Flush with liquidity, markets around the world surged last year, breaking records and pumping out healthy returns. So is there anything left for investors in 2014?

The flow of cheap money will lessen, say experts. But don't despair.

While that will stir up risk in some regions, it will also present opportunities. At the same time, corporate earnings will take center stage as stock markets are weaned off massive amounts of stimulus.

"Prospects are much more dependent upon near-term earnings growth," said John Wyn-Evans, head of investment strategy at Investec Wealth & Investment.

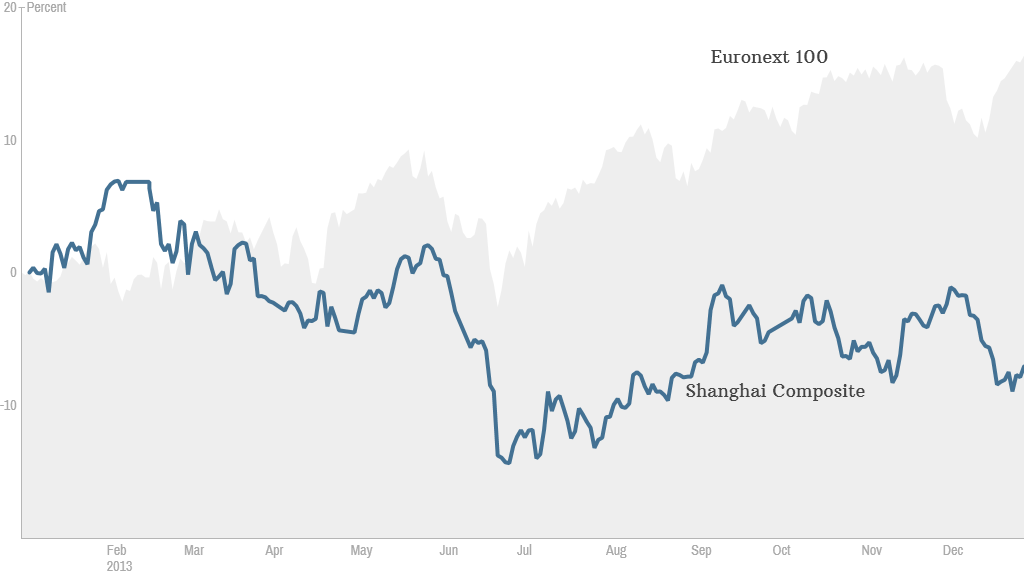

Strategists say developed markets hold better return potential than their emerging peers, as the U.S. Federal Reserve pulls back its support. Slowing growth in China is another challenge that could sap confidence and hurt equities in the year ahead.

But there's still plenty of opportunity for investors looking in the right places. We scoured the globe and gathered expert tips on where to invest, and where to avoid.

1. Europe

The fragile European recovery, frustrated by subdued global growth and a relatively strong euro, continues to cast a pall over the region. However, things are moving in the right direction.

A record-breaking run for Germany's blue-chip DAX index led a string of market rallies in Europe in 2013. Growth in the U.K. was reignited and London stocks marched higher in tandem.

Looking ahead, analysts are selectively optimistic about European equities. Analysts at Threadneedle Investments in London say improved economic fundamentals should translate into steady, rather than dramatic, earnings growth.

Nomura analysts are more upbeat. They expect "superior earnings growth" of 14% next year for companies in continental Europe.

If you're looking for a less traditional European play, Nomura analysts like countries with big financial sector exposures, such as Poland. Economies that are closely tied to improving global growth -- such as the Czech Republic -- are also ones to watch.

And is there more life in the market rally enjoyed by Europe's largest economy? Analysts at Wells Fargo think not: they advise investors to sell out of Germany, and instead position themselves to benefit from the eurozone rebound through Belgium and Switzerland.

Related: What's ahead for the U.S. economy in 2014

2. Asia

This year could be another big one for Japan. The benchmark Nikkei index surged nearly 60% in 2013, sealing its best annual performance in more than 40 years. And stock pickers see more upside on the horizon.

Major economic reform has helped drive the outsized gains. The stimulating effect of Abenomics is expected to keep stocks buoyed in the year ahead. Analysts at Nomura, Threadneedle Investments and Wells Fargo all expect Japanese equities to climb higher in 2014.

Elsewhere in Asia, a pick-up in global demand is likely to support many export-focused Asian economies. Improved confidence may spread to equities but the region faces two key headwinds: slowing growth in China and rising interest rates.

Markets to avoid? UBS analysts name India and Indonesia as their "least preferred markets in Asia." Both countries are vulnerable to reduced monetary stimulus from the Federal Reserve.

UBS Asia equity strategist Niall MacLeod said other southeast Asian markets, including Malaysia, Indonesia and Singapore, are expected to lag the region as the Fed pulls back.

Related: Don't expect a bond bloodbath in 2014

3. Emerging markets

Taper risk won't just be contained to developing markets in Asia. Brokerage CLSA expects stocks in emerging markets to underperform those in developed regions, at least into the second-half of the year.

Brazil might be scarred as the Fed scales back, though Mexico is poised to fare much better, given relatively solid economic fundamentals and stronger ties to U.S. growth.

Analysts at Threadneedle Investments like Mexico, citing solid growth prospects and a competitive manufacturing sector. And if investors want to beef up emerging market exposure, Threadneedle analysts suggest backing companies within regions that are tied into the developed market recovery.