A version of this story first appeared in CNN Business' Before the Bell newsletter. Not a subscriber? You can sign up right here.

London (CNN Business)A burst of anxiety is ricocheting across financial markets as Wall Street sets expectations for the next phase of the pandemic, which could take hold this spring and summer as vaccinations rise and coronavirus cases fall.

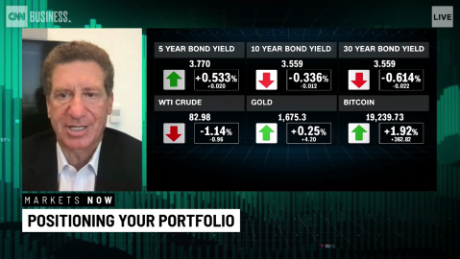

What's happening: US stock indexes, which have repeatedly hit all-time highs in recent weeks, took a leg lower on Thursday as fears about inflation reemerged. The tech-heavy Nasdaq plunged 3.5%, its worst drop since October, while the S&P 500 lost 2.5%.

The moves came as yields on government bonds, which move opposite prices, continued to rise, indicating faith in the economic recovery. But investors are also increasingly worried that a surge of activity later this year may cause prices to spike, pushing central banks like the Federal Reserve to roll back some of their support for the economy sooner than expected.

The resulting market tantrum may be tough for some investors to swallow. But it shouldn't necessarily be cause for alarm.

The turbulence has its roots in good news. Wall Street is increasingly confident that the pandemic can be brought under control, and life can begin to return to normal. Spending in cash-starved sectors like travel and hospitality may soon jump, and companies that have been struggling could see earnings bounce back.

"It's a bad thing when yields are rising and growth expectations aren't," James Smith, developed market economist at ING, told me. That's not what's happening here.

It's true that the run-up in yields is happening very quickly. That could hurt companies that are sensitive to changes in interest rates. Governments sitting on huge piles of debt thanks to a wave of pandemic-era borrowing will also be watching the spike closely.

Yet it's worth remembering that any increase in yields is off of historic lows. Last March, the yield on the benchmark 10-year US Treasury note fell below 1% for the first time ever.

"You've had this rise in yields, but they're from quite extreme or unusual levels," Smith said. "This is a bit more of a normalization."

Market watchers predicted that this day would come, triggering a sell-off in high-growth stocks that have been popular during the pandemic. Apple (AAPL) shares shed 3.5% on Thursday, while Amazon (AMZN) dropped 3.2%.

One reason this class of stocks has been trading at such rich valuations is because bond yields have been rock-bottom. That's made riskier assets look more attractive.

"Down the line, bond yields may just rise, and equity valuations may also have to reset alongside yields," economist Robert Shiller, who is an expert on bubbles and developed the most famous method for valuing stocks, wrote in late November.

Here we are down the line, and the coming days or weeks could be bumpy. But strategists remain confident that with careful planning, investors will make it to the other side.

House prepares to pass Biden's $1.9 trillion stimulus

Despite deep partisan divisions in Washington, President Joe Biden's massive plan to jumpstart the economic recovery is moving ahead.

The latest: The House of Representatives is expected to pass Biden's $1.9 trillion stimulus package on Friday. The bill would then be kicked to the Senate.

The vote would mark a victory for Democrats, even though a provision to raise the federal minimum wage to $15 an hour has run into trouble, according to my CNN colleague Stephen Collinson.

The Senate parliamentarian ruled Thursday that the measure violated the budgetary process known as reconciliation, which Democrats are planning to use so they can pass the package with a simple majority instead of having to rely on Republican votes.

The decision is a blow to progressives, but could ease Democratic divisions over the package and ultimately make it easier to pass.

Tick tock: Federal unemployment benefits are currently set to expire on Mar. 14. An estimated 11 million people could lose out if the bill doesn't become law before then.

Another 730,000 American workers filed for first-time unemployment benefits last week. That's lower than expected, but the labor market still needs additional support.

"For months, there's been no substantial improvement in the magnitude of total initial claims," said Indeed Hiring Lab economist AnnElizabeth Konkel.

The total number of initial applications is still nearly six times higher than it was one year ago.

AT&T's DirecTV buy was 'one of the worst deals ever made'

CNN parent AT&T (T) is selling a minority stake in its pay-TV business to private equity firm TPG, closing the door on a painful chapter in the company's history.

The details: The deal values DirecTV, AT&T TV and U-Verse at roughly $16 billion, my CNN Business colleague Frank Pallotta reports. That's less than a third of the $49 billion AT&T spent to buy DirecTV in 2015.

That "nonsensical" acquisition will go down "as one of the worst deals ever made," according to Craig Moffett, a telecom analyst at MoffettNathanson.

The merger took place just as streaming businesses like Netflix began consolidating their power, leading to an acceleration of cord-cutting that made DirecTV less dominant in the marketplace.

"People knew it was a bad deal when it was happening," Moffett said. "It's not like people at the time didn't see cord-cutting coming."

DirecTV has been an albatross for AT&T as customers have fled the service. Offloading part of the business ŌĆö even at a fire sale price ŌĆö will remove some of the strain and help AT&T tackle the huge pile of debt it took on to fund its 2018 purchase of Time Warner.

The company can now double down on its wireless and wired broadband businesses, as well as its own streaming service, HBO Max. But it won't be able to forget its DirecTV blunder.

"You can't pretend that you didn't buy those assets because the debt that you took on to buy them is still on the balance sheet," Moffett said. "[AT&T] bought a house [it] couldn't afford, and it turned out to be not a very nice house."

Up next

Cinemark (CNK) and DraftKings report earnings before US markets open.

Also today: US personal income and spending data for January arrives at 8:30 a.m. ET, along with the latest reading of the PCE price index, a crucial measure of inflation.

Coming next week: Oil producers meet to discuss next steps following a strong rebound in crude prices.