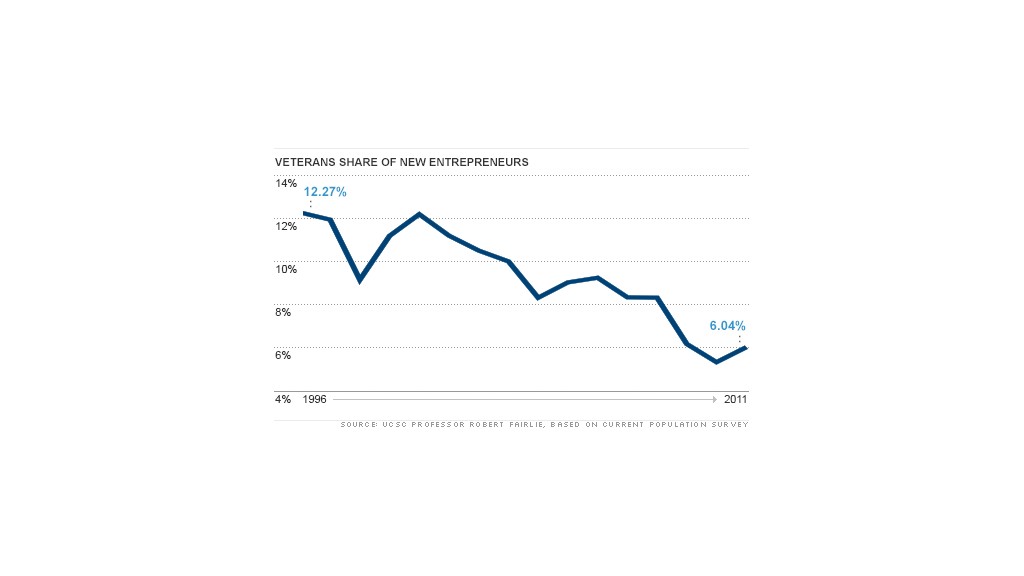

Fewer veterans are starting their own businesses, continuing a decline that began more than a decade ago.

Veterans made up only 6% of all new entrepreneurs last year, compared to 12% in 2000, according to a new report from the Kauffman Foundation, which focuses on entrepreneurial activity.

From 1999 until 2008, veterans started their own businesses at a greater rate than civilians. But from 2009 on, civilians have outpaced veterans in starting new companies.

Why the general decline?

Robert Fairlie, the author of the report and an economics professor at University of California, Santa Barbara, said it could be due to demographics because there are fewer veterans of working age.

Related: Entrepreneurship is 'weaker than ever'

"Veterans in general are more rare," Fairlie said. "But we're also losing [to retirement] older veterans that had a higher rate of business ownership. Younger veterans are less likely to start businesses."

Now, service members sometimes choose to attend college or trade school rather than start a business immediately after leaving the military. A survey of veterans who left the military between 2004 and 2006 showed that 48% participated in the Montgomery GI Bill, which provides college education and career instruction.

But as older veterans fade out of the employment landscape, younger vets lose a key source of mentorship.

Jon Robinson, a former U.S. Marine sergeant who now leads Kauffman Foundation's entrepreneurship programs, said mentors play a key role for first-time entrepreneurs. Younger veterans are better served by people who understand what they've been through, but they now "have fewer of those within their own community to look to," he said.

Robinson reasons that civilians are less likely to understand the unique challenges someone faces after returning from military service.

"It's important that your mentor be a veteran, especially in the period of transition," Robinson said. "I'm not just talking about hidden injuries like PTSD or traumatic brain injuries. A veteran can be extraordinarily accomplished in one area yet incredibly weak in another. You develop great innovative and professional skills, but that doesn't necessarily translate into good personal financial management."

Early next year, the military will launch a program to offer help starting a business to the approximately 250,000 who leave the military every year. Called Boots to Business, it's the first formal entrepreneurship program for outgoing service members.

Related: What's in the fiscal cliff?

For its part, the Small Business Administration provides bank loan guarantees to veteran-owned businesses: $2.1 billion in fiscal year 2012. That only goes so far, though, because banks are rarely the go-to source for startup capital. Banks -- now even more than before -- demand a flow of business income or a stellar credit rating. Veterans rarely have both, because they haven't yet launched a business and could have damaged credit due to delayed payments while on tours abroad.

"They don't have huge nest eggs to draw from, and guys who've been deployed may have a ding or two on their credit report," said Rhett Jeppson, associate administrator for the Office of Veterans Business Development.

Jeppson said he and other veteran's advocates are trying to create programs to help veterans find seed capital for new firms.

And there's plenty of veterans who are eager for it.

Joe Meyer is a former U.S. Army major who successfully launched a debit card company and is now an investor in Atlanta. When the military newspaper Stars and Stripes published a story saying the millionaire was "seeking a few good men and women," Meyer's inbox flooded with hundreds of emails from service members.

They had ideas. They had questions. They needed money. None were in his field -- financial technology -- so he offered them advice instead.

"There's nobody funding startups, and that's a terrible thing," he said. "There's still very little capital out there. It's just flat difficult."