Foreclosures can be extremely painful events. Imagine finding out years later that it was all a big mistake.

That’s exactly what happened to Jeff and Eva Reiner. The couple turned to Wells Fargo (WFC), their mortgage servicer, for help making their payments after Eva, the family’s breadwinner, was laid off by Verizon (VZ) in 2010.

“We were desperate. I begged them for help,” Eva Reiner told CNN Business.

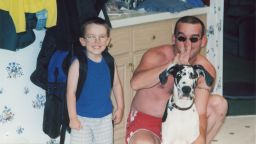

But Wells Fargo did not accepttheir requests for a mortgage modification for their beloved 6-acre property in rural South Carolina.Wells Fargo eventually foreclosed on the home, forcing the couple to move their teenage son, give up three dogs and forfeit the equity they had built up in the house.

This fall, the Reiners learned from media reports they were among the approximately 545 homeowners who lost their homes because of an apparent software glitch with Wells Fargo’s loan modification process.

The foreclosure problem is just the latest in a long series of issues confronting Wells Fargo, one of America’s biggest banks. Over the past two years, Wells Fargo has admitted to creating millions of fake accounts, forcing thousands of borrowers into auto insurance they didn’t want and imposing mortgage fees on homeowners they didn’t deserve. Wells Fargo has apologized for its conduct, revamped the C-Suite and pledged to do better. But the bank still faces multiple government investigations and lawsuits.

The latest was last week. A lawsuit was filed against Wells Fargo seeking justice for borrowers like the Reiners who say they were victimized by the bank’s wrongful foreclosures.

‘I had a breakdown’

In September 2018, Wells Fargo sent the Reiners a letter explaining that the bank had “difficult news” to share: The family’s plea for a mortgage modification would have been accepted if not for a “faulty calculation.Wells Fargo said the couple should have been approved for a trial modification — a reduction in monthly payments that would have saved their house from foreclosure.

“I had a breakdown. I could not believe we’d get a letter of that nature so many years later,” said Eva, who is on her fifth round of chemotherapy for ovarian cancer. The couple now lives in an apartment in Virginia.

Jeff Reiner, a stay-at-home dad who took care of their special needs son, said the mortgage modification would have allowed the family to remain in their home. “Without assistance, we just didn’t have a chance,” he said.

In the letter, Wells Fargo apologized for the mistake, enclosed a check for $15,000 to help “make things right” and offered free mediation for further compensation.

The letter did not explain how Wells Fargo decided on the $15,000 sum, but it did say the couple could cash it and still pursue mediation.

“We realize our decision impacted you at a time you were facing a hardship,” a Wells Fargo mortgage executive wrote.

A Wells Fargo spokesman told CNN Business that the bank should have sent the Reiner family a proactive modification offer in 2012, but it didn’t because of the calculation error. He said that loans like this one that are backed by Fannie Mae or Freddie Mac were eligible for modification even before the borrower requests one.

“If they had accepted the offer [that Wells Fargo never made] and kept up with the payments, then the foreclosure would have been avoidable potentially,” the Wells Fargo spokesman said.

He added that the October 2012 foreclosure occurred after the family filed for bankruptcy and the loan was nearly 17 months past due.

‘Don’t just blame it on the software’

Jeff Reiner said he appreciates that Wells Fargo has admitted its error, but that $15,000 is woefully insufficient given the financial and emotional loss the family suffered.

“It doesn’t even begin to compare to the chain of events that were started by their denial of assistance,” he said. He compared it to someone saying: “Sorry about cutting off your arm. Here’s a Band-Aid.”

Jeff said he wants Wells Fargo to at least show that it understands the consequences of its mistake. “And don’t just blame it on the software,” he said. “Where was the human oversight?”

Jeff and Eva Reiner are now represented by Gibbs Law Group, the Oakland law firm that filed a lawsuit against Wells Fargo. The complaint, filed on December 5 in US District Court for the Northern District of California, is seeking class action status.

“We think Wells Fargo’s errors are having devastating and long-lasting effects on people’s lives,” Michael Schrag, a partner at Gibbs Law Group, told CNN Business.

The Wells Fargo spokesman said the bank was served the lawsuit “only recently” and “can’t comment specifically on many of its claims at this time.”

He added that while Wells Fargo “would prefer to work directly with each customer to resolve the matter,” if they aren’t satisfied with the offer or mediation then borrowers are able to pursue other legal options.

Hundreds of customers lost their homes

During the mortgage crisis, Congress created the Home Affordable Modification Program, which aimed to keep struggling homeowners out of foreclosure. Wells Fargo, one of America’s biggest mortgage lenders, was among the many banks that chose to participate in HAMP.

Under Treasury Department guidelines, mortgage servicers were required to issue modifications to borrowers who had documented financial hardships and an ability to make their monthly mortgage payments after a modification.

Lenders were directed to reduce monthly mortgage payments to as close as possible to 31% of the borrower’s monthly income by slashing interest rates, extending the length of mortgages or taking other steps.

In August, Wells Fargo made a shocking admission in an SEC filing: about 400 homeowners were foreclosed upon between April 2010 and October 2015 because of a “calculation error” in the bank’s mortgage modification underwriting software. That glitch caused customers who were otherwise qualified to get denied for a loan modification.

Last month, Wells Fargo said in a new SEC filing that it identified another 145 customers whose homes were wrongly foreclosed on. The bank said an expanded review found additional “errors” that inflated the estimate of attorneys’ fees for homeowners in the foreclosure process. Legal fees are taken into account when banks determine if customers qualify for mortgage modification.

All told, Wells Fargo said in the filing that about 870 customers were incorrectly denied a loan modification or were not offered a loan modification plan in cases where they would have otherwise qualified.

Why didn’t Wells Fargo act earlier?

The lawsuit accuses Wells Fargo of “concealing” the glitch. It says that Wells Fargo failed to disclose the problem years ago even though the bank said in SEC filings the calculation error was corrected in October 2015.

The Wells Fargo spokesman told CNN Business that while the bank initially identified and fixed the calculation error in October 2015, it was only later determined that accounts should be reviewed to determine if the problem led to any “unintended issues” for customers. He said those later reviews identified customer impact and “shortly thereafter” the bank publicly disclosed the matter.

Victims of Wells Fargo’s wrongful foreclosure suffered “significant stress causing physical injuries and emotional distress,” the lawsuit alleges. The complaint accuses Wells Fargo of engaging in business practices that are “immoral, unethical, oppressive, unscrupulous,” and harmful to consumers.

The lead plaintiff in the lawsuit is Alicia Hernandez, who sought a mortgage modification from Wells Fargo after getting laid off during the Great Recession. Wells Fargo told Hernandez that she didn’t qualify for help and eventually foreclosed on her North Bergen, New Jersey, condo in late 2015, according to the lawsuit.

Wells Fargo informed Hernandez in a September 2018 letter that it discovered the rejection was because of a “faulty calculation,” according to the lawsuit. The bank sent Hernandez a check for $15,000.

“The check does not make up for the severe financial and other consequences that Wells Fargo’s calculation inflicted on Ms. Hernandez,” the lawsuit said.