The Federal Reserve left interest rates and monetary policy unchanged on Wednesday, pointing to the nation’s as yet incomplete economic recovery.

“The path of the economy continues to depend on the course of the virus,” the central bank said in a statement. While vaccinations are helping to limit the virus and its impact on the economy, the risk to the economic outlook still remains.

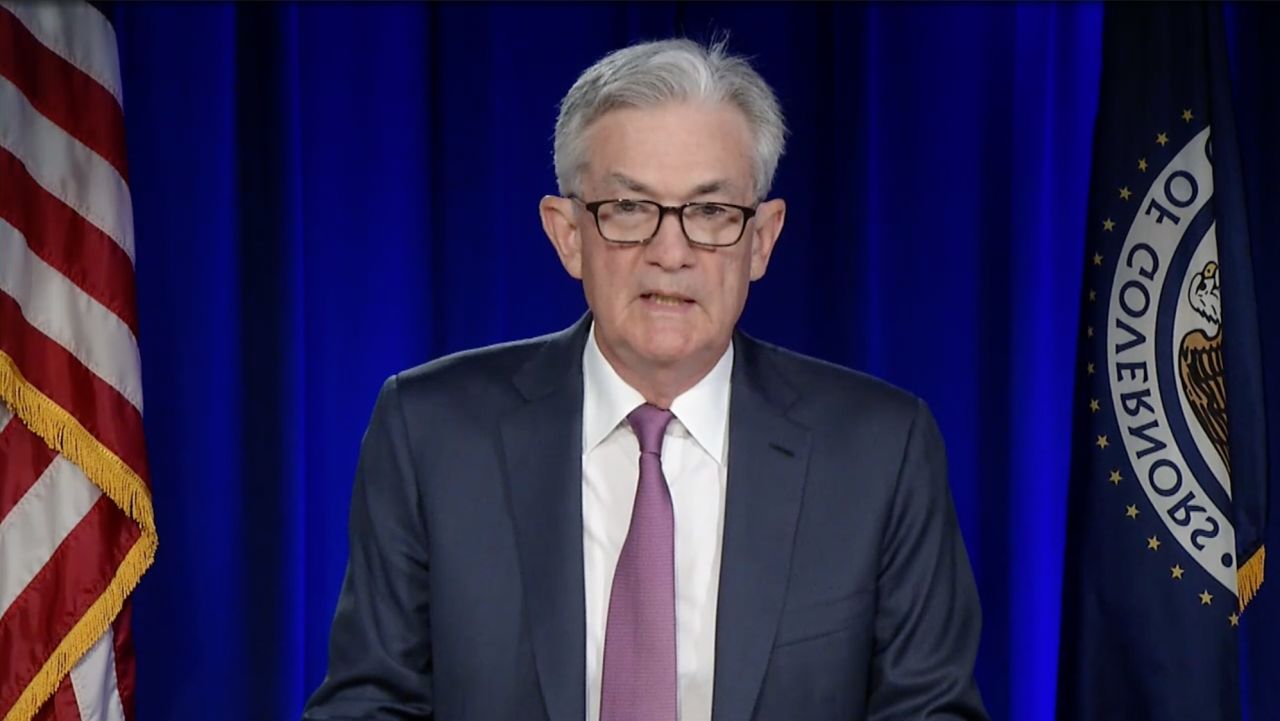

Without being alarmist, Fed Chairman Jerome Powell couldn’t help but sounding somewhat concerned about the new variants of Covid-19.

“There’s no reason they just can’t keep coming…one more powerful than the next. We don’t know that, but that’s that’s that’s certainly a plausible outcome,” Powell told reporters during Wednesday’s press conference.

“As vaccinations rise we can nonetheless get back to our economic activity,” he added. That’s why it’s imperative that people around the world get their shots.

The Delta variant likely won’t bring about another significant lockdown, Powell said, but “you could imagine school districts to wait a month or two” to open, he said.

Similarly, the jobless might want to wait before returning.

The virus is still a deterrent for some people who are reluctant to go back to work because of exposure risk. Workers who are also caretakers have additional reasons to stay home. And then there are the expanded pandemic jobless benefits. But eventually, “all of these factors should wane,” Powell said.

“The bottom line is that people want to work,” he added.

Cue the taper

The Fed, which each month currently buys Treasury securities worth $80 billion and mortgage-backed securities worth $40 billion, noted that the economy has made a lot of progress since this policy has been put into place.

“The Committee will continue to assess [the] progress in coming meetings,” according to the statement, hinting at the central bank getting ready to taper its asset purchases.

Monitoring this progress includes looking at various employment metrics, including certain demographic groups, wages and participation, Powell said, adding that “we have some ground to cover on the labor market side.”

“This is ever so slightly more hawkish than expected but there’s not much new for investors to see here, said James McCann, deputy chief economist at Aberdeen Standard Investments, in emailed comments.

That said, the Fed hasn’t made any decisions about a taper timeline, Powell said Wednesday. The summer meeting was never the place the central bank was going to shake things up too much, McCann added.

“Powell’s job at the moment is like trying to turn a cruise ship in a bath tub. He has very little room for maneuver and wants to avoid any sharp turns at the risk of unsettling markets,” he said.

When pressed on the effect of buying mortgage-backed securities in the face of a very hot housing market, Powell said “there really is little support for the idea of tapering mortgage-backed securities earlier than Treasuries. I think we will taper them at the same time.”

Meanwhile the Fed announced the establishment of two repurchasing, or repo, facilities — one for domestic markets and the other for foreign and international central banks. The facilities will ensure that the plumbing of the financial sector functions smoothly.