Millennials are not only saving for retirement at an earlier age than their parent's generation, but they are also saving more aggressively.

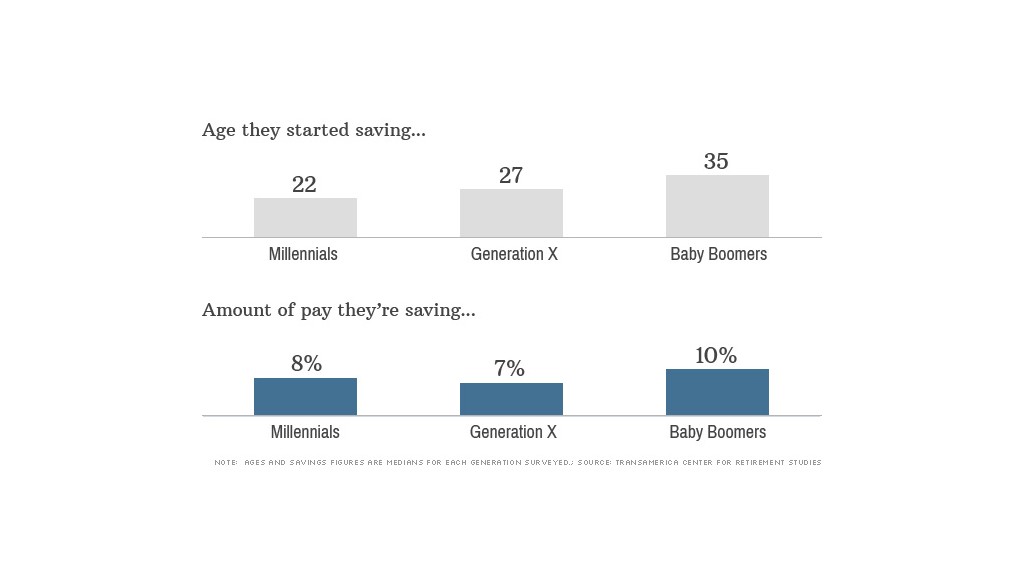

This generation (born after 1978) started saving at a median age of 22, more than a decade earlier than their Baby Boomer parents and five years before Gen Xers, a survey from the nonprofit Transamerica Center for Retirement Studies found.

Among Millennials who are being offered a 401(k) plan, 71% are participating in their employer's plan -- socking away a median 8% of their annual salary, the survey of more than 4,000 workers found.

Related: Tools to make your money grow

Meanwhile, Gen Xers (who were born between 1965 and 1978) are saving a median 7% of their paycheck and Baby Boomers, who were born between 1946 and 1964 and are now on the eve of retirement, are saving 10%.

"(Millennials have) heard and responded to the message they need to start early and save as much as possible," said Catherine Collinson, president of the Transamerica Center, in a statement.

Financial planners typically advise people to start saving for retirement as early as possible, noting that even small amounts set aside in your 20s can grow into significant sums through decades of compound returns.

Related: Why Millennials need to get over their fear of stocks

If a 25-year-old saves just $100 a month for 40 years, for example, she will have roughly $150,000 at age 65, assuming 5% annual returns. In contrast, a 35-year-old would have to sock away almost double that amount each month to achieve the same savings result.

The TransAmerica survey also found that two-thirds of Millennials would likely switch employers for a similar job that offered better retirement benefits.

"Millennials take their retirement benefits very seriously," Collinson said.