Pimco's Bill Gross told bond investors to keep an eye on inflation in 2014.

In his latest investment letter, Gross called inflation "the runt of the Fed's litter but one that promises to turn a sow's ear into a silk purse for those who watch it closely."

In fact, the bond guru said that if both inflation and inflationary expectations remain tame in 2014, bond investors could expect a total return of 3% to 4%. He conceded that this level of gains is not as high as what bond investors had grown accustomed to in the past few decades. But he also expects less volatility.

"Bond investors will be less rich, but more placid in 2014," said Gross, who also reiterated his love for short-term bonds. He used a seesaw as a metaphor.

"If you're on the wrong end of an interest rate teeter totter headed up, it makes you wonder why anyone would own bonds, or at least why anyone would own longer-term bonds," he wrote in his letter.

Related: Where Bill Gross is putting his money

Meanwhile, the government's monthly jobs report is due out Friday, and Gross took the opportunity to point out that he sees "the third little pig of the litter -- inflation" to be the more critical statistic when it comes to Federal Reserve policy. Gross said he was "amazed at the fascination and emphasis" on the unemployment rate.

Related: Here comes the end of QE

Even with the Fed starting to slim down, or taper, its bond purchases, Gross pointed out that the Fed has been clear that no rate hikes are in the cards just yet. The Fed has said its "thresholds" are for unemployment to dip below 6.5% (it is currently 7%) and for inflation to be no higher than 2.5%. Consumer prices (excluding food and energy) are up 1.7% over the past 12 months.

With that in mind, Gross doesn't see a rate hike in the cards until at least 2016, as long as inflation remains under control.

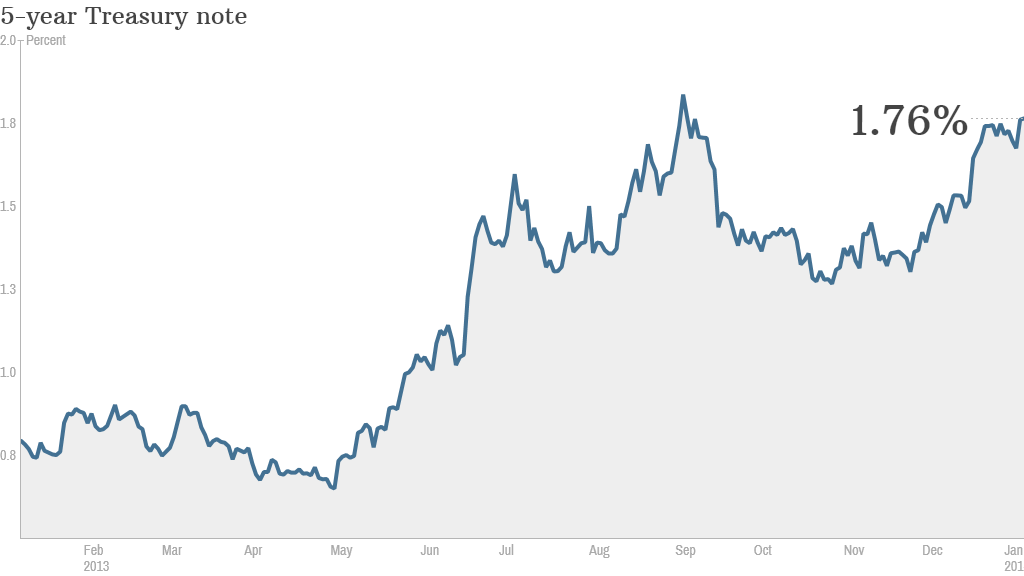

"If so, then 1-5 year bonds, combined with credit, volatility, curve rolldown and a dollop of currency should float a bond investor's boat in 2014 and avoid breaking the [investment] buck," he said.

Gross, who runs the Pimco Total Return Fund (PTTRX), also returned to his pop culture roots, starting his letter with a nod to a Paul Simon classic.

"There's 50 ways to leave your lover and maybe more than that to lose your money," he wrote.

Gross knows that firsthand. His flagship fund suffered losses last year along with the rest of the bond market as interest rates rose. Investors pulled more money out of his fund than any other bond fund last year, according to Morningstar.