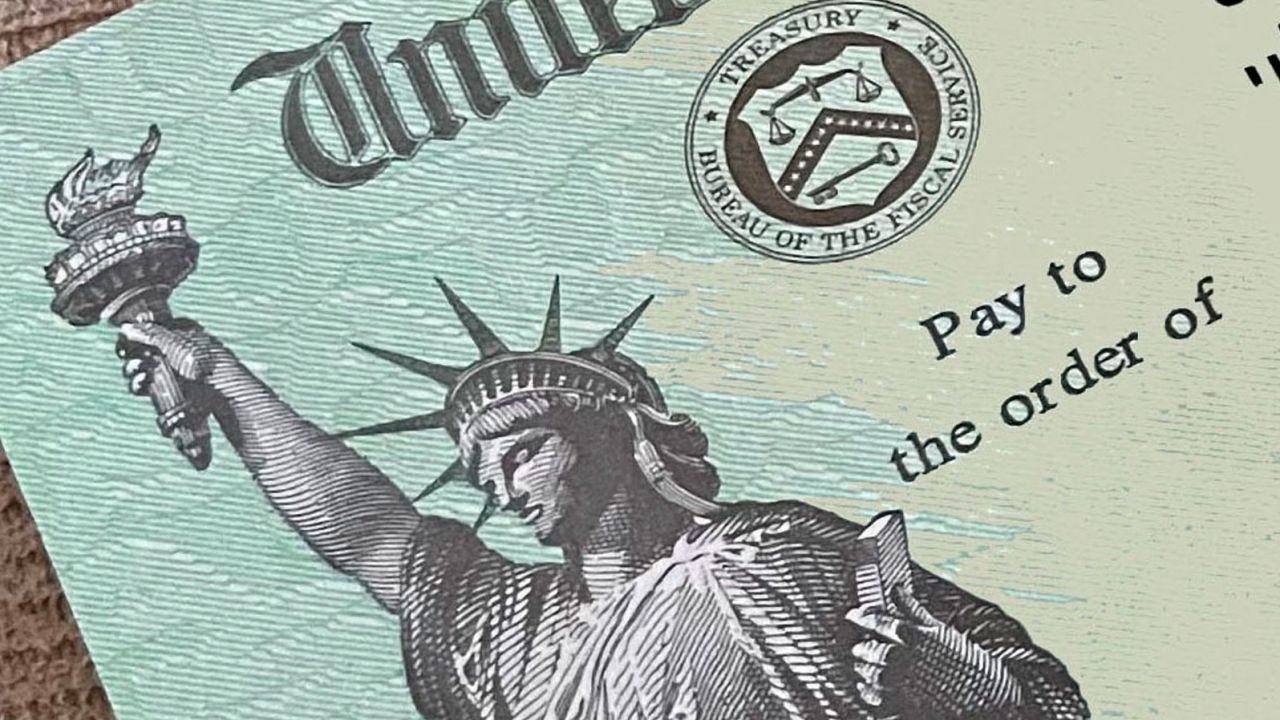

The Internal Revenue Service started sending what it calls “plus-up” payments last week to people who are owed a bigger stimulus check based on their actual 2020 income than they initially received.

The original payments were based on 2018 or 2019 tax returns. That means people who earned less in 2020 could be owed more money. Once they file their 2020 tax return that shows a lower income amount, the IRS will automatically send them an additional payment.

Separately, families that welcomed new children in 2020 could also be eligible for additional dependent payments.

As of last week, the government had sent out 130 million stimulus payments to those who qualify for the third round of checks approved by Congress in March.

Who gets a payment?

The new payments are worth up to $1,400 per person and are expected to reach 85% of households, according to the White House. Families will receive an additional $1,400 per dependent, so a couple with two children could receive up to $5,600. Unlike prior rounds, families will now receive the additional money for adult dependents over the age of 17.

The full amount goes to individuals earning less than $75,000 of adjusted gross income, heads of households (like single parents) earning less than $112,500 and married couples earning less than $150,000. But then the payments gradually phase out as income goes up.

Lawmakers narrowed the scope of the payments this time so that not everyone who received a previous check will be sent one now. It cuts off individuals who earn at least $80,000 a year of adjusted gross income, heads of households who earn at least $120,000 and married couples who earn at least $160,000 – regardless of how many children they have.

On what year are the income limits based?

The new income thresholds will be based on a taxpayer’s most recent return. If they’ve already filed a 2020 return by the time the payment is sent and it has been processed, the IRS will base eligibility on their 2020 adjusted gross income. If not, it will be based on the 2019 return or the information submitted through an online portal set up last year for people who don’t usually file tax returns.

If your 2019 income was less than your pay in 2020, you will not owe back any money. But if your income fell in 2020, filing your tax return now – before the payments go out – may mean you’ll get a bigger check.

Who is still waiting?

Many low-income Social Security recipients may still be waiting for the cash to hit their accounts.

Those who don’t have a 2019 or 2020 tax return on file – typically because their income is below the threshold for filing – will still get the money automatically. But the payments didn’t start going out to those people until this weekend. A lot of those electronic payments are expected to reach accounts on April 7. The delay affects those who receive Social Security, Supplemental Security Income, or Railroad Retirement Board benefits.

People who receive Veterans Affairs pensions and don’t have a recent tax return on file are also still waiting for their stimulus payments. Last week, the IRS said it was continuing to review data received for veteran benefit recipients and said those payments could be disbursed by mid-April.

Other households who are eligible for the new round of payments but haven’t filed a 2020 or 2019 tax return and did not use the IRS’s online portal for non-filers last year could also still be waiting for their stimulus payment. The agency is encouraging those to file a 2020 tax return as soon as possible in order to receive their payment.