Welcome to a new month.

Here are the five things you need to know before the opening bell rings in New York:

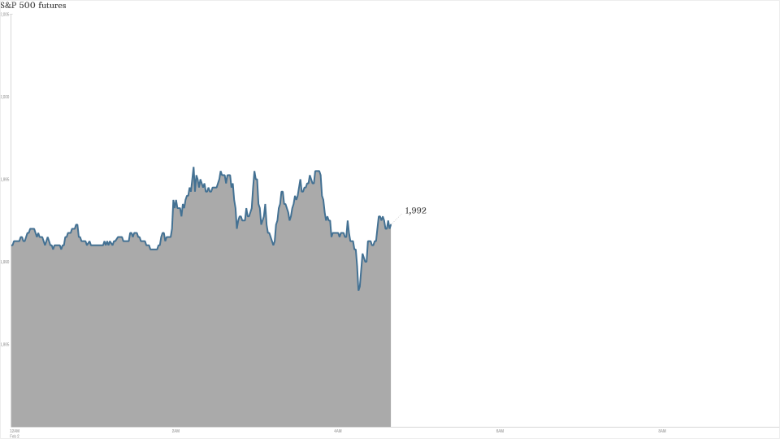

1. New month, new direction?: U.S. stock futures are edging higher ahead of February's first trading day, but the moves are modest and the mood cautious.

Investors will be hoping for a change in direction after what could be described as a joyless January. The Dow Jones industrial average shed 3.7% last month, while the S&P 500 lost 3.1% and the Nasdaq 2.1%. On Friday alone, the Dow dropped 251 points.

"February starts with a feeling of apprehension," said Angus Campbell, a senior market analyst at FxPro. When the S&P 500 tumbles in January, that's "historically considered to be a bad sign for equities, leading to a negative year for the stock market."

2. More auto recalls: Trading in auto stocks could be higher than normal Monday after the U.S. National Highway Traffic Safety Administration announced the recall of over 2 million vehicles to fix faulty crash sensors. Saturday's news may hit shares in TRW (TRW), which made the faulty sensors.

Separately, General Motors (GM) is facing more than 3,350 claims alleging that GM vehicles with faulty ignition switches caused deaths and injuries. GM recalled millions of cars last year, with the ignition switch problem seriously tarnishing its image.

3. Greek drama: Greek stock markets are bouncing back after a week of steep losses. Bank stocks are leading the rebound, but are still nursing losses of between 30% and 40% for the year so far on fears that a clash between Greece's new government and its creditors will cut them off from vital ECB support.

European markets were creeping higher in early trade, but uncertainty about Greece and weak economic data from China kept a lid on gains.

China's official manufacturing index dipped below 50 for the first time since 2012, more evidence that activity in the country's all-important factories is slowing. The slowdown raises the likelihood that China will cut interest rates again, or launch other stimulus measures.

Asian markets ended mostly weaker. The Shanghai Composite index led the way with a decline of 2.6% Monday. That was the fifth consecutive daily decline.

4. Earnings: Exxon Mobil (XOM)and Sysco (SYY) are among the main companies reporting earnings Monday. They will both report before the opening bell.

5. Economics: The U.S. Census Bureau will report December construction spending at 10 a.m. ET.