The pain of higher prices continues for US consumers.

Record gas prices drove inflation to 8.6% for the 12 months ending in May, higher than the pace in April, according to the latest Consumer Price Index, the government’s basic inflation measure.

The reading for core CPI, which strips out volatile food and energy prices, posted a 6% increase over the same period, higher than the previous month’s level. Both readings are among the biggest jumps in prices experienced by consumers since 1981.

Overall, the increases were higher than forecast by economists, who had been expecting prices to jump by 8.3% over the 12 months ending in May, and which would have matched April’s reading. This report dashed hopes that inflation had peaked earlier this year.

“Inflation is going higher and broader with a worsening outlook,” said Sung Won Sohn, professor of finance and economics at Loyola Marymount University in Los Angeles. “The probability of a recession in the next year or so is rising. Inflation is eating away at consumers’ purchasing power. Since consumer spending accounts for about 70% of the economy, a real decrease in consumer spending would deal a big blow to the economy.”

The typical US household is spending about $460 more every month than they did last year to purchase the same basket of goods and services, said Mark Zandi, chief economist with Moody’s Analytics.

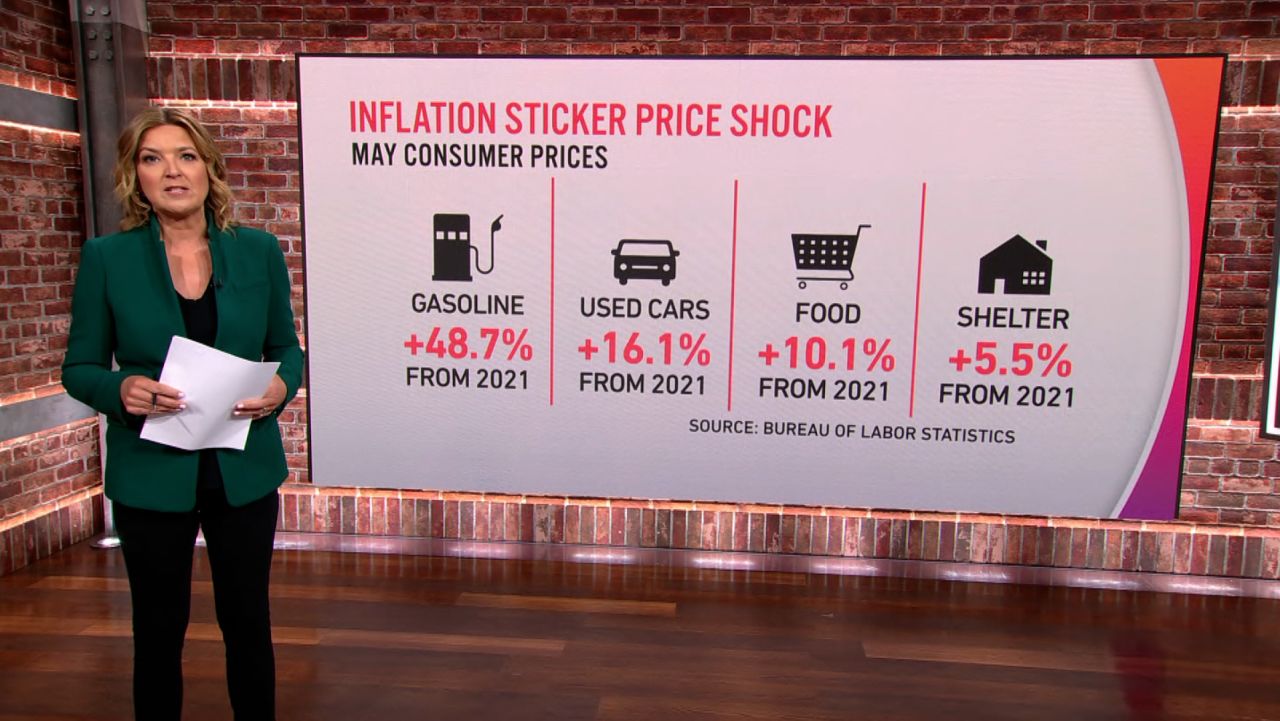

Energy prices rose 34.6% compared to a year ago, driven by a nearly 50% jump in gas prices over the last year. AAA’s tracking of gas prices shows the price of a gallon of regular gas nationwide is now at $4.99, after setting records in 31 of the last 32 days. The June CPI report due next month is certain to show another big jump in gas prices.

But energy price hikes were not limited to the record gasoline prices. Electricity prices rose 12% over the last 12 months, the biggest annual increase since 2006. And the price of natural gas being used by consumers rose 30.2%, the biggest jump since 2008.

The higher energy prices alone added 2 percentage points to the overall CPI.

It’s not just energy that is driving prices higher. The Labor Department said almost all the major components that make up the index showed increased prices.

Prices for food purchased to eat at home rose 11.9%, the largest 12-month increase since 1979, with eggs up 32.2%, milk up 15.9% and poultry up 16.6%.

The shelter index, which measures rents and other housing costs, posted a 5.5% increase, its biggest 12-month gain since 1991. While that might not be as big an increase as the double-digit price hikes in other categories, the money that consumers spend on their home, whether renting or buying, is typically the largest expenditure they make each month.

Used car prices, which had shown signs of moderating with monthly declines over the last three months, rose once again, lifting prices 16.1% over the last 12 months. Meanwhile, new car prices are up 12.6% over the same period. A shortage of computer chips has curbed production at automakers, and that limited inventory is responsible for the rise in prices.

Strong demand for air travel at the start of the summer travel season is also lifting airfares, which posted a one-month jump of 12.6% in May, the third-straight monthly rise of more than 10%. In the last 12 months, airfares are up 37.8% and fares in May are 21.7% higher than in May 2019, before the pandemic caused a near halt in demand for air travel.

The continuing high pace of inflation means the Federal Reserve is all but certain to continue to aggressively raise interest rates when it meets next week. At its May meeting, the Fed raised rates by half a percentage point, the first such move in 22 years. Another half-point hike is likely at next week’s meeting, with some forecasters now calling for a three-quarter-point hike in light of Friday’s report.

But there are worries that the Fed’s monetary tightening could plunge the US economy into a recession. That has been a major factor in the sharp decline in US stock prices in recent months that has wiped out a great deal of household wealth. Stocks were sharply lower again Friday following the inflation reading.

“Inflation is proving to be more persistent than was widely believed a year ago, when transitory was the buzzword,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “The two key questions now? How far will the Fed go to knock inflation down, and how far can the Fed go without pushing the economy into recession?”

While the inflation report brought new attacks on the Biden administration from Republicans, the White House sought to blame the worst of the inflation on the rise in the price of oil and gasoline after Russia invaded Ukraine.

“Today’s inflation report confirms what Americans already know. Putin’s price hike is hitting American hard,” President Joe Biden said at the Port of Los Angeles, where he was pausing from a regional summit to address what his team views as the most pressing current issue: high prices on everything from gas to groceries.

Biden sought both to acknowledge the pain Americans are feeling, explain how he was looking to solve it and pin blame on others.

“I understand,” Biden said. “Inflation is a real challenge to American families.”

He lambasted shipping conglomerates for raising prices and oil companies for their stock buybacks, singling out oil giant Exxon for making “more money than God” last year.

– CNN’s Kevin Liptak contributed to this report.