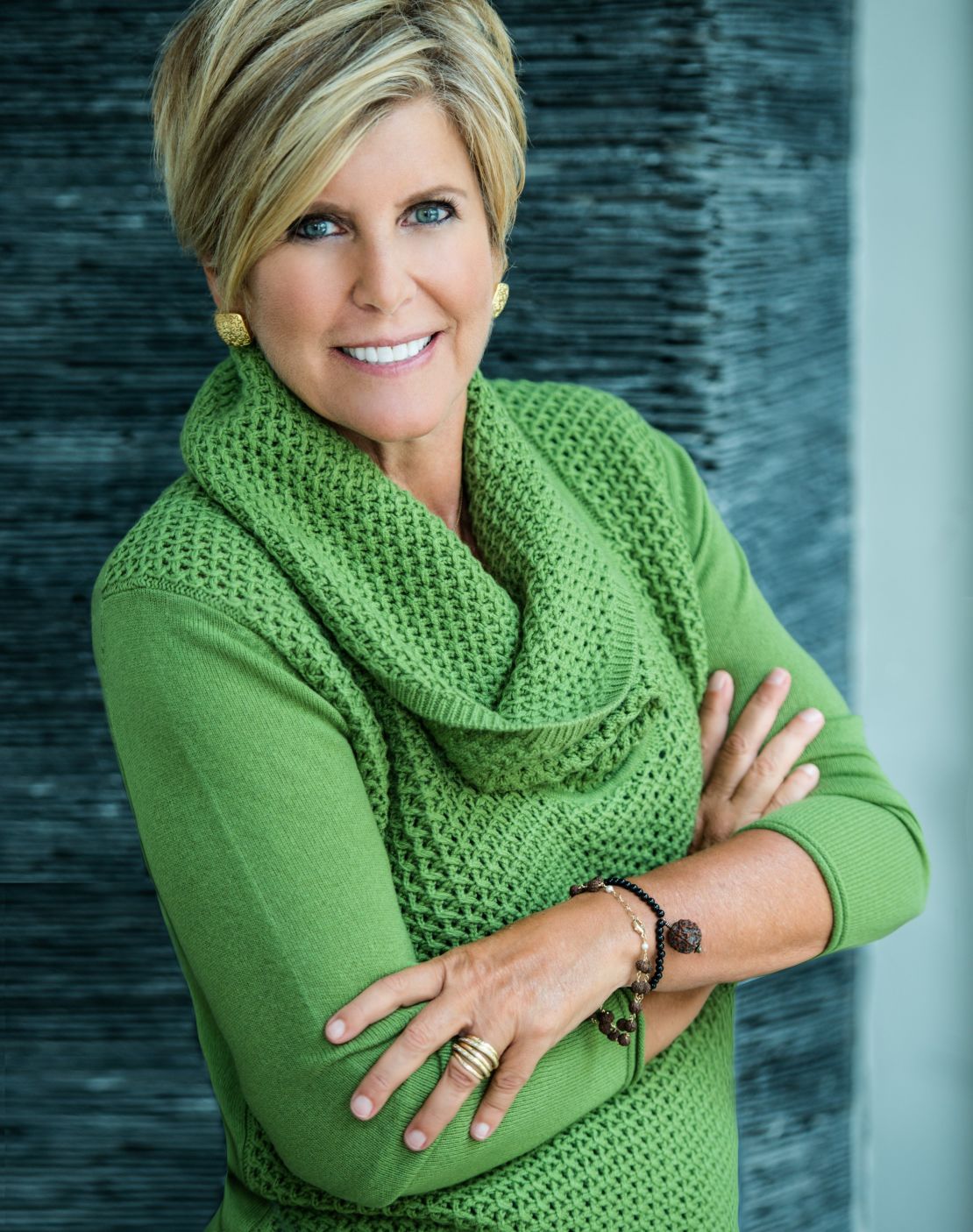

Editor’s Note: Suze Orman is a personal finance expert and hosts “The Suze Orman Show” on CNBC. She is a bestselling author of ten books, including “The Money Class.”

