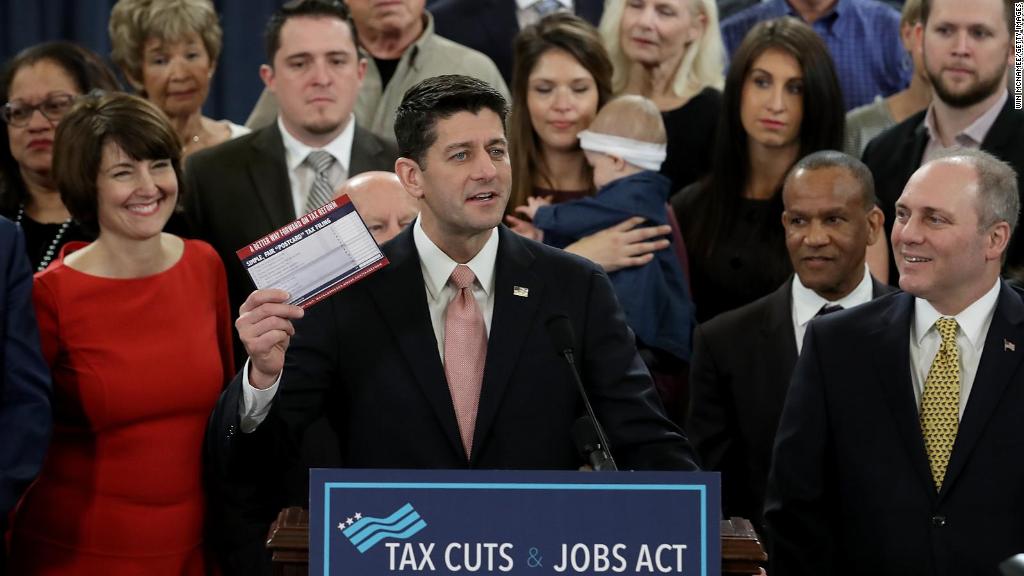

President Trump argues the GOP tax overhaul will "create tremendous success for companies." Yet some of America's most powerful business alliances are already trying to kill the bill.

The instant opposition of well-organized and deep-pocketed lobbying groups threatens to delay or even derail passage of the legislation, which House Republicans unveiled on Thursday.

Three of the country's largest and most influential business groups have already come out against the GOP bill.

"These three groups aren't 'lean no' -- they are full-blown, burn-it-to-the ground 'no'," Chris Krueger, managing director of the Cowen Washington Research Group, wrote in a report on Friday.

This hostility underscores why it's so difficult to get tax reform done: entrenched interests will always fight tooth and nail to keep coveted tax breaks. Yet tax loopholes need to be closed to pay for the corporate and individual tax cuts promised.

The GOP bill would permanently cut the corporate tax rate to 20% from 35%, consolidate income tax brackets for individuals from seven to four and repeal or limits many deductions.

Analysts believe business opposition, combined with concern from Republicans in high-tax states, will make it tough for the GOP to pass meaningful reform by year-end -- the party's latest self-imposed deadline.

The initial reaction from "livid lobbyists" and others suggest it's "farcical" that Congress will enact tax legislation before 2018, Isaac Boltansky, senior policy analyst at Compass Point Research & Trading, wrote in a report.

Here's why some business groups are voicing serious concern about Trump's effort to revamp the tax system:

Related: What's in the House GOP tax bill for businesses

Big problems for small business: Owners of mom-and-pop shops worry the tax bill doesn't fix a system they feel already favors big business.

The National Federation of Independent Business, which represents 325,000 small businesses in the U.S., wasted little time saying it can't support the tax legislation "in its current form."

"This bill leaves too many small businesses behind," Juanita Duggan, the groups' president and CEO, said in a statement.

Most small businesses are set up as "pass-throughs," meaning their profits are passed through to the owners, shareholders and partners, who pay tax on them through their personal returns. The GOP tax bill slashes the pass-through tax rate to 25%.

However, small business owners fear this won't help the vast majority of them because most already pay taxes at a 25% rate or less.

"This proposal would primarily help wealthy individuals rather than small businesses," according to John Arensmeyer, CEO of the Small Business Majority, another advocacy group.

Housing trouble: While Trump often brags about record highs on Wall Street, the tax plan he endorsed was greeted poorly by the homebuilding stocks.

Toll Brothers (TOL), KB Home (KBH) and other builders tumbled this week because the tax bill would limit key tax breaks that favor homebuyers.

Specifically, the legislation calls for capping the mortgage interest deduction at $500,000 instead of $1 million. It would also limit the deduction for state and local property taxes at $10,000.

The fear, at least in the housing industry, is that these tax breaks could sap demand for pricey homes, especially in expensive markets. Many of those markets, such as San Francisco and Manhattan, are in high-tax states. That's a problem because the GOP tax plan would eliminate state income tax deductions altogether.

The National Association of Home Builders warned the GOP tax plan "slams the middle class" by hurting home values. The group complained that Republicans didn't include its proposal to replace the mortgage deductions with a tax credit.

"This tax reform plan will put millions of home owners at risk," said Granger MacDonald, chairman of the NAHB.

Related: What's in the House tax bill for people

Realtors really mad: The GOP proposal to cap the mortgage interest deduction is also riling up the vast real estate industry.

Echoing the arguments made by the home builders, the National Association of Realtors complained that the plan "threatens home values and takes money straight from the pockets of homeowners."

The concern for realtors is that a slowdown in housing could hurt their income or even employment prospects. It's a major employer. There are about 2 million active real estate licensees in the U.S., according to the Association of Real Estate License Law Officials. The NAR alone represents 1.3 million realtors.

The White House has argued that Americans don't buy homes for the tax breaks, they do it because they feel confident about the economy.

Nonetheless, the tax bill "fundamentally alters the tax benefits of homeownership," according to Compass Point's Boltansky.

Expect the "housing industrial complex fighting ferociously," he said.

--CNNMoney's Jeanne Sahadi contributed to this report.