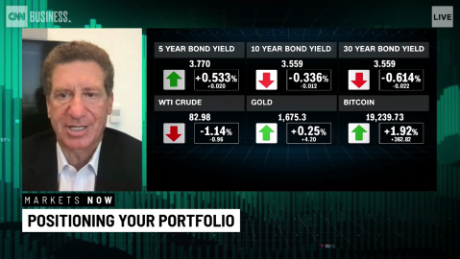

New York (CNN Business)The boom-to-bust oil market has rapidly gone from spiking to crashing.

US oil prices declined nearly 1% and briefly broke below $60 a barrel on Friday, tumbling deeper into a bear market.

Crude closed lower for the 10th day in a row. That's the longest losing streak since July 1984, according to S&P Platts.

In barely a month, crude has plunged 21% -- and that's since closing at a four-year high of $76.41 on October 3.

Friday's low of $59.28 a barrel is the weakest price since February.

It's a stunning turnaround considering just a few months ago some analysts were warning that $100-a-barrel oil could be just around the corner, especially given the Trump administration's crackdown on Iran.

The oil slump has been sparked by a combination of forces.

First, the global growth fears that rocked the stock market spilled into commodities. Investors worried that an economic slowdown would eat into demand for energy.

"It's so amazing how fast sentiment shifts," said Michael Tran, director of global energy strategy at RBC Capital Markets. "The economic slowdown fears are winning the narrative."

And despite the recent Wall Street rebound, crude has continued to tumble. That's because oil bulls were disappointed by the Trump administration's decision to grant temporary waivers that allow India, China and other countries to continue to buy oil from Iran, the world's fifth-biggest producer.

President Donald Trump said the move was designed to ease the impact of sanctions on Iran, which took effect on Monday.

"We're going to let some of the oil go out to these countries that really do need it, because I don't want to drive the oil prices up to $100 or $150 a barrel, which could happen very easily," Trump said during a press conference on Wednesday.

Trump argued that prices have "come down very substantially" recently "because of me."

Yet the oil plunge is also due to Saudi Arabia and frackers in Texas ramping up production. US oil output, led by the Permian Basin in West Texas, raced above 11 million barrels per day in August for the first time ever. The United States recently surpassed Russia and Saudi Arabia as the world's largest oil producer.

The flood of production has helped lift oil stockpiles. Commercial oil inventories in the United States soared by 5.8 million barrels last week and are now 3% above the five-year average, according to the federal government.

However, RBC's Tran said physical demand for crude remains solid: "It's not that bad out there. It doesn't warrant a 20% decline."

The bear market for oil unnerved energy investors on Wall Street. Baker Hughes (BHGE) dropped 4% and Schlumberger (SLB) declined 2%.

But some analysts are warning the oil tailspin might be short lived. Goldman Sachs and RBC recently called for prices to rebound as the Iran sanctions waivers wear off.

And analysts are increasingly concerned Saudi Arabia and the United States have limited room to respond to future shocks.

Saudi Arabia is already pumping near record highs and the Permian Basin is growing so rapidly that it's running out of pipelines. Bottlenecks in Texas may not get cleared up until the second half of 2019.

"The risks are skewed to the upside through the end of the year," said Tran.