Story highlights

Suze Orman: It is progress that a handful of states have legalized same-sex marriage

Orman: The federal government should make this basic civil right a law of the land

She says gay couples are penalized when it comes to taxes and Social Security benefits

Orman: When will our government end financial, social and civil discrimination?

That nine states and the District of Columbia have legalized same-sex marriage is encouraging progress for those of us who believe that everyone deserves to have basic civil rights. But, even if every state in the country could pass a similar legislation, it would not be enough. What we need is for our federal government to step up and make this basic right a law of the land.

Beyond the social discrimination, the refusal of our federal government to legally recognize same-sex marriages imposes steep financial penalties on same-sex couples. That two of the most costly penalties are triggered upon the death of one partner just adds to the ache of the senseless discrimination.

I have been with my partner, Kathy Travis, for 12 years. If I am lucky I will spend the rest of my life living and sharing my joys and happiness with her. We have worked very hard as a team to save for our future together and consider everything we have as equally owned by the other.

If the federal government recognized same-sex marriage, then when one of us dies our assets would seamlessly transfer free of tax to the survivor. That’s a basic right that every heterosexual married couple has.

But because there is no federal recognition of same-sex marriage, if I die first, or vice versa, before either of us can inherit what is now jointly our assets, there would be a federal estate tax bill that one of us would currently have to pay. Again, to be clear: If we were a heterosexual married couple, there would be no estate tax regardless of the size of the estate or who died first.

Get our free weekly newsletter

This spring, the Supreme Court will weigh in on the constitutionality of the federal Defense of Marriage Act. The Court needs to do the right thing and end discrimination against gay couples.

We all have 83-year-old Edith Windsor to thank for in pushing the issue of same-sex marriage equality on to the national front. Edie and her partner Thea were together for 40 years. How many marriages do you know that have lasted that long? But when Thea died in 2009, Edie was hit with a $363,000 federal estate tax bill because as a same-sex couple they were not eligible for the unlimited marital deduction. Are we really a nation that says it is fair and just to demand Edie pay a $363,000 penalty because she is gay?

There’s another penalty that’s even worse. Regardless of the size of their estates, every gay couple is discriminated against when it comes to Social Security benefits.

Married heterosexual couples can maximize their Social Security retirement benefits by taking advantage of the highest-earner’s benefit. When both spouses are alive, the lower earner can opt to collect a monthly benefit check that is equal to 50% of his or her spouse’s benefit. For many married couples, that 50% spousal benefit is often much higher than what the lower-wage-earning spouse could collect based on his or her own earnings record. Most important, when the high earner dies, the surviving spouse is allowed to collect 100% of the deceased’s higher benefit.

Because same-sex marriages aren’t recognized on the federal level, gay and lesbian couples are not eligible for Social Security spousal benefits. The lower earner cannot claim any benefits based on the higher earner’s benefit. A heterosexual couple married for just a few months is able to collect a federal benefit that same-sex couples who have been together for decades can’t. Are we really a nation that says that is fair?

Beyond those two glaring death penalties, health insurance is another area of severe federal financial discrimination against gay couples. I am so glad to see more employers extending health insurance benefits to same-sex partners. But because same-sex couples are not considered legally married under the eyes of the federal government, the dollar value of the health coverage is considered taxable income.

A 2007 study estimated that this gay health insurance penalty costs same-sex couples an aggregate $178 million ($1,069 per household), while employers paid an additional $57 million in payroll tax on that taxable income. No heterosexual married couple or their employers pay that penalty. Again, are we really a nation that says that is fair?

The social and civil discrimination that persists as long as our federal government does not recognize same-sex marriage is inexcusable. Add in the financial discrimination gay and lesbian couples face and the current policy becomes all the more indefensible.

Follow us on Twitter @CNNOpinion.

Join us on Facebook/CNNOpinion.

The opinions expressed in this commentary are solely those of Suze Orman.