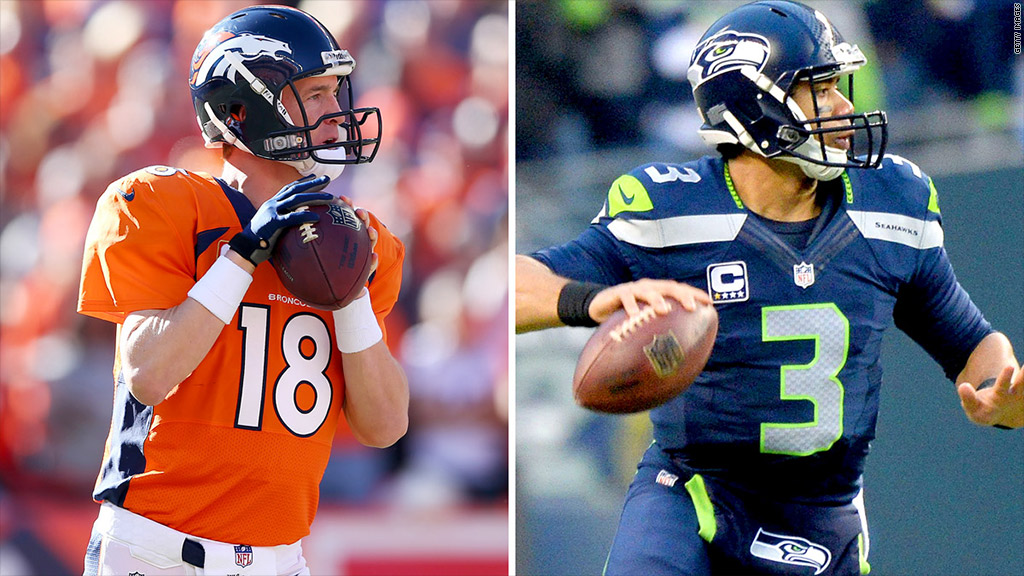

The market isn't off to a great start in 2014. But if you believe in the so-called Super Bowl Indicator, stocks could pick up steam if the Seattle Seahawks defeat the Denver Broncos in less than two weeks.

According to this bit of Wall Street lore, the Dow tends to go up when a team from the original National Football League beats a team that played in the upstart American Football League, which merged to create the current NFL.

The Seahawks actually didn't come into existence until the 1970s. But they started in the National Football Conference, where most old NFL teams play. Following a 25-year stint in the opposing American Football Conference, the Seahawks returned to the NFC in 2002. That's why investors are supposed to root for Seattle.

Most of the old AFL teams, including the Broncos, now play in the AFC. So usually it's better when a current NFC team beats the AFC team.

Of course, the Super Bowl Indicator is nothing more than a correlation. There is no real cause and effect and investors should NOT use it as a guide for buying and selling stocks.

But for what it's worth, the indicator has been accurate more than 80% of time since the first Super Bowl in 1967 -- albeit with plenty of loopholes.

For example, the six-time Super Bowl champ Pittsburgh Steelers count as an "old" team even though they play in the AFC. That's because they were originally in the NFL before the merger.

Similarly, the Baltimore Ravens, which won last year's Super Bowl, are also considered an "old" team despite playing in the AFC. They were previously the old NFL's Cleveland Browns before moving to Baltimore nearly two decades ago.

Related: Fox Sports sells out Super Bowl ads

During the times when the indicator has worked, the Dow has averaged a 10% gain that year..

But the indicator is not perfect. And the last time it failed, it went horribly wrong for stocks. That was in 2008, when the NFC's New York Giants beat the New England Patriots. The Dow tumbled more than 30% due to the financial crisis and Great Recession.

A Broncos win may not be so bad: Interestingly enough, in the nine times that the Super Bowl Indicator has failed to accurately predict market direction, the Denver Broncos have been participants in four of those championship games.

In 1978 and 1990, the Denver Broncos were defeated in the Super Bowl by the Dallas Cowboys and San Francisco 49ers respectively. But the Dow fell anyway in both years.

When the Broncos beat the Green Bay Packers in 1998 and repeated as champs with a victory over the Atlanta Falcons in 1999, the Dow delivered gains north of 15% during one of the best bull markets in history.

The market really loves the 49ers: Still, some might argue that the Seahawks jinxed things by making it to the Super Bowl. While the Dallas Cowboys will always be America's Team (disclosure: this writer was born and bred a Dallas Cowboys fan), Wall Street's favorite team seems to be the San Francisco 49ers.

San Francisco lost Sunday night in a testy battle against the Seahawks that led to an instant classic postgame interview with Seattle cornerback Richard Sherman.

During the five years that the Niners have won the Super Bowl, the Dow averaged an increase of more than 20%.

Then again, San Francisco lost last year and the Dow went on to hit a record high.

So feel free to have fun on Super Bowl Sunday and root for whichever team is your favorite. What the market does in 2014 depends more on how strong earnings are and how quickly new Fed chief Janet Yellen pulls back on stimulus for the economy than whether or not Peyton Manning gets his second Super Bowl ring.