It looks like the streak of big gains for stocks following huge losses is over.

The broader market was down again Friday. The Dow suffered another triple-digit loss, dropping 115 points. The S&P 500 fell more than 1%.

And tech stocks really took it in the chin. The Nasdaq also dropped more than 100 points, a decline of more than 2%. Intel (INTC), Facebook (FB), Cisco (CSCO), Microsoft (MSFT) and many other stocks in CNNMoney's Tech 30 index fell sharply.

It's been a rough start to October. Volatility is back with a vengeance and white-knuckled investors are worried that the recent sell-off is going to get worse. CNNMoney's Fear & Greed Index hit 1 on Friday. It can't go lower than 0.

But do you know what? Stocks probably should fall further in the short-term.

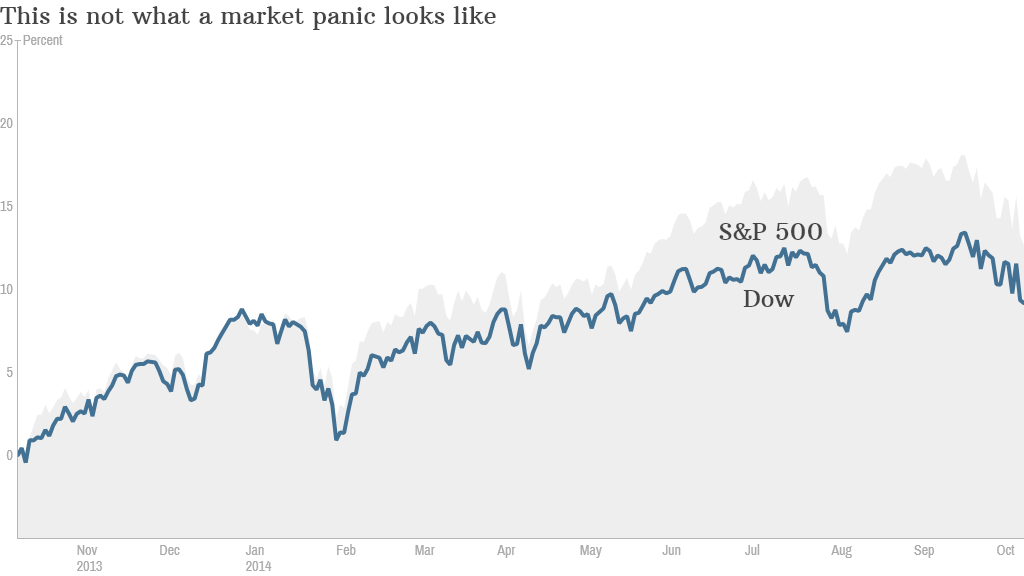

Let's put things in perspective. The Dow is only 4% below its all-time high from September 19. The S&P 500 is about 5% below its record high -- also set that day.

If those records turn out to be a market top for the foreseeable future, people will point to Alibaba's (BABA) red hot initial public offering that day as Exhibit A for how "irrationally exuberant" (You can call me Al ... Greenspan) stocks had become.

Related: Strategists still expect small gains for stocks this year

Many experts believe that the market is long overdue for what's known as a correction. That's a 10% pullback from a recent peak. The last correction took place in 2011. The market did get within a whisker of a correction in the spring of 2012. The S&P 500 fell 9.94% between April 2 and June 1 of that year.

Why should stocks go even lower though? Beyond the fact that the market eventually needs to obey the law of gravity, there are legitimate concerns facing investors right now. Here are five that shouldn't come as any surprise.

1. Earnings for the third quarter are expected to be good, but not great. Ditto for fourth quarter guidance.

2. The Federal Reserve will almost certainly announce later this month that it is finally ending its policy of "quantitative easing" -- purchasing billions of dollars in Treasury bonds and mortgage-backed securities.

What is your best investment? Share your story with CNN

QE has helped keep long-term rates low. It has been the financial equivalent of human growth hormones, steroids and other performance-enhancing drugs. So it's understandable for investors to be concerned about how the market will do after being "juiced" by the Fed for nearly six years.

3. The Fed is also expected to begin raising interest rates sometime in 2015. It hasn't hiked rates since December 2008. A whole generation of new traders and investors have no idea what it's like to invest while the Fed is tightening. That could be a problem.

Related: Are stocks a trick or treat?

4. Europe is an economic mess. China is showing signs of a slowdown. That will hurt corporate profits for big U.S. firms and could also spill over to the broader economy. We all should have learned by now that decoupling is a myth. The U.S. can't outgrow the rest of the world indefinitely when two of its major trading partners are struggling.

5. The world is a scary place right now. Ebola, ISIS and the Russia-Ukraine situation are all things that were not on many people's radar at the start of 2014. But they are constantly in the headlines now. So all three of them could classify as a "Black Swan" -- an event that came out of nowhere to disrupt the markets.

Take a deep breath and relax. Now all of this may sound unsettling. But it doesn't mean that stocks are likely to crash. Even if a correction happens soon, that does not mean that it has to be the beginning of a bear market.

I've already mentioned that the market's last correction was in 2011 and that stocks flirted with one in 2012. There was also a correction in 2010. But what happened after all those pullbacks? Stocks eventually bounced back and hit new highs.

This is not to suggest that you should just shrug off the recent concerns plaguing the market. Quite the contrary.

It's actually a good sign that investors are no longer complacent and ignoring bad news. People should be worried and stocks should be pulling back.

But this dip should help restore some normalcy to the market. Stocks will trade at more reasonable prices as investors adjust their expectations for earnings and economic growth.

None of that is bad. It's healthy. I'd be a lot more worried if the Dow and S&P 500 were still at all-time highs. The market has finally woken up and smelled the proverbial coffee. It's about time.