Story highlights

- Bitcoin reaches record price in Zimbabwe

- Soaring demand prompted by shocks in the formal economy

- Government could crack down on the digital currency, or adopt it

(CNN)The most expensive bitcoin in the world are flying off virtual shelves in Zimbabwe.

The price of the digital currency has soared beyond $10,000 over the past week on Harare-based trading platform Golix, almost double the rates on major international exchanges.

"The price has been high for some time and it keeps going up," says Golix trade coordinator Yeukai Kusangaya. She expects soaring demand to drive the price even higher.

Bitcoin is no longer a specialist curiosity in Zimbabwe. The virtual currency is in increasingly common usage, even accepted by businesses such as car dealers.

A uniquely dysfunctional economy has created ideal conditions for the bitcoin surge.

Safe haven

Zimbabwe is undergoing a fresh currency crisis.

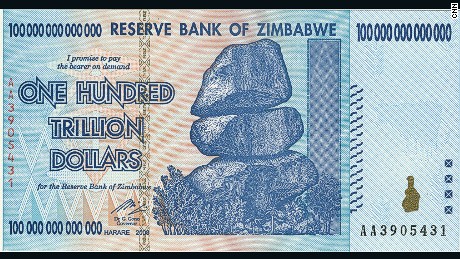

President Robert Mugabe's administration addressed rampant hyperinflation in 2008 by ditching the Zimbabwean dollar and replacing it with US currency. But the southern African nation now faces an acute shortage of US dollars that has led to banks rationing withdrawals.

The government has sought to make up the shortfall by issuing "bond notes" that it claims have equivalent value to the US dollar. But their value has dropped sharply on black market exchanges, leading to price inflation in stores, and they are not accepted by foreign suppliers.

International trade is further complicated by strict capital controls, which have left importers searching for creative solutions -- including digital currencies.

"Bitcoin isn't subject to the central bank measures so it has become an alternative that importers are willing to pay a premium for," says Zimbabwean technology analyst Nigel Gambanga, pointing to a rise in businesses accepting the currency as payment.

Bitcoin also offers investors a refuge from the faltering formal economy.

"When confidence in national currencies wavers because of monetary policy or political uncertainty, bitcoin often behaves as a safe haven because the price is totally based on market discovery," says Nolan Bauerle, director of research at news site CoinDesk.

"Some people find bitcoin useful because it is immune from the bright ideas of centralized authorities and their unintended consequences."

Test case

Even before the current crisis, Zimbabwe offered favorable conditions for bitcoin adoption.

The country ranks third on the Bitcoin Market Potential Index, created by economic historian Dr. Garrick Hileman of the University of Cambridge, just behind the inflation-plagued economies of Argentina and Venezuela.

The Index cites Zimbabwe's vast informal economy and history of financial crises as key factors that could drive bitcoin adoption.

But while Zimbabwe's conditions are unique, digital currency experts believe it offers a valuable test case for the viability of bitcoin on a national scale, which could have global implications.

"The underlying takeaway is that cryptocurrencies are here to stay and have a place in the world where monetary policy and fiat currencies cannot be trusted," says Saxo Bank analyst Kay Van-Petersen.

"It's only a matter of time before an emerging or frontier market government decides to adopt a cryptocurrency as a foundation for credibility, transparency, accountability, and attraction of foreign capital."

Beat them or join them?

Should the bitcoin surge continue, the market could come under pressure from Mugabe's authoritarian government.

"I wouldn't expect any tolerance from a country with a fragile financial system trying to maintain capital controls," says Hileman, suggesting the Zimbabwean government might follow China's example of banning bitcoin exchanges.

But he questions whether the country has the resources to enforce such a ban, which could safeguard the currency's future.

Another possibility is the government could embrace a thriving market and seek to take advantage of it.

"If trade in bitcoin intensifies with no resolution to the country's currency woes, we could witness the central bank and government revise its position by taking on a more active role in cryptocurrency trading," says Gambanga. "At the very least, (by) recognizing cryptocurrencies through some form of regulation."

The analyst even raises the prospect of bitcoin becoming an official currency of Zimbabwe.

"The state has already taken extreme measures like banning the importation of fruits," he says. "So adding bitcoin to the country's multi-currency basket might not be so absurd."