A version of this story first appeared in CNN Business' Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)In recent weeks, investors have poured money into bets on raw materials like steel and iron ore, confident that limits to supply and massive post-pandemic demand would trigger one of the biggest price spikes in decades.

Now, thanks to action from China, the frenzy may be on hold.

What's happening: Five top Chinese regulators announced Monday that they had jointly summoned key companies in the iron ore, steel, copper and aluminum sectors over the weekend. During the meeting, the agencies vowed to step up regulation and closely monitor commodities markets, warning that there would be "zero tolerance" for speculation or market manipulation.

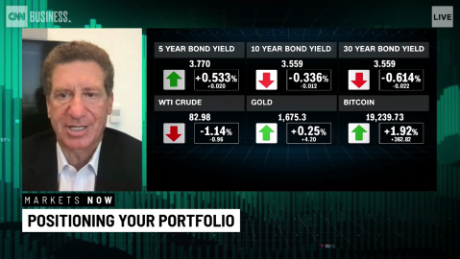

Commodities prices plummeted in China on Monday following the news. Iron ore futures fell 5.2%, while futures of rebar ŌĆö a type of steel used to reinforce concrete ŌĆö slumped 3.6%.

Atilla Widnell, managing director at Navigate Commodities in Singapore, told me that he views this as a healthy pullback, since many everyday investors had been getting ahead of themselves.

"I think we're getting closer to acceptable price ranges now," Widnell said. He noted that prices for steel and iron had "increased parabolically" but appeared detached from "underlying supply and demand fundamentals."

April data showed that Chinese demand was "starting to level off a bit," and that realistically, given the country's relatively early exit from harsh pandemic restrictions and stimulus rollout, "this year isn't going to be magnificently stronger than last year."

Still, enthusiasm for commodities among investors could rear its head again before long. US President Joe Biden wants to spend $1.7 trillion to renew the country's infrastructure. And Goldman Sachs thinks the case for higher oil prices "remains intact given the large vaccine-driven increase in demand in the face of inelastic supply."

The investment bank now expects Brent crude prices, the global benchmark, to reach $80 a barrel this summer, up from about $67 right now.

Remember: Brent crude prices started the year under $52 per barrel. So even as traders take a breather, the impact of significant price increases will remain a major topic of conversation.

A Deutsche Bank survey of 620 global market professionals released Monday found that 63% of respondents see higher-than-expected inflation as one of the top three risks to market stability. That's up from 43% in its April survey.

Bitcoin remains under pressure following huge crash

Regulatory action in China is also feeding massive volatility in cryptocurrency markets.

Chinese Vice Premier Liu He told a group of finance officials on Friday that the government would "clamp down on bitcoin mining and trading activity" as part of its goal to achieve financial stability. The government didn't elaborate on specific policies targeting mining or trading.

While China has taken steps to restrict the use of cryptocurrencies for years, the focus on mining is new. HashCow ŌĆö which owns the world's largest mining farms ŌĆö said Saturday that it would stop selling machines to clients in China. Another Chinese mining company, BIT.TOP, said it would no longer offer mining services for clients in mainland China.

The moves fed the recent selloff in bitcoin and shares in crypto-related companies. Bitcoin prices fell as much as 13% on Sunday. The currency was last trading at around $37,000 per coin ŌĆö far below the peak of $64,000 it reached a month ago, according to CoinDesk.

Step back: The seismic course correction in the crypto market isn't spreading to other parts of the financial system, at least for now. JPMorgan's John Normand thinks that's related in part to who owns digital currencies.

"It is true that flows into crypto have become more balanced between retail and institutional over the past few quarters, which raises the risk of contagion," he wrote in a recent research note. "But institutional holdings are probably limited to an array of hedge funds rather than the fuller spectrum of asset managers, insurance companies, pension funds, central banks, sovereign wealth funds and commercial/investment banks."

That said: Should what's happening in the world of bitcoin be seen as an advance warning that investors are experiencing a change in mood?

"It is possible that crypto mania does provide a broader read across when it comes to more established markets owing to the signaling effect it provides in terms of investor sentiment," Rabobank's Richard McGuire and Lyn Graham-Taylor told clients.

Virgin Galactic moves closer to sending tourists to space

Thinking about making travel plans again? Have you considered ... space?

Richard Branson's Virgin Galactic (SPCE) is moving closer to sending wealthy tourists on out-of-this-world trips. Over the weekend, its rocket-powered plane carrying two pilots successfully soared into the upper atmosphere.

Space plane VSS Unity reached an altitude of 55.45 miles, according to the company. The US government recognizes the 50-mile mark as the edge of space.

"Everything just worked like a dream," Branson, who founded Virgin Galactic in 2004, said in an interview with CNN.

What it means: The mission is great news for Virgin Galactic, which plans to start launching paying customers within the next year. The company's last spaceflight attempt ended abruptly when the plane's rocket engine failed to ignite, setting the company's testing schedule back months.

Investor insight: Shares of Virgin Galactic, which have struggled this year, have skyrocketed 18% in premarket trading.

Virgin Galactic has already sold tickets for $200,000 to $250,000 to more than 600 people. Branson said it "will not be very long now" before they can hop on board.

Up next

Lordstown Motors reports results before US markets open.

Also today: Closing arguments in the blockbuster trial between Apple (AAPL) and Epic, the maker of Fortnite.

Coming tomorrow: Fresh data on US home sales and consumer confidence.

ŌĆö Laura He and Michelle Toh contributed reporting.