Symbol Matches

Symbol Starts With

Company Matches

thanks for visiting cnnmoney.

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

What's next for the markets?

Stocks, bond yields and oil prices have been climbing. But gold has slipped. Here's a look at what may come next for these major asset classes.

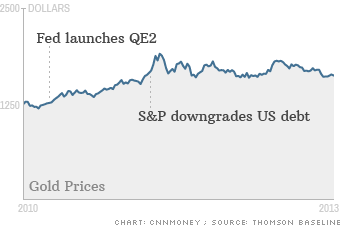

Gold bugs have had a shaky start to 2013, but things may be turning around for the precious metal.

While prices are down more than 3% so far this year, analysts Douglas Borthwick of Chapdelaine and Neil Meader at GFM both predict gold prices could top off at $1,800 an ounce by year end. That's nearly 13% above current levels.

The driver? Central banks launching -- or in the case of the Federal Reserve, continuing -- stimulus programs.

Just look the Bank of Japan. Its aggressive moves weakened the yen enough to spark currency war talk and inflation fears.

That could boost gold, used as a hedge against currency depreciation. Also, Cyprus has raised worries about the safety of bank deposits so investors may turn toward gold, a tangible asset, as a safety play. Bottom line: Investors are looking at gold not just as a hedge against inflation, but as a way to gain an extra edge in their portfolios.