Dubai (CNN Business)Etihad Airways has often come to the rescue of struggling airlines. Now it has serious problems of its own and may have to consider merging with its bigger neighbor to cut its losses.

The Abu Dhabi airline has racked up about $4.7 billion of losses in the last three years as investments in Alitalia, Air Berlin and India's Jet Airways turned sour and competition from rivals bit into revenue.

It's a dramatic reversal of fortune for the second national carrier of the United Arab Emirates. Together with Emirates, based down the road in Dubai, and Qatar Airways, Etihad helped transform global aviation in recent decades by using its Gulf hub to fly millions of people between east and west.

"The concept of using the UAE region as ... connecting point for East-West air travel made sense up until about three years ago, when the traffic flows were pretty much optimized," said Mike Boyd, president of aviation consultancy firm, Boyd Group International.

The volume of passengers using UAE airspace "has likely reached its peak," he added.

The UAE already has some of the world's busiest skies. In 2017, the government created new airways to streamline the huge volume of traffic and reduce delays.

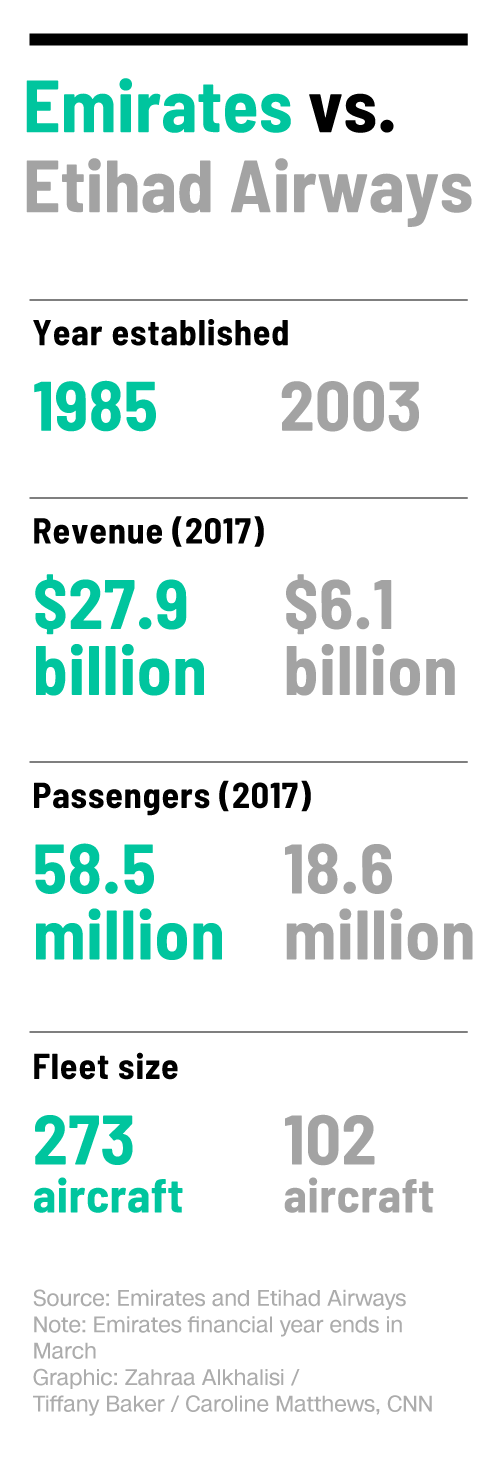

Now analysts are questioning whether the UAE still needs two global players. Emirates, the older and bigger of the two national carriers, has remained profitable over three decades. In 2017, it agreed an extensive partnership with low-cost carrier FlyDubai that included coordinating their schedules and aligning their airport operations.

"The region is now in an overcapacity mode and that means that some consolidation may be in the works," Boyd said.

Emirates has already been touted as a possible savior for Etihad. Bloomberg reported in September that the airlines were in talks to merge and create the world's biggest carrier by passenger traffic.

Neither would comment on what they described as "rumor or speculation," but Etihad CEO Tony Douglas poured scorn on the Bloomberg report in a recent interview with Arabian Business magazine.

In 2017, Emirates President Tim Clark said it was "early days" to talk about a merger with Etihad. And he made clear that such a decision would only be taken by the rulers of Dubai and Abu Dhabi.

"I take guidance from my bosses. If they want to take it on we can do a lot of things," Clark said in an interview with CNN. "But if they wanted to go so far, I don't know."

Whether they're talking about a merger or not, the two airlines have been forging closer ties. Last year, they agreed to cooperate in aviation security and also work together on aircraft maintenance and repair. In January, Etihad asked an Emirates subsidiary to manage its customer service centers.

Aviation industry consultant John Strickland said the two airlines are coming together to "achieve cost efficiencies" but he doesn't expect a merger any time soon. Etihad managed to shrink its loss from $1.52 billion in 2017 to $1.28 billion in 2018.

Losing a million passengers

Cutting costs is only half the battle. Etihad is also struggling to maintain passenger numbers at a time when traffic continues to grow.

It carried more than a million passengers fewer in 2018 than a year earlier. That hurt its load factor, which measures how many seats are filled on each flight.

"[Etihad's] losses, whilst heavy, were at least reduced year on year but the load factor at around 76% was disappointingly weak for a predominantly long haul carrier with much feeder traffic and despite reduced capacity," added Strickland.

The International Air Transport Association expects 290 million more passengers will travel to, from and within the Gulf region by 2037.

A merged Emirates-Etihad airline could serve those passengers more efficiently.

"If Etihad were a private sector carrier, it would be unlikely the airline would be able to sustain such extensive losses," said Henry Harteveldt, travel industry analyst at Atmosphere Research Group.

Etihad and Emirates serve similar markets and "a merger would allow the combined entity to rationalize capacity, and adjust schedules to better compete," he added.