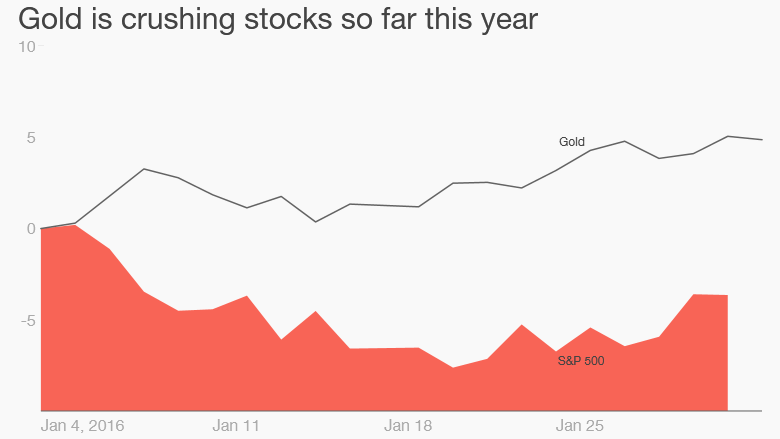

Gold bugs are among the only smiling investors these days.

Prices have jumped 6% this year to $1,127 an ounce. That makes gold the best performing commodity and one of the only major assets to post a sizable gain in 2016.

By comparison, stocks have had a dismal start to the year: The Dow is down more than 1,000 points this year, while the Nasdaq has lost 8% of its value.

These opposite moves actually make perfect sense. Gold tends to shine brightest during times of stress. The precious metal is viewed as a reliable store of value for investors to turn to when they're worried about economic doom. And right now, there's no shortage of exactly that kind of anxiety.

Whether it's falling oil prices, trouble in China or geopolitical uncertainty, Wall Street has a long list of worries steering money towards safe havens like gold.

"As we have seen stock markets around the world tumble dramatically, the need to protect capital has increased -- and gold has benefited from that," said Juan Carlos, director of investment research at the World Gold Council.

Gold ETFs, or exchange-traded funds, are also humming along. Both the SPDR Gold Shares ETF (GLD) and the Market Vectors Gold Miners ETF (GDX) are up nearly 7% apiece.

Related: Star investor thinks gold prices will spike 30%

Gold's gains have come as commodities overall have crumbled under the pressure of oversupply and the slowdown in China. Crude oil has plummeted 18% this year, sinking to as low as $26 a barrel. Other metals like copper and palladium are down sharply. The Bloomberg Commodity Index, a popular measure of raw materials, tumbled last month to its weakest level since 1991.

"Gold is the winner of that game because it has the least industrial use so it's least affected by the global slowdown," said Axel Merk, founder of Merk Investments. which now holds about 20% of its assets in gold.

Related: There's a global fire sale of copper and coal mines

To be sure, gold prices remain well below their 2011 record highs of nearly $1,900 an ounce. In fact, just six weeks ago gold tumbled to a six-year low of $1,049 an ounce.

Gold fell out of favor last year due to the Federal Reserve's decision to raise rates for the first time in nearly a decade. The rate hike lowered the chances that the Fed's near-zero rates would cause a bout of severe inflation. That was bad for gold, which is seen as a hedge against inflation.

But now that trade is reversing. Investors are betting the global turmoil will cause the Fed to scale back its plans to raise interest rates four times this year.

"The Fed might have to do a U-turn after its historic quarter point rate hike," said Merk.

Related: Goldman Sachs: It's too late for OPEC to save oil

Of course, if the market is wrong and the Fed does raise rates three or four times this year, gold could take a hit.

Capital Economics doesn't think the gold rally is done. The firm thinks strong demand from China and India, two of the biggest consumers of gold, will help send the yellow metal another 10% higher to $1,250 per ounce by the end of the year.