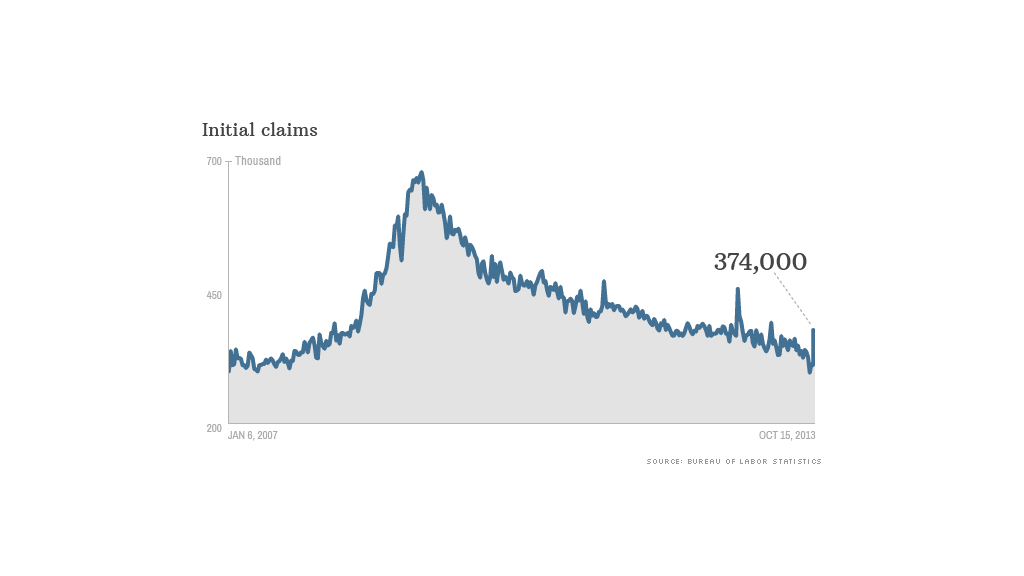

First-time claims for unemployment benefits suddenly jumped last week, marking the biggest one-week rise since Superstorm Sandy left thousands of people temporarily out of work.

The rise was partly due to the government shutdown, as well as other temporary factors, the Department of Labor said.

About 374,000 people filed for their first week of unemployment benefits last week, 66,000 more than just a week earlier. It was the largest one-week rise since November 2012, when unemployment claims surged by 88,000 in the week following Superstorm Sandy.

Because initial unemployment claims closely correlate with layoffs, this report is considered one of the foremost economic indicators. But a series of recent temporary factors have muddled the numbers lately.

Last week for example, half the jump in claims came from California alone. The state labor agency has been struggling to keep up with claims after upgrading its computer system last month. A processing error has delayed unemployment checks for many people in the state, causing hardship for those who relied on the money to pay bills and feed their families.

Related: The safety net failed me

The national data was also partially impacted by the government shutdown, as about 15,000 claims came from private sector workers who rely on business from the federal government. Those workers may include anyone from government contractors, to tour bus drivers who offer trips to national parks, to waitstaff at DC-area restaurants frequented by federal employees.

As the government shutdown drags on for the tenth-straight day, nearly 500,000 federal workers remain on furlough. They are allowed to file for unemployment benefits, but if Congress grants them their pay retroactively, most states will ask them to repay the money later.

Today's report does not include federal workers who may have filed for unemployment benefits during the government shutdown. The Labor Department counts those workers in a separate category, but that data lags by three weeks.

Related: Federal workers can collect unemployment during shutdown

Accounting for all these temporary factors, it looks like there would have been roughly 326,000 initial claims last week, if it weren't for California's computer glitch and the government shutdown. That's roughly in line with a four-week average, so economists interpret the report as showing little change in the underlying job market.

"The broader picture is still that labor market conditions are improving, albeit not quite as much as we previously thought," said Paul Ashworth, chief U.S. economist for Capital Economics, in a research note.

Nationwide, about 2.9 million people received their second week or more of unemployment benefits in the week ending September 28, the most recent data available. These people account for only about a quarter of the 11 million people who remain unemployed in the United States. The other 75% do not receive unemployment benefits.