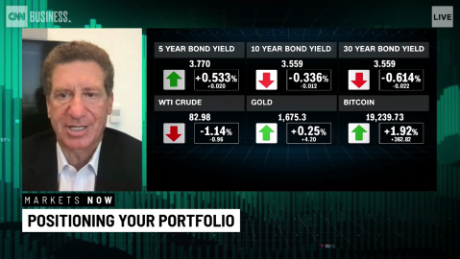

In fact, Biden's plan to raise the

capital gains rate that wealthy Americans pay on profits from the sale of stocks or bonds, from 23.8% to 43.4%, is eminently reasonable and a long time coming. As a former executive at BlackRock, wealthy investors like me have spent decades paying a lower tax rate on our passively earned wealth than people who work for a living, and all the Biden plan does is treat our income from wealth exactly like income from work.

The

top 0.1%, a group of just 120,000 people earning an average of more than $11 million a year, earned more than half of all

capital gains income in the United States in 2019. The bottom 99%, on the other hand, earned less than a quarter of capital gains that year. So yes, a significant amount of capital gains will fall under Biden's newly proposed top tax rate, but that shouldn't discourage lawmakers. If anything, such extreme levels of inequality should spur even more progressive taxation.

The idea that wealthy people will stop investing if they have to pay these slightly higher tax rates on their returns is absurd. Rich people are going to invest their wealth no matter the tax rate because there is literally nothing else they can productively do with it.

Rich people have two options: They can either invest their money, make additional money and pay taxes on whatever they make, or they can keep all their money in cash, make no additional money and pay no taxes. At any tax rate short of 100%, the first option is still the better one, especially considering any non-zero level of inflation means idle money will actually depreciate in value. No matter what the tax rate is, investing is still better than hiding your money in a shoebox under your bed.

It's also time we put to bed the myth that wealthy investors deserve tax breaks because they are job creators who single-handedly support the entire US economy.

I'm an investor who lives off millions of dollars' worth of investments. Like many other wealthy people, I haven't actually worked in years ŌĆö I let my money work for me. Do you know how many jobs I've directly created from all those investments? Zero.

I'm an investor in Apple, and while I benefit from Apple doing well, I certainly don't deserve the credit for creating the jobs of the people employed to design and make iPhones. They have their jobs because of the millions of people who want to buy iPhones.

Wealthy investors have been claiming to be the backbone of the country's economy for so long that they've started to believe it themselves. I have no doubt that many of the people who predict economic ruin from higher capital gains rates sincerely believe they're telling the truth, but they're sorely mistaken.

The true backbone of our economy is consumer demand, which depends on a strong, financially secure middle class. The critics are missing the key point that everyone, even wealthy investors, benefits from everyone having money to spend. I'm happy to pay higher tax rates if they're going to lead to a fairer, stronger economy for everyone, and the public investments laid out in the American Families Plan will make everyone, including rich people like me, better off in the long run.