime and the actions of a few individuals aren't representative of its overall business practices. But one former Linebarger partner, who asked to remain anonymous, said some of the firm's tactics for getting contracts made him uncomfortable and didn't always "pass the smell test."

So how does Linebarger keep getting new business? The firm touts its longstanding work in the field saying: "we are hired and rehired because we are good at what we do."

Illustration: Jesse Harp While Linebarger is able to go after consumers nationwide, the government clients it works for are in these 21 states.

But others say it's all about the money.

Linebarger spends millions on campaigns and lobbying efforts across the country. And it pays big bucks to influential current Texas public officials by putting them on its payroll -- a surprising but legal practice.

"They’ve discovered a niche that they can monopolize through political manipulation," said Byron Schlomach, a former fellow at the Texas Public Policy Foundation. "And they’ve become very good at it."

During the 2012 elections, for example, the firm spent nearly $500,000 on Texas political campaigns alone, according to public records.

Years earlier, the firm lobbied heavily for the 2004 law that allowed the IRS to use private collectors. It had spent nearly $700,000 on its overall federal lobbying efforts between 2003 and 2006. Linebarger was hired by the IRS as part of a pilot program in 2006, but the contract ended about a year later -- before the program was nixed entirely amid controversy over the use of third-party collectors.

Linebarger says it undertakes all of its political activities with "strict adherence to the law."

While co-founder and former partner Dale Linebarger said he believes elections should be government funded, he admits that political spending is vital to a company’s success.

"The way you get access is you contribute to political campaigns, you go to fundraisers ... You make friends with these people," he said.

But even if all of the politicians and government agencies end their love affair with Linebarger, there are other private collectors that would be happy to take its place. What is really needed, consumer advocates say, is an end to the special treatment given to government debt collectors.

Until then, millions of Americans are left facing ominous threats and steep fees each year.

"They're bottom feeders; that's what they are," said Tom, the Oklahoma tax attorney. "The problem is they're bottom feeders with the power of the government behind them."

Design by: Tiffany Baker/Web production: Tyler Sidell